Homeowners insurance rates are rising at a pace not seen in more than a decade, so more customers are asking why they should stay loyal if they perceive their insurer isn’t reciprocating.

According to a recent survey from J.D. Power, 47% of homeowners have seen at least one rate increase over the previous year. The consumer-data provider found that increases are even more pronounced in what it calls “high lifetime-value” customers—those with higher annual premiums and a higher proportion of product and services with one insurer. Among these policyholders, 49% have been handed rate increases.

“In a year marked by inflation, severe weather and tightening reinsurance markets, home insurance premiums have risen sharply in many parts of the country. While these increases often reflect real cost pressures, they’re also eroding trust and driving customers to shop for alternatives,” said Craig Martin, executive director, global insurance intelligence at J.D. Power.

High lifetime-value customers may be profitable for insurers, but they are also the most likely to start shopping, according to J.D. Power. Among customers who are unlikely to renew with their insurer, 45% of high-value customers blame the price increases while 30% of low lifetime-value customers who probably won’t renew cite the repeated price increases.

Rate increases also tend to erode customer-insurer trust and decrease the likelihood customers will say their insurer is easy to work with.

Survey results appear to indicate that communication is key. Policyholders who felt they understood the reasoning behind rate increases and were presented with options gave much higher overall satisfaction scores—721 on average compared to an average 537 among customers who do not understand the reasons or got options. In fact, the average satisfaction score of 721 for customers who received rate increases and options was even 33 points higher than customers who had not seen premium increases at all, J.D. Power said.

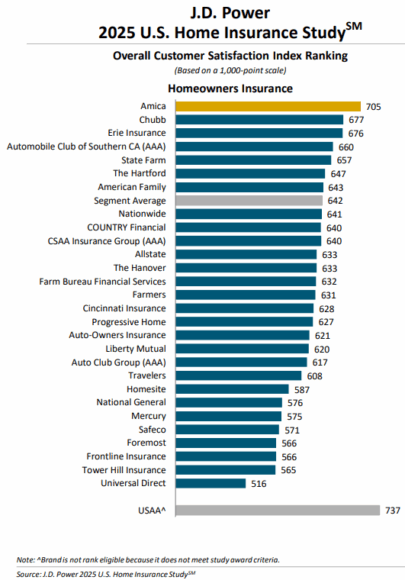

Turning to rankings, Amica, Chubb, and Erie round out the top three in overall customer satisfaction.

Topics Trends Pricing Trends Homeowners

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting