The European Union reached a tentative deal to slash ESG requirements, as the bloc faces intensifying pressure from the US to rein in such rules amid ever-present trade tensions.

In late-night talks, representatives of member states and the EU parliament agreed to wind back the Corporate Sustainability Reporting Directive so that over 80% of the companies originally intended to be in scope will no longer need to comply. A preliminary agreement was also reached on other EU requirements around environmental, social and governance standards, broadly in line with cuts set by lawmakers last month.

The agreement reached, which also scales back the scope of the Corporate Sustainability Due Diligence Directive, represents an effort to “boost competitiveness and cut red tape,” the EU Parliament’s legal affairs committee said in a statement.

But there are already signs that the rollback will be seen as inadequate by the US. That’s because of the continued extraterritoriality of the rules, which require large non-EU corporations to comply if they do business in the bloc.

A spokesperson for Exxon Mobil Corp. said even after the agreed watering down of CSDDD, the concern is that the EU “didn’t go nearly far enough,” in comments sent via email.

“The ability of Brussels to regulate a US company’s operations anywhere in the world remains and this is completely unacceptable,” the spokesperson said. “The Trump administration has made clear this is a non-starter for trade talks and we look forward to a common-sense resolution in the near future.”

Representatives of the government in Washington, D.C., have repeatedly made clear that the EU will face American displeasure until the issue of extraterritoriality is tackled. President Donald Trump’s envoy to the European Union, Andrew Puzder, said net zero and due diligence requirements on oil companies “make it very difficult” for them to supply Europe with the energy it needs, in an interview with Bloomberg Television’s Francine Lacqua on Friday.

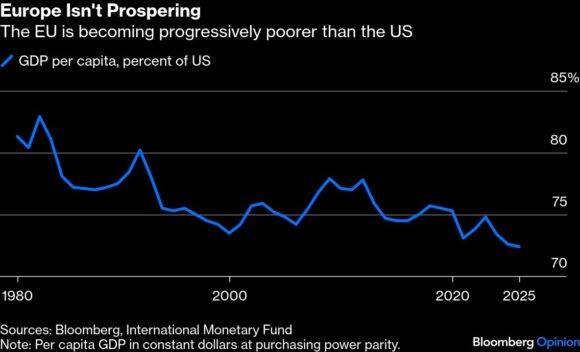

The decision to wind back ESG rules comes as Europe struggles to keep its economy on track, with energy bills up roughly 60% since 2020 adding to the burden on households and businesses. In response, policymakers have launched a wide-reaching process of simplification, targeting both CSRD and CSDDD, which encompasses supply chain rules, in order to ease requirements.

The agreement “is a welcome step towards cutting complexity,” said Oliver Moullin, managing director for sustainable finance at the Association for Financial Markets in Europe, in a statement. “Clear, workable rules will support the mobilization of finance for the transition while minimizing unnecessary regulatory burdens and supporting competitiveness.”

Environmental nonprofits, meanwhile, voiced their discontent.

“This compromise remains an alarming dismantling of good policymaking and removes some of the most important tools Europe had at its disposal,” said Richard Gardiner, interim head of EU Policy at ShareAction, in a statement. Dropping climate transition plan requirements and EU-wide civil liability “weaken Europe’s competitive edge.”

The Details of the ESG Agreement:

Monday night’s agreement between lawmakers and member states means that CSRD will only apply to companies with at least 1,000 employees and annual revenue of €450 million.

CSDDD will no longer require companies to produce climate transition plans. Meanwhile, companies will be required to focus on ESG vulnerabilities in supply chains where relevant.

A clause on extraterritoriality remains part of the agreed text.

In their rush to address complaints, European policymakers have also faced criticism from within, with European Ombudswoman Teresa Anjinho last month finding “shortcomings” in the legislative process that “amounted to “maladministration.”

The deal now needs to be formally approved by member states in the EU Council and by the European Parliament in order to become binding law.

Photograph: Flags of the European Union (EU) in front of the Berlaymont Building, which houses the European Commission’s headquarters in Brussels, Belgium, on Wednesday, Nov. 5, 2025; photo credit: Simon Wohlfahrt/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance