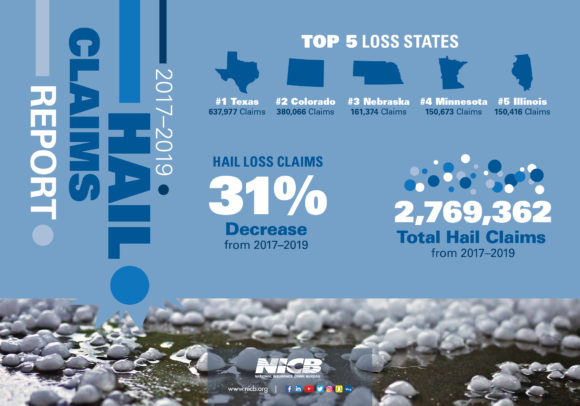

Texas leads the nation in insurance claims for hail damage— far outdistancing other states with 23% of loss claims filed over the past three years.

The National Insurance Crime Bureau released a three-year analysis of insurance claims associated with hail storms in the U.S. The top five states for hail loss claims were Texas (637,977), Colorado (380,066), Nebraska (161,374), Minnesota (150,673) and Illinois (150,416).

The report is based on a review of claims data from ISO ClaimSearch during the period of January 1, 2017 through December 31, 2019, totaling 2,769,362 hail loss claims.

The top five cities for hail loss claims during that period were Omaha, Neb. (54,153); Denver, Colo. (51,887); Colorado Springs, Colo. (38,044); McKinney, Texas (34,134); and Dallas, Texas (25,262).

Over the three years covered by this report, May had the highest monthly total for hail loss claims with 621,945 and June was next with 586,749. March (368,885), April (346,214) and July (277,363) round out the top five.

Over the three years covered by this report, May had the highest monthly total for hail loss claims with 621,945 and June was next with 586,749. March (368,885), April (346,214) and July (277,363) round out the top five.

Of the five policy types providing hail loss coverage, Personal Property-Homeowners was the most affected with 1,711,094 claims or 62% of the three-year total. It was followed by Personal Auto with 734,985 claims and Personal Property – Farm with 153,737 claims.

According to the NICB, while annual hail damage is generally a function of severe storm frequency and location, what is more predictable is the appearance of unscrupulous contractors— “storm chasers”—who swoop in promising a quick repair. These unsolicited approaches are red flags as nearly all post-storm repair scams begin with an unsolicited visit to a victim by a repair person.

“NICB encourages policyholders to use caution when selecting a contractor or other workers to help repair your property or replace your windshield following a storm,” said Brooke Kelley, NICB vice president of communications.

She urges policyholders to always check first with their insurance company or agent before signing any documents presented by a contractor.

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial