Geopolitical volatility has surged into a top 10 business risk with cyber risk remaining the number one concern globally, followed by business interruption at number two, according to Aon’s 2025 Global Risk Management Survey, which has tracked the most pressing risks for business decision makers for nearly 20 years.

Geopolitical volatility rose 12 places since the last Aon survey in 2023, breaking into the top 10 global risks (at number 9) for the first time in the survey’s history — and is forecast to rise to fifth by 2028, said the survey report, which was based on interviews with nearly 3,000 risk managers, C-suite leaders and executives in 63 countries. (See below for the lists of the top 10 business risks in 2025 and the top 10 future risks for 2028).

Aon noted that the depth of business concerns about geopolitical volatility depends on the region and differing exposures to geopolitical flashpoints. For example, it is ranked at number 6 in Europe, the Middle East and Africa (EMEA), where ongoing conflicts, sanctions regimes and political fragmentation are directly affecting business operations. By contrast, respondents in Asia Pacific, Latin America and North America rank this risk lower at 11, 17 and 13, respectively. However, businesses in all the regions predicted that this risk would rise in their future list of business concerns.

“The dramatic rise of trade and geopolitical risk highlights a new reality: volatility and uncertainty are now constants for organizations,” said Joe Peiser, CEO of Commercial Risk for Aon, in a statement accompanying the Aon survey report. “From evolving tariffs to shifting alliances, these forces directly impact organizations’ balance sheets. Building resilience through analytics and scenario planning is essential for navigating this environment.”

Cyber Threats

“Cyber Attack or Data Breach” remains the number one current and future risk, according to survey respondents, as the rapid adoption of digital platforms and AI technologies has expanded the attack surface for threat actors, the Aon report said.

“The scale and complexity of cyber risk today is unlike anything we’ve seen before,” commented Brent Rieth, global cyber leader for Aon. “Our clients are increasingly using AI both defensively and offensively, to enhance resilience and unlock growth. The key is embedding cyber into board-level strategy, investing in quantification and viewing resilience as a competitive differentiator.”

Despite its top risk ranking, only 13% of respondents say they have quantified their cyber exposure, Aon said, noting that the gap between awareness and action is contributing to significant underinsurance, exposing businesses to financial and reputational loss.

“With the global average cost of a data breach reaching a record $4.88 million in 2024, the stakes have never been higher,” said the Aon report, quoting IBM’s “Cost of a Data Breach Report 2025.”

“The reality is that what worked yesterday may not be enough tomorrow,” Aon emhasized. “Sophisticated hackers, AI-driven threats and interconnected systems mean even well-prepared organizations are challenged to keep pace.”

Business Interruption

As the second-highest global risk in 2025, business interruption is expected to fall to seventh place by 2028.

“As interconnected threats multiply, from cyber attacks to climate events, organizations must diversify supply chains, embed geopolitical insight and regularly update continuity plans,” said Aon in the survey report.

“From cyber attacks and natural disasters to labor strikes and geopolitical conflicts, business interruption is a critical risk impacting businesses worldwide, with each of these threats capable of severely disrupting operations. Cyber risk, in particular, is becoming a more prominent contributor to overall business interruption,” the report stressed.

Respondents identified the top 10 global risks in 2025 as:

- Cyber attack or data breach

- Business interruption

- Economic slowdown or slow recovery

- Regulatory or legislative changes

- Increasing competition

- Commodity price risk or scarcity of materials

- Supply chain or distribution failure

- Damage to reputation or brand

- Geopolitical volatility

- Cash flow or liquidity risk

Intersecting Risks

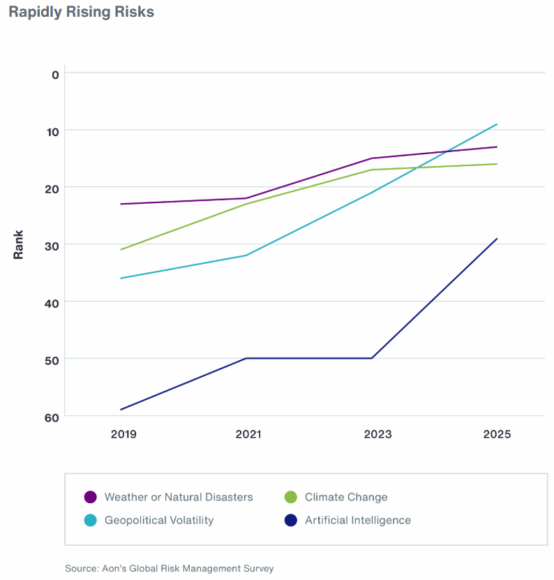

“What stands out in the survey results is how these rapidly rising risks interact, as well as their potential impact on multiple areas of a business. Technology risks intersect with workforce dynamics and challenges in adopting artificial intelligence (AI),” said the survey report. “Geopolitical instability affects supply chains, influences the regulatory landscape and has an impact on balance sheets. Climate change is a force that intensifies all of these and more. These top risks are systemic and interconnected.”

Despite rising risk volatility, most organizations remain underprepared with only 14% of respondents tracking their exposure to the top 10 risks and only 19% using analytics to evaluate the value of their insurance programs, which limits their ability to respond to threats or be confident their capital position is optimized, Aon explained.

Given the intersection of the highest-ranking risks, Aon said, it is important for businesses to adapt a more integrated enterprise-wide approach to risk management in today’s environment.

Workforce Risks Drop From Top 10 List

“Failure to Attract and Retain Top Talent” ranked fourth globally in Aon’s 2023 survey, which highlighted human capital as a critical business risk. This year, however, Aon found that workforce risks dropped out of the top 10, despite ongoing talent shortages and rising healthcare costs.

“It’s alarming to see workforce risks slip down the rankings when human capital challenges remain deeply connected to every aspect of business resilience,” said Lisa Stevens, chief administrative officer for Aon. “When you look at the top 10 risks in this year’s survey – cyber threats, supply chain disruptions, geopolitical volatility – they all have a direct impact on the workforce. Treating these risks as isolated issues creates blind spots for organizations.”

Future Risks

Aon’s 2025 survey also provides a forward-looking perspective on the risks business leaders expect to be most critical by 2028. Cyber risk remains the top concern for the future, while AI and climate change join the top 10, reflecting the accelerating impact of technology and extreme weather on global business.

Climate change climbs to number nine on the future risk list, underscoring heightened awareness of its threat to financial and operational stability. With 2024 marking the hottest year on record and global insured catastrophe losses exceeding $145 billion, leaders are increasingly treating climate as a systemic business risk, Aon said.

Respondents identified the predicted top 10 future risks in 2028 as:

- Cyber attack or data breach

- Economic slowdown or slow recovery

- Increasing competition

- Commodity price risk or scarcity of materials

- Geopolitical volatility

- Regulatory or legislative changes

- Business interruption

- Artificial intelligence

- Climate change

- Cash flow or liquidity risk

Survey methodology

Aon’s 10th Global Risk Management Survey, a biennial web-based research report, was conducted between April and June 2025 in 11 languages. The research gathered responses from 2,941 decision makers including c-suite leaders, risk managers and treasurers from 16 industry clusters, which include small, medium and large companies in 63 countries and territories around the world. The respondents answered questions about their approach to risk management and insurance, as well as wider business decisions.

Was this article valuable?

Here are more articles you may enjoy.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer