The Chicago-based specialty wholesale brokerage Ryan Specialty Group has filed with the Securities and Exchange Commission (SEC) for a proposed initial public offering (IPO).

The number of shares to be offered and the price range for the proposed offering have not yet been determined.

Upon completion of the proposed IPO, Ryan Specialty Group Holdings will be the sole managing member of Ryan Specialty Group, LLC and will exclusively operate and control all of its business and affairs.

Founded by Patrick G. Ryan in 2010, RSG is a provider of specialty products for insurance brokers, agents and carriers. It provides distribution, underwriting, product development, administration and risk management services by acting as a wholesale broker and a managing underwriter.

Ryan Specialty Group Holdings intends to list its stock on the New York Stock Exchange under the ticker symbol “RYAN.”

According to its SEC filing, RSG is the second-largest U.S. property/casualty insurance wholesale broker and the third-largest U.S. property/casualty managing general agency and underwriter. Its distribution network has more than 650 producers who have access to more than 15,500 retail insurance firms and over 200 excess and surplus lines carriers.

Since 2010, RSG has completed 40 acquisitions in various specialties and geographies. In September 2020, RSG acquired All Risks Specialty, the fourth largest wholesale distributor. RSG says the All Risks acquisition advanced many of its strategic priorities and enhanced its competitive position. The firm is currently merging All Risks Specialty’s binding authority service model and premium scale with its own technology platform, The Connector, through which retail clients can receive quotes and bind policies online

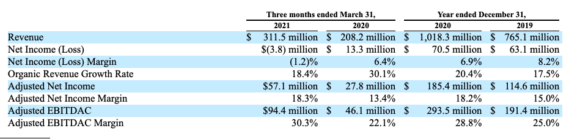

For the years ended December 31, 2020 and 2019, RSG generated:

| • | Revenue of $1,018.3 million and $765.1 million, respectively; |

| • | Total revenue growth of 33.1% and 25.3%, respectively; and |

| • | Organic Revenue Growth Rate of 20.4% and 17.5%, respectively. |

RSG said its financial performance includes a 49.6% and 33.1% increase in revenue from March 31, 2020 to March 31, 2021 and 2019 to 2020, respectively. Despite the rapid pace of growth, while its net income margin decreased due to costs primarily associated with the All Risk acquisition, the broker was able to expand its adjusted net income margin and adjusted EBITDAC margin from March 31, 2020 to March 31, 2021 and December 31, 2019 to December 31, 2020.

In its SEC filing, RSG notes that more than 70% of the total premiums it places goes to the excess and surplus lines market, which has been growing faster than the admitted market. It believes the higher rate of growth of the E&S market is due to the “shift towards complex risks,” which it says will “insulate the E&S market from broader economic” trends. It expects this increase in complex risks to continue, citing cyber threats, health risks and the digital economy.

The firm believes it has various competitive advantages including “robust” access to capital, freedom from channel conflict with its retail insurance broker clients, and its platform that can drive revenue and cost synergies.

“We believe that as the complexity of the E&S market continues to escalate, wholesale brokers that do not have sufficient scale or the financial and intellectual capital to invest in the required specialty capabilities will struggle to compete effectively. This will further the trend of market share consolidation among the wholesale insurance brokers who have these capabilities,” the firm wrote.

Its growth strategy stresses attracting and retaining top talent; continuing to innovate with products for the changing risks in life sciences, cyber and professional services and other areas; continuing to make strategic acquisitions; deepening its relationships with retail brokers; building its binding authority business and investing in its operations.

RSG feels it can grow as a preferred broker in an industry where retail brokers and carriers are consolidating and limiting the wholesalers with which they do business. Also, its Connector technology allows it to better serve retail insurance brokers by placing their smaller-premium accounts efficiently.

RSG said it has identified certain markets as near-term potential growth opportunities: cyber, hired non-owned auto and New York habitational spaces.

Was this article valuable?

Here are more articles you may enjoy.

Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen