After losing their biggest export market due to Donald Trump’s trade wars, US farmers are now counting on the president’s support for biofuels to prevent their next crop from piling up in storage.

The administration is set to soon unveil a plan for how much crop-based biofuels will be blended into fossil fuels starting next year. A higher mandate, still opposed by some in the oil industry, would create a much needed outlet for crops after tariffs hit China — the top commodities buyer simply has no orders for corn, soybeans or wheat from the next harvest on its books, according to the US Department of Agriculture.

“If we don’t get this done, we’ll end up with a surplus of soybeans,” Caleb Ragland, a Kentucky farmer who is also president of the American Soybean Association, said of the upcoming biofuels mandate. “I can store one good crop, I can’t store multiple years.”

Trump instigated a $28 billion bailout for farmers hurt by the economic standoff with Beijing during his first term. While his administration is considering similar plans again, so far he has only pledged to find domestic markets to compensate for lost sales abroad.

Boosting demand at home is a key priority for growers, industry groups and some of the top agricultural commodity traders. That’s because overseas sales of soybeans from the next crop are currently running 79% below the average of the past five years, USDA data showed. Corn sales are 49% lower.

The US farm economy was already struggling before Trump’s trade disputes. Bumper crops globally boosted supplies and sent a Bloomberg gauge of grain prices tumbling more than 40% since a 2022 peak.

For Trump and the Republican party, reinforcing the farmer vote ahead of next year’s midterm elections will be key. American growers have been a loyal constituency, but some cracks in that support have started to emerge.

An AgWeb poll of almost 3,000 farmers earlier this year revealed that 54% were against Trump’s use of tariffs as a negotiating strategy. A group of growers from Maryland, Massachusetts, and Mississippi also sued the administration after the USDA canceled grants under a program to install solar panels.

The April Purdue University/CME Group Ag Economy Barometer found that 56% of respondents expect tariffs to have a negative or very negative impact on farm income this year. Still, 70% said the policy will strengthen the US agricultural economy in the long-term.

Domestic Demand

“If we’re going to get behind this America First policy, let’s make sure that we have a great domestic policy strategy,” said Lucas Lentsch, a North Dakota farmer who heads the United Soybean Board. “Let’s make sure we’ve got good demand here at home.”

Creating more markets at home is easier said than done. The US cattle herd is already at the lowest since the 1950s, curbing demand for crops in feed rations. That’s leaving farmers reliant on the so-called renewable volume obligation, or RVOs — a rule that’s been controversial since being enshrined into law two decades ago to safeguard energy security.

Farmers benefit from a higher biofuels mandate, but oil refiners have historically opposed it. Some of that has since changed as Big Oil invested in biofuels in recent years as part of their decarbonization efforts.

“We need a robust RVO to keep US soybeans a profitable business to be in,” said Greg Anderson, who grows the oilseed in Nebraska.

Biofuel Mandates

Agribusiness giants Archer-Daniels-Midland Co., Bunge Global SA and Cargill Inc., as well as trade groups including the Clean Fuels Alliance America want the Environmental Protection Agency to set the RVO at no less than 5.25 billion gallons for biomass-based diesel starting next year, up 60% from 2025 levels.

Farm lobby groups and US Midwestern governors also want a mandate for US ethanol of at least the 15 billion gallons currently in place.

The American Petroleum Institute is also backing the requests.

“We’re certainly doing our job to push administration to help us and help the industry,” Christopher Cuddy, ADM’s president of carbohydrate solutions, said at a BMO conference in New York this month. “The most encouraging piece for me is the fact that we’re aligned with the Petroleum Institute, which at least in my time has never happened.”

Still, the American Fuel & Petrochemical Manufacturers, which represents some refiners, is against it. The group argues the US isn’t selling enough gasoline to absorb so much ethanol and that there’s uncertainty over the amount of feedstock available to produce more renewable diesel and other biomass-based biofuels.

The biofuels industry disagrees. Randall Stuewe, chief executive officer of Darling Ingredients Inc., said the previous quotas set under former President Joe Biden were far too low. The company’s Diamond Green Diesel venture with Valero Energy Corp. is a top producer of renewable fuels.

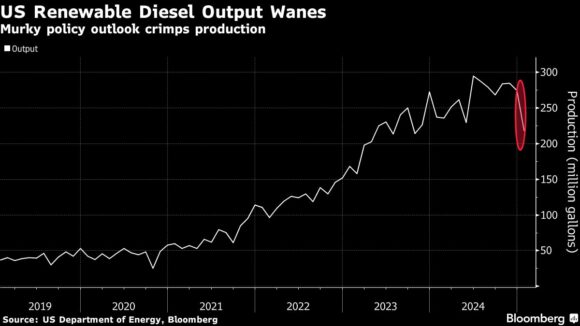

That led to a number of factory closures. Biodiesel plants in the US produced at just 51% of capacity in the year through April, while facilities that make renewable diesel — a fuel that’s chemically identical to its fossil fuel peer — ran at a rate of 72%, according to Bloomberg Intelligence’s Project Tracker.

“We used to have more demand than supply, it’s now reversed,” said Peter Zonneveld, US president for biofuels producer Neste Oyj. “Some companies are reducing run rates or shelving their investment plans for renewable fuels,” which will make it harder to curb emissions from heavy-duty industries, he said.

“It’s resulting in difficulties for the ag industry too because farmers can’t get rid of their soybeans,” Zonneveld said.

In a statement to Bloomberg, the EPA said it has already sent its biofuel-blending proposal to the White House and will make it available for public comment once the proposal is signed.

The US biofuels program “supports President Trump’s broader economic vision of strengthening American energy independence, growing domestic agricultural markets, and fighting back against unfair trade practices,” the agency said.

A higher RVO is a chance to get domestic biofuels back up to normalized run rates of around 80%, said Brett Gibbs, a renewable energy analyst at Bloomberg Intelligence, who estimates the mandate will need to be at least 3.9 billion gallons to bring some facilities back online.

Trade Uncertainty

It’s unclear how the EPA will balance the concerns of some refiners and the agriculture industry. And even as the president announced a truce with China, lowering tariffs for 90 days, uncertainty remains.

Sales of next season’s crops to Mexico and Japan, the second and third-largest soybean buyers, are lagging well behind historical levels for this time of year. And China continues to snap up supplies from rival Brazil.

Agriculture Secretary Brooke Rollins has openly hinted at a bailout, and nearly two thirds of farmers in the March Purdue/CME barometer said aid was either likely or very likely. Still, many growers say they want to sell their crops instead of receiving aid.

“As a farmer, I’d rather receive it from the market,” said Philip Good, a Mississippi farmer who’s the chair of the United Soybean Board. “We go back to the domestic markets, and developing domestic uses.”

Topics Profit Loss Agribusiness

Was this article valuable?

Here are more articles you may enjoy.

Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims

Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk