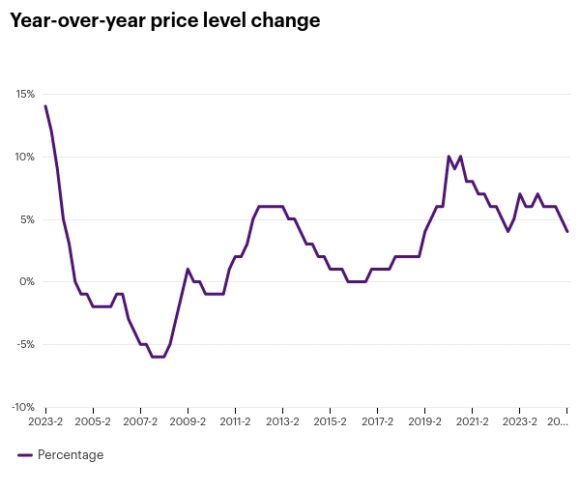

U.S. commercial insurance rates increased 3.8% in the second quarter of 2025, according to the latest WTW Commercial Lines Insurance Pricing Survey (CLIPS).

WTW said the price increase has been very close to 6% over the past six quarters. Carriers reported an aggregate price increase of 5.3% during the first three months of 2025–down from increases of 5.6% and 6.1% for the fourth and third quarters of 2024, respectively.

“Amidst the ongoing general upward trend, our latest data from the second quarter of 2025 shows a moderation in commercial insurance pricing,” said Yi Jing, senior director if insurance consulting and technology (ICT), WTW. “While some lines continued to see increases, others remained stable or slightly declined, reflecting a period of more measured rate growth across the market.”

Commercial property saw prices decrease during Q2 2025. Data for most lines continue to indicate moderate to significant price increases in the second quarter of 2025 with the exception of workers compensation, directors’ and officers’ liability, commercial property and cyber.

The largest price increases continued to come from excess/umbrella liability, with double-digit price increases also seen in commercial auto, reported WTW.

The survey compared prices charged on policies written during the second quarter of 2025, with the prices charged for the same coverage during Q2 2024. Forty-two participating insurers participated in the survey, representing about 20% of the U.S. commercial insurance market.

Topics Trends USA Commercial Lines Business Insurance Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers