“Black Lives Matter to me and they matter to us as an organization,” Progressive Corp. CEO Tricia Griffith wrote in a letter to shareholders.

In the letter that was mostly commentary on second quarter results, Griffith vowed to increase her own company’s efforts to improve inclusion and diversity and to also encourage other business leaders to do more as well in her capacity as a member of the Business Roundtable subcommittee in racial equity and justice.

“Working with my peers in the private sector, I am confident our actions will lead to meaningful change. This is a moment of moral reflection and bold action in our country,” she wrote.

“As citizens, we have to decide whether we are going to live up to our democratic ideals of full equality or whether we go back to turning a blind eye to the injustices and lack of equity in the U.S. As a company, we believe we have a role to play in this – for our customers, for our employees, for our communities, and for our shareholders.”

On financial matters, Progressive Corp. managed an overall strong second quarter with net income up 83% to $2.3 billion, reflecting the impact of fewer personal and commercial auto claims due to coronavirus shelter-in-place policies, but also sizable storm claims that hit its homeowners business.

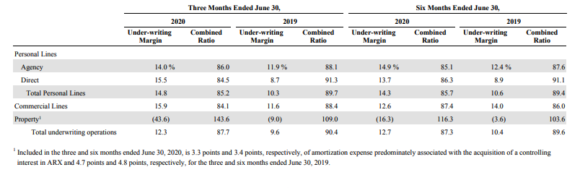

During the quarter, the personal lines and small business insurer generated $10.1 billion of net premiums written, an increase of $1.0 billion, or 11%, compared to the second quarter 2019. The underwriting profit margin of 12.3% for the second quarter 2020 was 2.7 points better than the same period last year.

“While significant uncertainty remains surrounding the pace of recovery and implications on our vehicle and property lines of business, we’re confident that we have the appropriate monitoring and action plans in place to rapidly adapt our business to capitalize on changing market conditions,” commented Griffith.

The company said personal auto incurred accident frequency, which continued to moderate as the quarter progressed, was down about 39% for the second quarter 2020, as compared to the prior year.

The total Personal Lines combined ratio for the second quarter was 85.2 compared to 89.7 for the same quarter in 2019.

The Commercial Lines combined ratio came in at 84.1 compared to 88.4 for the same quarter in 2019.

Personal auto and homeowners premiums written were down at the beginning of the quarter but showed an uptick in June. Commercial auto premiums were down due to the pandemic, notably for ridesharing accounts, but up considerably by the end of the quarter for other small business insurance sold direct.

While both the agency and direct distribution channels experienced a similar personal auto recovery, it happened more quickly for the direct than the agency channel. Griffith attributed this in part to agents having to “get their offices compliant with social distancing requirements and their operations back to pre-COVID levels.”

Property Loss

The news out of the Property business segment was less favorable. Property business generated an underwriting loss (43.6% loss margin) due to $234.8 million in wind, hail and tornado losses from 20 catastrophes during the quarter, as well as development from direct quarter storms.

The Property combined ratio came in at 143.6 compared to 109.0 for the same quarter in 2019.

The company said it has continued to raise its property rates and implement higher deductibles in states with significant hail exposure. It has also added minimum deductible or actual cash value requirements for wind/hail coverage in six more states during 2020, bringing the total to 16 states with such mandates.

Commercial Lines business during the second quarter saw commercial auto new business applications decrease by 10% but small business insurance applications increase by 46%. Sales recovered in May and were even stronger in June. The sales growth suggested at least a temporary shift in small business owner purchasing toward the direct channel.

“Direct distribution of Commercial Lines products is an area where we have made a significant investment, and we are well positioned if a permanent change occurs in small business insurance shopping to the direct channel,” Griffith commented.

Commercial Lines profitability was aided by reduced vehicle utilization and lower auto accident frequency early in the quarter. The insurer provided premium and billing credits of more than $26 million to customers due to reduced business activity. It also saw a $29 million decrease in premiums written for transportation network company (TNC) business due to lower levels of ridesharing usage.

“Ridesharing mileage is now increasing on a month-to-month basis, though a full recovery may take time as our TNC market presence skews toward southern and southwestern states, which are presently seeing rising coronavirus infection rates,” noted the CEO. “We remain committed to this business segment, due to its synergy with our core commercial auto business and have a positive view of the platforms’ long-term prospects.”

The company continues to institute work-from-home measures and said it expects they will largely be in place throughout the remainder of 2020. To help employees, the company paid a portion of their annual bonus in April and July.

Other second quarter results:

- Partially offsetting the favorable loss experience were higher expenses reflecting $1 billion in credits issued to personal auto policyholders during the second quarter 2020 and additional $120 million bad debt expense related to the billing leniencies that put in place through the middle of May.

- There was a 22% new applications growth in special lines products. The company attributes the interest in recreational vehicles, boats and motorcycles to consumers looking for ways to enjoy the summer and take vacations while maintaining social distance.

- New homeowner and condo policy sales declined during April and May, due to the shelter-in-place restrictions, although sales activity recovered in June. New Property applications increased 4% and renewal applications increased 15% during the second quarter 2020.

- In April 2020, Progressive acquired the remaining outstanding stock of ARX Holding Corp., for an aggregate cost of $243.0 million, which included the acquisition of vested stock options, making ARX a wholly owned subsidiary of Progressive. While this acquisition was originally expected to occur in April 2021, the company said it believes that completing it a year earlier will benefit its efforts to grow our bundled home and auto customers. ARX is the parent of home insurer ASI.

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Preparing for an AI Native Future

Preparing for an AI Native Future