Direct written premiums in the U.S. homeowners insurance market rose more than 13 percent in 2024, and the net combined ratio for the line fell below breakeven for the first time in five years.

Higher prices explained much of the industrywide loss and combined ratio improvements, but not all homeowners insurers grew premiums last year, a new report from S&P Global Market Intelligence reveals.

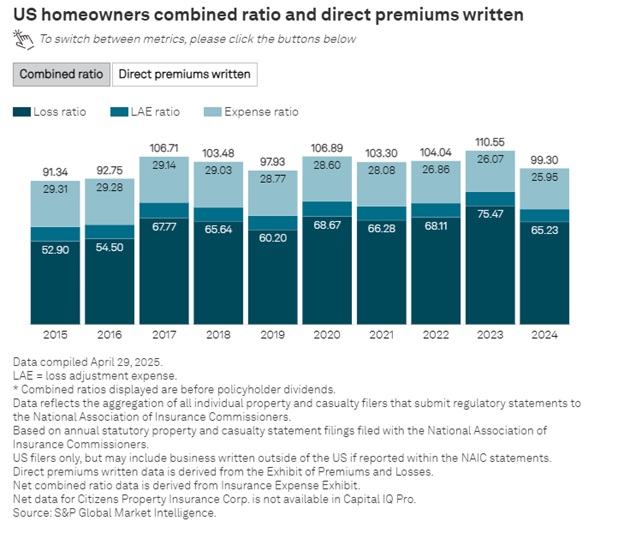

The new report, “Premiums rise, ratios recede for U.S. homeowners insurers in 2024,” shows that in spite of five tropical cyclones and numerous severe weather events, the industrywide net combined ratio for homeowners (excluding policyholder dividends) was 99.3 in 2024, 11.2 points better than the 110.5 ratio recorded in 2023.

The 99.3 marked the first time since 2019 that the ratio was below 100, the report said.

(Editor’s Note: Earlier this month, Carrier Management reported on a separate report from S&P GMI in an article titled “2024 P/C Insurance Combined Ratio: Best in More Than a Decade,” which showed the homeowners net combined ratio landing at 99.7 last year. The 2024 combined ratio in the prior report included policyholder dividends. The latest report on just the homeowners line does not.)

The report shows industrywide homeowners net combined ratios (including loss ratio and expense components) for the last decade on an interactive chart, which also provides tallies of direct written premiums and year-over-year premium jumps for each year from 2015-2024. Overall, direct premiums written in the sector rose 13.4 percent to nearly $173.1 billion. The increase marked the second-highest since 2015, behind a 14.1 percent leap recorded in 2023.

The national average rise in owner-occupied homeowner rates in 2024 rose to 11 percent from 9.7 percent in 2023, according to Market Intelligence’s RateWatch application, the report said.

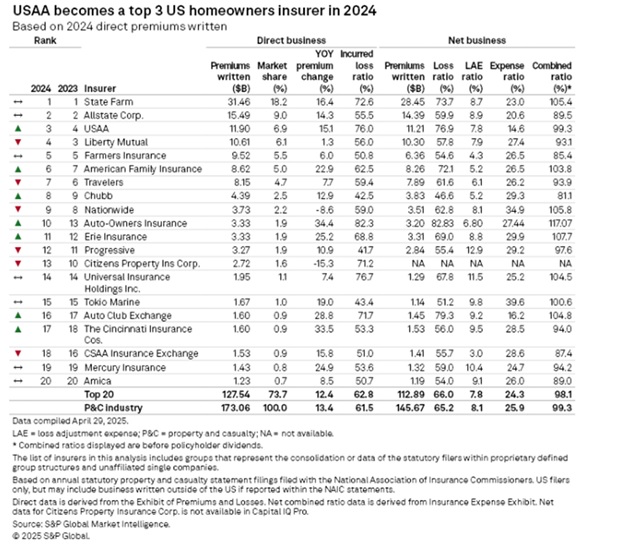

A ranking of the top 20 homeowners insurers based on direct written premium volume shows the three largest players—State Farm, Allstate and USAA—each growing by double digits and reporting improved combined ratios. But in spite of what S&P GMI calculates to be a 16.4 percent jump in direct premiums to $31.5 billion for the year, State Farm’s net combined ratio remained above 100, ending up at 105.4.

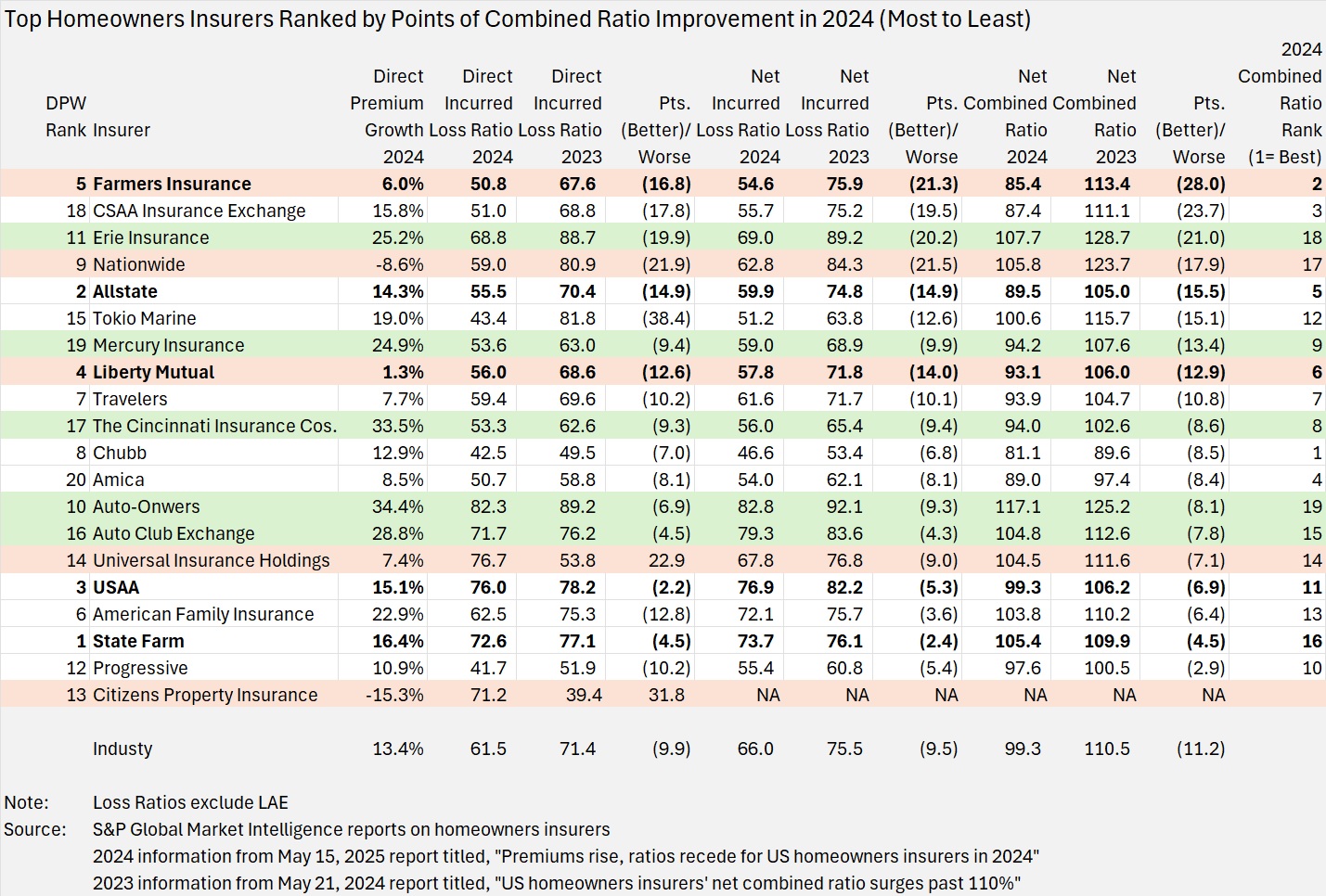

A comparison of individual carrier direct incurred loss ratios displayed in the latest S&P GMI report about homeowners insurance results with those set forth for the same 20 insurers in a similar report published in May last year reveals that State Farm and USAA had the smallest direct loss ratio improvements among the 18 that reported better results in 2024 (4.5 points for State Farm and 2.2 points for USAA).

Only two Florida regional insurers—Citizens Property Ins. Corp. and Universal Insurance Holdings Inc.—reported deteriorating loss ratios for 2024.

Focusing on net combined ratio improvements (after the impacts of reinsurance) instead of direct loss ratio changes, State Farm and USAA still rank near the bottom. (Chart produced by Carrier Management below displays the 20 insurers ranked by points of combined ratio improvement from 2023 to 2024.)

Two other large homeowners insurers—Farmers and Liberty Mutual—posted the smallest growth rates among the 18 that reported more direct written premiums in 2024 than 2023. In contrast to State Farm and USAA, however, these two companies rank among those with the most improved combined ratios, likely benefiting from initiatives to shrink their portfolios as they increased rates.

Farmers, growing premiums by just 6 percent, saw its net combined ratio improve by 28 points to 85.4 in 2024. (That was the second best combined ratio result among the top 20 carriers. Chubb posted an 81.1 net combined ratio.)

Meanwhile, Auto-Owners, which recorded the largest 2024 direct premium growth rate among the 20 largest carriers at 34.4 percent, also ended up with the worst combined ratio, 117.1.

Nationwide Mutual Insurance Co., the only company among the top 10 largest homeowners to record lower premiums in 2024 than 2023—a drop of 8.6 percent to just over $4 billion—nonetheless recorded 17.9 points of combined ratio improvement. The improved ratio, however, remained above breakeven in 2024 at 105.8.

Citizens Property Insurance Corp. was the only other insurer among the top 20 to record a decline in direct premiums written last year. The 15.3 percent drop to $3.2 billion for Citizens pushed Florida’s insurer of last resort out of the top 10 to a 13th-place ranking based on premium volume. The S&P GMI report attributes this to the success of depopulation efforts. Still, Citizens was one of only two insurers listed in the S&P GMI report to record worse direct underwriting results in 2024 than 2023—with its direct incurred loss ratio more than 30 points higher than the one listed in a similar report published by S&P GMI in May 2024 laying out 2023 results.

Florida-based Universal Insurance Holdings also saw its direct loss ratio deteriorate by more than 20 points, but its net combined ratios showed improvement, after the impact of reinsurance. (Net combined ratios for Citizens were not available in the S&P GMI reports.)

Florida, however, did not produce the worst loss ratio results for insurers in 2024.

The latest report also includes a U.S. map color-coded to indicate the states with the worst and best industrywide direct loss ratios. Nebraska, which was impacted by tornadoes and hail in two separate storms last June, had the highest direct loss ratio—136.6 (including loss adjustment expenses).

Topics Carriers Homeowners

Was this article valuable?

Here are more articles you may enjoy.

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists  Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures

Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes  Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations

Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations