Insurers in the U.S. paid out about $1 billion in claims for lightning-related damage in 2024, down 16.5% from the amount paid in 2023, according to the Insurance Information Institute (Triple-I).

The tally was $1.04 billion in 2024 compared to $1.24 billion in 2023.

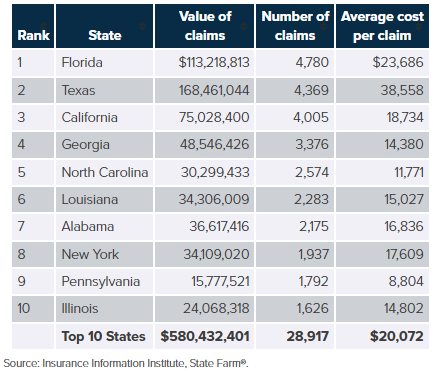

More than half of the claims were filed in the top 10 states—with Florida, Texas and California the top 3—but the total number of lightning-caused claims fell 21.5% to 55,537 in 2024.

Triple-I said this was the lowest number of claims since before 2017. The high mark since 2017 was 2020 with nearly $2.1 billion paid on 71,551 claims—an average of $28,885 per claim.

Data was compiled by Triple-I to coincide with National Lightning Safety Awareness Week (June 22-28).

“Lightning remains a costly and unpredictable threat, with ground surges causing nearly half of all claims,” said Michal Brower, media spokesperson for State Farm, in a statement. “These events can cause extensive damage to electrical systems, appliances and even structural issues. The damage underscores the critical need for homeowners to be aware of the risks, invest in protective measures, and stay prepared, especially in high-risk regions where lightning strikes are most frequent and damaging.”

Damage caused by lightning, such as fire, is covered by standard homeowners, condo, renters and business insurance policies. Some homeowners policies provide coverage for power surges that are the direct result of a lightning strike, said Triple-I.

Topics Claims

Was this article valuable?

Here are more articles you may enjoy.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs