Moment of opportunity.

Clear horizons.

The latest WTW Marketplace Realities report, published in early October, is heavy on descriptions of a “unique and promising” inflection point for commercial insurance buyers.

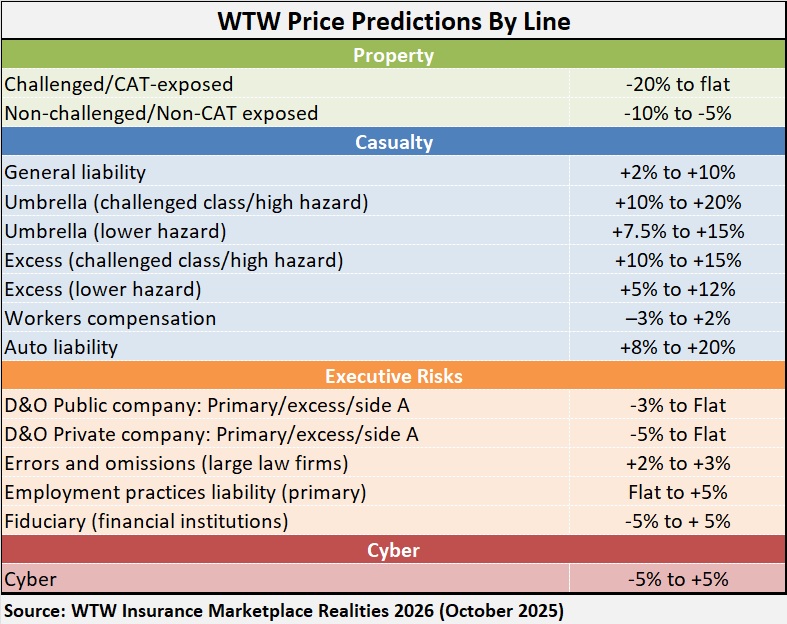

“Today, nearly every commercial line of insurance—aside from excess casualty—finds itself in soft-market territory,” states the report, which includes detailed descriptions of market conditions and 2026 price predictions for more than 30 lines of business in North America, including standard commercial lines (such as property, auto liability, general liability, excess casualty, umbrella and workers compensation), as well as professional liability lines and specialty markets.

Read more: Insurance Marketplace Realities 2026

“For buyers, this creates a rare window of opportunity: expanding coverage, enhancing structural positions and reexamining your portfolio through the lens of a broader and more flexible market,” says WTW in Insurance Marketplace Realities 2026, published late last week.

Below, we have excerpted some of the by-line price predictions set forth by the global broker in this report.

When compared to predictions in last year’s Marketplace Realities for 2025, the latest report’s 2026 price predictions reveal the greatest amount of softening for property coverages. Even for challenged occupancies and catastrophe-exposed accounts, the new report is showing that the worst result is a flat renewal. Last year’s report, in contrast, showed that a 10 percent increase was possible on the high-end of WTW’s ranges of predictions for these risks.

Offering a different breakdown of property programs—single carrier programs vs. shared-and-layered programs, the report indicates renewal price predictions dropping as much as 20 percent on the low end for shared-and-layered programs, while the lowest drop for single-carrier programs is 5 percent.

According to the text of the report, property rates have continued on a downward trend throughout 2025, with average second-quarter 2025 renewal rates dropping 8 percent, compared to an average 5.5 percent decline in the first quarter. Noting that the accelerating rate of decline is most pronounced on multi-carrier programs, the report nonetheless revealed that increased downward pressure on single-carrier program was evidenced by the first average rate decrease recorded in several years—roughly 3.8 percent in the second quarter.

“The overall market trajectory has clearly reversed from the multi‑year challenging period that lasted from Q1 2018 through Q1 2024,” the report states.

In spite of the softer market environments the report recommends the insurance buyers “carefully evaluate the trade-offs and future value of maintaining incumbent relationships versus moving to new markets.”

“Long-term incumbents with a record of profitability may reduce volatility at future renewals when losses occur or market conditions change, while new carriers lack legacy premium and relationship history to help smooth rate and coverage fluctuations,” the report says.

There’s a similar word of warning in the report’s executive summary about all softening market segments.

“The horizon is indeed clear — but clarity doesn’t mean complacency. The conditions we enjoy today can shift rapidly. A turbulent close to hurricane season, a globally coordinated cyber event, or unexpected financial market disruptions could darken the skies ahead….”

“[T]he opportunity in front of us demands both vision and vigilance,” the report says.

In fact, harder market terms still persist in wildfire prone regions, according to the report which notes pressure for higher deductibles and reduced coverage following the significant losses of the January 2025 Los Angeles area wildfires.

The Standout: Excess Casualty

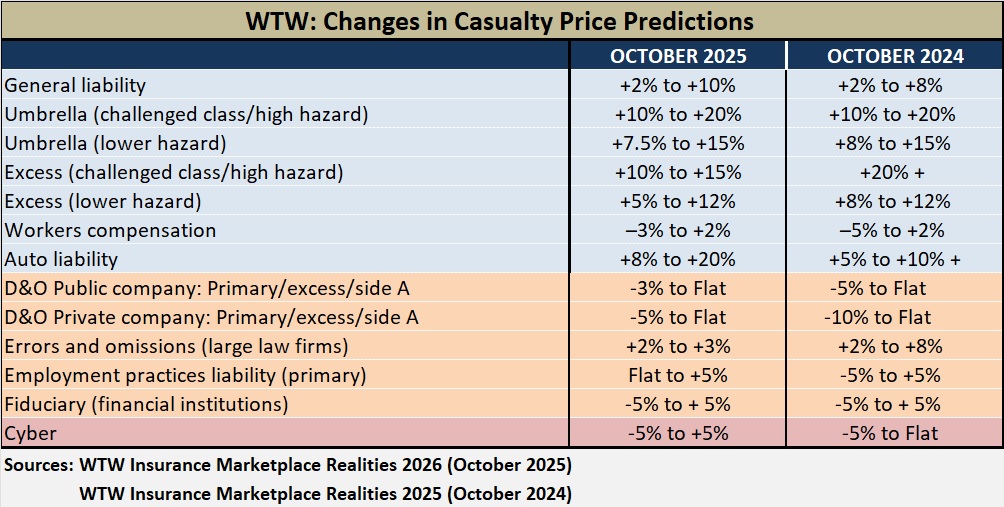

Focusing on one of the lines of business facing continued price increases—excess casualty—the October 2025 report shows slightly lower price hikes now compared to predictions in the previous October 2024 report. For high-hazard and challenged classes, for example, the latest report is indicating increases ranging from 10-15 percent, while the prior report indicated price jumps of at least 20 percent.

The text of the report notes that 20 straight quarters of sustained rate hikes have not been enough to stabilize the market. In fact, even new capacity is demanding higher rates, the report indicates.

“While new capacity has entered the market, overall excess limits deployed continue to shrink as carriers manage overall exposure to loss,” the report also says.

The report described a number of alternative program designs that insureds have had to consider to manage rising costs and limited capacity, including buffer policies to fill coverage gaps between primary and excess liability policies, quota-share retentions, and captive layering, among other strategies.

“Overall, the market remains challenging, with a clear divide between standard and high-hazard risks,” the reports says. It also notes that market selectively extends to traditionally lower-risk profiles, which are also experiencing pricing pressure.

Offering some positive news for buyers, the report notes that despite a slowdown in the emergence of new capital, several new carriers formed responding to excess liability insurance needs, including Helix, Vantage, and Ascot, earlier in the decade. More recently, two major Japanese insurers—Mitsui Sumitomo Insurance Group and Tokio Fire and Marine—entered the North American excess liability space, and MGA startups have started targeting general excess casualty.

As for other liability lines of business shown in the casualty and professional liability sections, comparative price predictions from the current report and the comparable report published by WTW in October 2024 reveal a higher range of price increases for commercial auto (a range of +8 percent to +20 percent for 2026 vs. +5 percent to +10 percent previously predicted for 2025), a lower level of potential rate declines for directors and officers liability, and only flat to slightly increasing rates for employment practices liability as compared to potential declines up to 5 percent predicted in last year’s report.

Middle Market Accounts

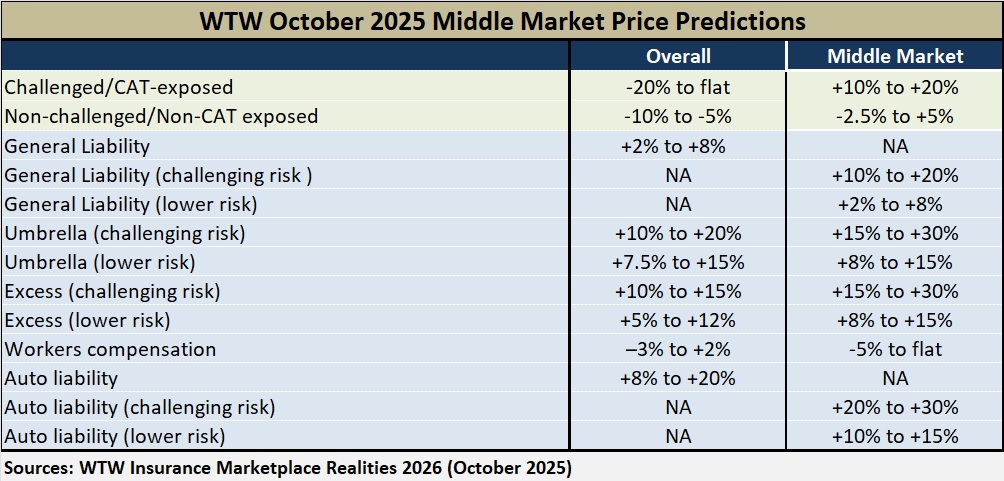

As was the case with prior reports, WTW’s Insurance Marketplace Realities 2026 includes a section devoted to middle market accounts. While a comparison of the pricing predictions for these accounts and predictions for larger risks in the balance of the report reveals bigger increases for challenged middle-market risks, the text of the report notes that carriers have been intensifying their focus on the middle-market.

Referring to a “two-tiered marketplace,” the report states that financial institutions, professional services and technology/media/telecom are considered favorable classes that continue to get “good prices and a lot of space.” On the other hand, middle market insureds participating in the food and beverage, residential real estate, and social services sectors face reduced market appetite, tighter terms and higher retentions.

“Selective underwriting is emerging alongside expansion, with some carriers raising minimum premiums, narrowing industry focus and leveraging profitable lines like workers compensation to balance portfolio risk,” the WTW brokers authoring this section of the report observe.

“This bifurcation reflects a strategic recalibration rather than a retreat from the segment,” the report says.

In fact, there’s a generally increasing focus on the middle market that is being driven by favorable reinsurance conditions and aggressive growth targets. Established carriers are reallocating underwriting resources to the segment, and offering more competitive terms to capture market share, while new entrants (MGAs and international facilities) are expanding capacity, WTW reports.

Topics Commercial Lines Business Insurance Pricing Trends Market

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  AI Needs Its Own Risk Class: Lockton Re

AI Needs Its Own Risk Class: Lockton Re  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley