Most independent insurance agents stick with their top personal lines and commercial lines companies for years, although they are less-than-satisfied in a number of carrier-performance areas. This is among the many findings in a new national survey of agents conducted by Channel Harvest Research.

The national survey of agents on their attitudes regarding carriers — on a wide range of issues — was sponsored by Insurance Journal.

No. 1 Personal Lines Carrier

More than half of respondents (54 percent) have had the same No. 1 personal lines carrier for more than five years. More than a third (38 percent) have had the same No. 1 for one to five years.

Younger respondents, males, and those in agencies with revenue less than $300,000 were more likely to have switched No. 1 personal lines carriers within the past year. Meanwhile, those in larger agencies were more likely to have had the same No. 1 personal carrier for more than five years, noted Jess McLaughlin, research director for Channel Harvest.

From a list of company attributes, respondents in the Channel Harvest study most often rated their No. 1 personal lines carrier as “far better than average” with regard to financial strength (53 percent), claims service quality (46 percent) and underwriting expertise (38 percent).

However, agents seem less satisfied with their No. 1 personal lines carrier with regard to agency compensation, training and education, and underwriting appetite. Fewer than 30 percent provided top ratings on these attributes, said McLaughlin.

Why Change

Among those who reported that their No. 1 personal lines carrier changed over the past year:

- The most frequent reason for the switch was pricing/rates (rate increases, or rates were “not competitive”).

- Some were motivated to switch based on underwriting policies.

- A few cited declining or unsatisfactory customer service and support. Many commented on the importance of ease of working with carriers, including customer service and support as well as responsiveness and timely handling of issues.

Commercial Lines Satisfaction

More than half of respondents have had the same No. 1 commercial lines carrier for more than five years; 41 percent have had the same No. 1 carrier for one to five years.

As with personal lines, those in larger agencies are more likely to have had the same No. 1 commercial carrier for more than five years.

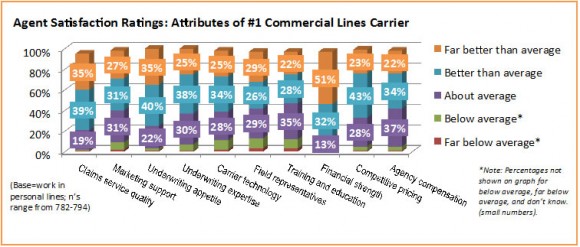

Respondents tended to express the greatest satisfaction with the performance of their No. 1 commercial lines carrier with regard to financial strength, with 51 percent saying their preferred carrier is “far better than average” on this measure.

McLaughlin said agents cited potential areas for improvement:

- Nearly half of respondents rated their No. 1 carrier as average or below on training and education.

- Many respondents rated their No. 1 carrier as average or below on field representatives (42 percent), agency compensation (42 percent), and marketing support (40 percent).

Respondents whose primary focus is producing/servicing commercial accounts provided higher ratings for several of the attributes of the No. 1 commercial carrier; those focused on life/health/employee benefits rated “competitive pricing” more highly than others.

“It is interesting to note that satisfaction for the personal No. 1 carrier was directionally higher overall: 83 percent very or extremely satisfied, versus 75 percent very or extremely satisfied with the No. 1 commercial carrier,” McLaughlin said.

About the Research

The study, “2014 Survey of Agent-Carrier Relationships: Agents Left to Their Own Devices,” is the seventh in a series examining independent agents’ views on marketplace issues. More than 1,400 agents completed the survey.

The survey instrument covers about 50 separate questions. Quantitative survey results are presented in a variety of formats, including importance rankings of specific-carrier attributes, ratings of specific companies on attributes, industry issues, and open-ended agency comments about what breaks out superior carriers from the pack. The report explores differences between agents focused on personal and commercial lines. Carriers can purchase the data set to further explore cross-tabs.

For information on obtaining the survey report, contact John Campbell at john@channelharvest.com or 202-363-2069, or visit www.channelharvest.com.

Topics Carriers Agencies Training Development

Was this article valuable?

Here are more articles you may enjoy.

Florida House Gives Final Approval to Much-Debated Citizens Clearinghouse Bill

Florida House Gives Final Approval to Much-Debated Citizens Clearinghouse Bill  US Offers $20 Billion Reinsurance Plan to Spur Gulf Oil Flow

US Offers $20 Billion Reinsurance Plan to Spur Gulf Oil Flow  Asia’s Rich Having Second Thoughts on Dubai as War Rages

Asia’s Rich Having Second Thoughts on Dubai as War Rages  Stryker Remains Offline After Cyberattack Linked to Iran Group

Stryker Remains Offline After Cyberattack Linked to Iran Group