Commercial auto has been a dark cloud hanging over the U.S. property/casualty industry for more than a dozen years—and things are getting worse.

For the 14th consecutive year, commercial auto has posted an underwriting loss and has accumulated more than $10 billion in net underwriting losses over the late two years, according to insurance industry rating agency AM Best. In addition, rate increases have not kept up with increases in loss costs.

In its new report, “Stuck in Reverse: Commercial Auto Losses Keep Mounting,” AM Best said underwriting losses in 2024 totaled about $4.9 billion. Losses the prior year were about $5.5 billion.

Commercial auto physical damage posted an underwriting profit of about $1.5 billion in 2024 and has been profitable five of the last six years. The problem, said AM Best, is with commercial auto liability—having posted the largest underwriting loss in 2024 of about $6.4 billion.

Commercial physical damage and liability are diverting on paths farther away from each other. While, physical damage posted a combined ratio of 88.6 in 2024 and hasn’t eclipsed 100 since 2017, liability posted a 2024 combined ratio of 113, similar to the 113.3 posted the prior year. Liability has posted a combined ratio above 100 in each year since 2014 and has reached 113 five times. Were it not for the adoption of technology to improve efficiency at some underwriters, expenses may have been worse.

AM Best warned the divergence could hurt insurers. Liability is a compulsory buy but physical damage is optional. Insured may determine PD is not worth the extra cost, and even if they do want the coverage, they may choose higher deductibles to offset the cost.

“This would cut into insurers benefiting from the great profitability of the physical damage coverage, potentially worsening the overall results for the commercial auto lines,” AM Best said in the report.

Inflation and rising replacement and labor costs have long been headwinds in the space. Now, claims are taking longer to resolve. The longer claims remain open, the higher the exposure to a potential nuclear verdict. This has swung open the door for adverse development, and AM Best said it estimated commercial auto liability is under-reserved by $4 billion to $5 billion—”setting up another year of poor results.”

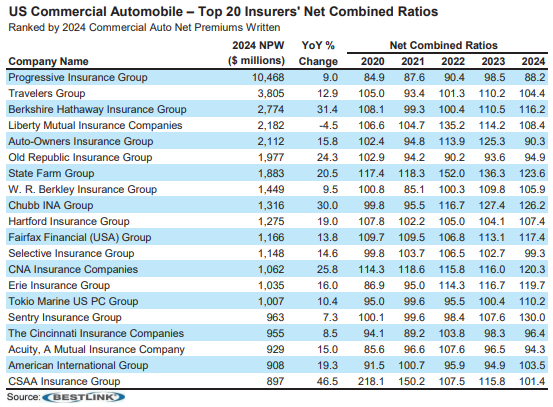

AM Best’s list of top commercial auto insurers still has Progressive at the top but Nationwide, a longtime top 10 member, has fallen outside the top 20. Its decline in commercial auto premiums is the result of strategic decisions to concentrate on profit over growth. Fourteen of the top 20 writers posted a combined ratio over 100 in 2024. Leading the way was Sentry, Chubb, and State Farm with combined ratios of 130, 126.2, and 123.6, respectively. The rating agency said continued losses in commercial auto “may have insurers rethinking” whether the line is worth accepting losses for access to other commercial lines.

Topics Auto Commercial Lines Business Insurance AM Best Liability

Was this article valuable?

Here are more articles you may enjoy.

Dubai Flights Disrupted After Drones Injure Four Near Main Airport

Dubai Flights Disrupted After Drones Injure Four Near Main Airport  Meta Loses Insurance for Defense in Major Social Media Addiction Litigation

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation  3 Big Questions Facing FEMA With Kristi Noem Out

3 Big Questions Facing FEMA With Kristi Noem Out  Indiana Church Not Owed Replacement-Cost Payment for Fire Damage

Indiana Church Not Owed Replacement-Cost Payment for Fire Damage