During earnings conference calls last week leaders of two large personal lines insurers commented on affordability issues, highlighting the downward impact of Florida tort reforms on auto insurance prices.

“At a time when voters are clearly voting with their pocketbooks, this is really a golden opportunity for other states,” said Tom Wilson, president and chief executive officer of Allstate, suggesting that more states should “lean in” to the types of reform measures that took hold in Florida 2023.

“We really applaud the political leadership in Florida for taking on an important issue that’s a difficult issue, which is how do you lower suits against our customers for fender-bender accidents. Their courage is really helping Florida consumers save billions of dollars a year,” he said, referring to Florida government officials. “We’re happy, of course, because our customers are saving money. We will charge them less,” Wilson added.

“Tort reform may seem arcane from an inflation standpoint, but it has the potential to really help consumers deal with increased inflation…. It is just a terrific way to help customers,” he said.

At competitor Progressive, where CEO Tricia Griffith and Chief Financial Officer John Sauerland specifically reported that the company has put through two auto insurance rate reductions this year in Florida already, with another in the works for a December filing, Griffith said that she hadn’t seen law changes have such a consumer impact in her 38 years in the insurance business.

“I would never imagine these changes and how great they are for the benefit of Florida consumers,” she said, specifically commending Florida Governor Ron DeSantis and Florida Insurance Commissioner Michael Yaworsky for work on a particular legislative change—House Bill 837 (2023 tort reform). “It really has had a profound and a momentous effect on the state of Florida’s insurance market,” she said.

Related: Allstate Triples Net Income in Q3 to $3.7 Billion

Sauerland led off the Progressive call with a lengthy discussion of Florida, after briefly noting some key financial metrics for the quarter—an 89.5 combined ratio, 10 percent premium growth and policies in force growth of 12 percent, equating to 4.2 million more policyholders, across all lines and states.

Still, Progressive’s 89.5 combined ratio was 0.5 points higher than in third-quarter 2024, reflecting the inclusion of a $950 million policyholder expense for to credit personal auto customers in Florida—Progressive’s largest market—in recognition of the fact that Progressive recorded profits more than 500 basis points better than Progressive’s filed and approved underwriting profit margin over a recent three year period.

Those are excess profits according to Florida statutes. And the profits, Sauerland explained, came about because of the better-than-anticipated impacts of House Bill 837. Among other things, H.B. 237 moved Florida to a modified comparative negligent system, meaning drivers who are more than 50 percent at fault for an accident could no longer sue for damages, and disallowed one-way attorney fees, the CFO said.

“Since House Bill 837 took effect, our average loss cost or pure premiums for Florida injury claims are down between 10 and 20 percent, and the percentage of Florida personal injury protection or PIP claims for which we receive lawsuits is down around 60 percent,” he reported.

“While we have been responsive in reflecting these changes in our loss costs through two rate reductions for Florida consumers in the past year, and another planned for December, the drop in loss costs was more pronounced than we expected,” he said.

“We applaud the legislative changes in House Bill 837 and resulting in more affordable personal auto insurance premiums for consumers, and desire to continue to grow our presence in Florida,” he said, also noting that loss reserve changes will necessitate monthly adjustments to the accrual. “Naturally, going forward, our intent is to manage profitability in Florida to avoid excess profits,” he said.

An analyst who noted that Progressive’s Florida auto book is now 50 percent bigger than it was in 2022, and asked whether a targeted market for Progressive—customers who bundle auto and home insurance—translated into Florida homeowners insurance policy growth also, Griffith clarified that this is not the case. “Our property growth in Florida has been minimal,” she said, also referencing the sale of coastal policies Progressive chose not to renew to another company a few years back.

“We will write a little bit in Florida now, mostly new construction,” she said.

During the Allstate call, Wilson’s commentary on Florida was a follow-on to an answer from an another executive to a question about the current impact of inflation and tariffs on the auto insurance business. Executives at both companies said they are less concerned these days about these general economic impacts on business, and don’t foresee them translating into price increases.

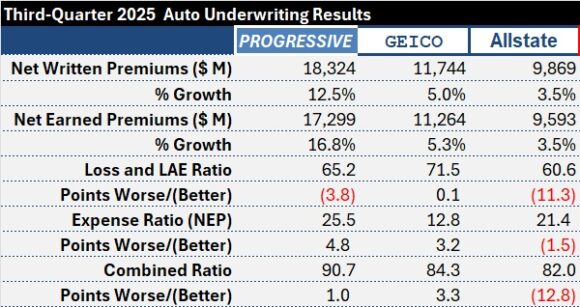

Unlike its competitors, Allstate’s underwriting results in the third quarter did not reflect increased underwriting expenses. GEICO, like Progressive, saw its expense ratio increase—in GEICO’s case because advertising cost growth outpaced premium growth rather than Florida excess profits.

But Allstate’s auto expense ratio declined 1.5 points in third quarter. The Northbrook, lllinois-based insurer also saw its third-quarter auto insurance loss ratio drop 11.3 points, with 2.3 points attributable to a $1.1 billion less catastrophe losses, 4.4 points attributable to a higher amount of favorable prior-year loss development—almost $0.5 billion in third-quarter 2025—and the rest resulting from lower claims frequency and increased earned premiums.

Allstate’s third-quarter auto earned premiums grew 3.5 percent over the comparable quarter last year, while auto earned premiums through nine months grew 4.9 percent, compared to the same period in 2024.

Auto policies in force at Sept. 30, 2025 were 1.3 percent higher than the total recorded last year at the end of September.

Significant improvement in homeowners underwriting results also contributed to Allstate’s improved bottom line.

During the conference call, Jesse Merten, president of property-liability, displayed a U.S. map highlighting 38 states where Allstate is growing policies in force in its personal lines businesses, including Florida. The executives, however, did not reveal whether the carrier is growing both auto and homeowners insurance businesses in the state.

This article originally ran in Insurance Journal’s affiliated publication, Carrier Management.

Before Reforms Take Effect, Though, Expect Thousands of Lawsuits

Topics Trends Florida Profit Loss Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway