Recently, well-known insurtech start-up, Lemonade, announced the launch of a new product initiative called Policy 2.0. According to Lemonade, the project is meant to simplify the language within a standard insurance policy so that insureds can easily understand what is and what is not being covered. Designed through an open-source platform, it will allow anyone from competitors to state regulators to contribute to its design – all towards meeting Lemonade’s core mission of making insurance simple for the end consumer.

While the project is still in its design phase (not scheduled for release until 2019 according to company sources), and is fraught with regulatory and legal challenges, the underlying premise of the initiative is exactly on target.

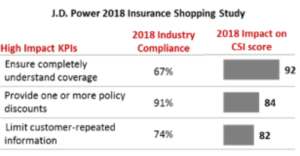

According to our J.D. Power 2018 Insurance Shopping StudySM, the number one factor impacting customer satisfaction is understandability of coverages. Just 67 percent of consumers felt that their carrier had done a good job in ensuring they completely understood their policy coverages. Further, those companies that were able to meet customer expectations in this regard, were able to achieve a 9 percent lift in their overall customer satisfaction scores.

Lemonade’s Policy 2.0 initiative addresses this core issue while reinforcing three broader trends we are seeing across the property and casualty industry.

First, digital service providers are continuing to influence consumer expectations and preferences, and have ushered in an era in which products and services must be relevant, personalized, easy, and timely. Despite significant tech investment, the auto insurance industry has been playing catch-up with other consumer-facing industries on this front.

Second, consumers are empowered like never before, and, as a result, insurance companies are making investments into customer experience improvements in order to attract and retain business. With less than 2% new consumer entrants this year, growth requires taking share from a competitor. This puts a huge focus on conveying and delivering on value.

Third, this provides yet another example of insurtech’s collective impact on the property and casualty industry. Of the $2.4 billion in seed funding that flowed into insurtechs last year, the majority focused on enhancing incumbents value chain rather than disrupting it. Lemonade’s Policy 2.0 provides yet another example of this movement.

While multiple challenges persist in taking Lemonade’s Policy 2.0 from concept to market across all 50 states, the over-arching principle of consumer-centric design should serve as a lesson to the nation’s largest insurers.

Related:

- Lemonade Proposes Open Source Insurance Policy for All to Change, Adopt

- Auto Insurers Turn to Improving Digital Experience as Competition Intensifies

- Insurtechs Haven’t Yet Made Impression on Public

- Buyers Aren’t Happy With Their Cyber Insurance: J.D. Power

- Managing Time Expectation for Claims Key to Keeping Homeowners Happy

- Satisfied Independent Agents Are Growth Engines for P/C Carriers: J.D. Power

- Take This Lemonade and Startups: Insurers Garner Record High Satisfaction Grades

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent

Viewpoint: How P/C Carriers Can Win the Next Decade With Tech + Talent