UK insolvencies are rising sharply, with a leading trade credit insurer saying any new government policies that stand to raise business costs risk further pressuring vulnerable sectors.

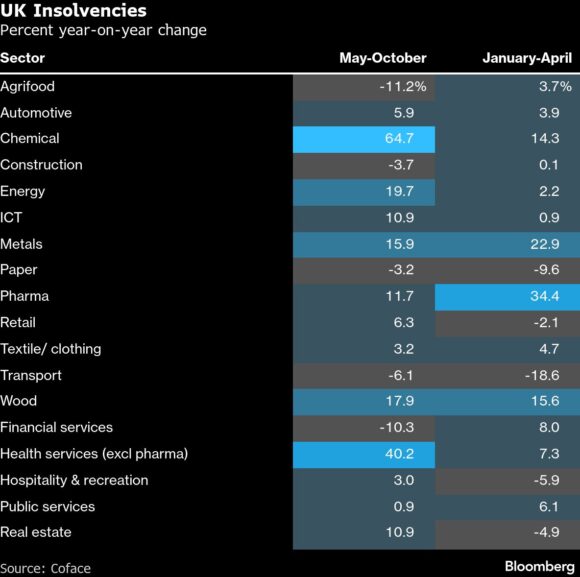

The increase reflects the impact of measures announced in last year’s budget, including higher minimum wages and reduced business relief rates, according to Coface SA. The data analyzed by the firm showed insolvencies rose 3.9% year-on-year between May and October, reversing a decline seen before the policies took effect in April.

Official data underscore the trend, with the number of insolvencies in England and Wales 17% higher in October than in the same month a year ago.

The pain is hitting hardest in labor-intensive sectors such as hospitality, retail and health services, where razor-thin margins leave firms struggling to pass on higher costs, according to Coface. It also underscores what’s at stake in this week’s budget, as the government weighs new measures to plug a fiscal gap.

“We need a good Christmas and January season here; we need these companies to be able to maintain some sort of margins,” said Jonathan Steenberg, UK chief economist at Coface. “If we could see some sort of support for in particular these SMEs, that would be very, very good.”

Consumer confidence has fallen in the run-up to the budget speech, weighed down by stubborn inflation and uncertainty over the government’s next move. Worryingly, insolvencies are climbing ahead of the traditionally lucrative holiday season, suggesting many businesses are already throwing in the towel.

“The fact that we’re already starting to see it now is usually not a great indicator,” Steenberg said. “If it’s not a good season, then we do expect to see an even bigger increase thereafter.”

Overall, the so-called liquidation rate — which measures insolvencies as a share of total companies in the economy — is now roughly 25% higher than in 2019, according to Steenberg.

To be fair, other European economies including France and Germany are facing their own challenges. US tariffs and Chinese competition have weighed heavily across the region.

In the UK, however, the situation risks being compounded by stricter immigration policies that could deepen labor shortages in key sectors, Steenberg said. Just last week, the Labour government announced sweeping changes to its immigration rules, including extending the waiting period for some workers to 10 years or even longer before they can apply for permanent residency.

One potential silver lining is that borrowing costs could start to ease soon, provided inflation cools alongside a slowing labor market. Money markets are now almost fully pricing in a quarter-point rate cut next month, followed by another similar reduction by June.

So far, most insolvencies tracked by Coface have been among smaller businesses.

Compulsory liquidations, which are common among larger firms, jumped 50% month-on-month in October, signaling that financial stress is spreading. Even on a three-month rolling basis, the rate of increase was 30%, Steenberg said.

“There are clearly also bigger companies going under,” he said.

Photograph: Shuttered stores in Croydon; photo credit: Chris Ratcliffe/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs