Artificial intelligence (AI) is revolutionizing the insurance business. Insurers recognize and are already taking advantage of the manifold ways in which AI can significantly improve their routine processes, decision-making and risk management. At the same time, some insurers recognize the potential for negative impacts as well. In this Real Solutions piece, we will place the intersection of AI and insurance in its historical context, present what insurers are doing with AI today, and offer some notes of caution.

Insurance companies are in the data management business. They quantify, model, and price risk by analyzing past, present, and projected future loss patterns. Despite their reputation as slow and stodgy, insurance companies have long been big buyers of technology. For example, Travelers Insurance Company installed one of the first IBM mainframe computers in the 1960s.

Introduced in 1964, the IBM System/360 was an industry workhorse, mechanizing accounting and reporting functions. Underwriting and portfolio management functions were slower to enter the computer age. Prior to the introduction of computers, underwriters would stick push pins on wall maps to measure risk concentrations and debate whether insurance underwriting is an art or a science (spoiler alert: The science crowd won the debate).

Since then, insurance companies have moved through five distinct phases, using different methodologies to rate and price risks. While some might see AI as simply the next step up in risk pricing sophistication, it is truly a game-changer. To paraphrase Neil Armstrong, AI represents one giant leap for the insurance industry.

Phase 1: One Size Fits All

The least sophisticated insurance pricing methodology is charging the same amount for anyone who buys insurance. For example, once ubiquitous airport vending machines charged just $2.50 (payable in quarters) for accidental death and dismemberment insurance in case of a plane crash. Airport-bought insurance disappeared by the late 1970s, partly in reaction to criminal acts involving bombs on planes. One explosion in 1955 involved a man killing his mother and other passengers to collect the insurance money.

Phase 2: Risk Classes

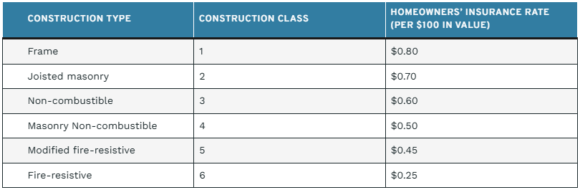

Recognizing that a one-size-fits-all approach could end up overcharging low-risk consumers while undercharging high-risk buyers, insurers developed risk classifications. For example, a property underwriter may have used a simple table—similar to the following hypothetical one—to determine insurance pricing for high-risk versus low-risk homeowners.

The underwriter would then use the data in the table to work up a quote based on the home’s construction type and cost to replace. Homes outfitted with a smoke detector or burglar alarm or that sat close to a fire station received premium credits, while applied debits raised rates for homes with a swimming pool, trampoline, or dangerous pet on the premises.

Phase 3: Rating Bureaus

Small insurers with limited amounts of proprietary data used rating bureaus like the Insurance Services Office, the American Association of Insurance Services, and the National Council on Compensation Insurance to collect data from multiple insurers and develop rates to reflect risk magnitude more accurately. Because today’s insurers have access to more proprietary data from which to calculate risk-adjusted rates, most rating bureaus have gone the way of the buggy whip.

Phase 4: Segmentation

Armed with larger datasets, insurers were able to construct rating tables with more granular segmentation than the simple six-row table shown earlier. For example, each construction class listed in the table includes several subtypes. Progressive Insurance was a pioneer in more granular rating, segmenting the automobile market into hundreds of categories based on car make and model.

Phase 5: Big Data and Predictive Analytics

The availability of new datasets (or “big data“) from social media, telematics, and elsewhere has allowed insurers to predict future loss potential more accurately.

Phase 6 (In Progress): AI

AI has vastly compressed the time it takes to mine data to perform insurance company functions normally done manually. Tasks that could take many minutes or hours, such as underwriting and pricing and claims fraud detection, can now be accomplished in seconds. Whereas the developments between phases 1 and 5 were incremental, the move into Phase 6 is radical and discontinuous—a revolution rather than an evolution.

Insurers Use of AI

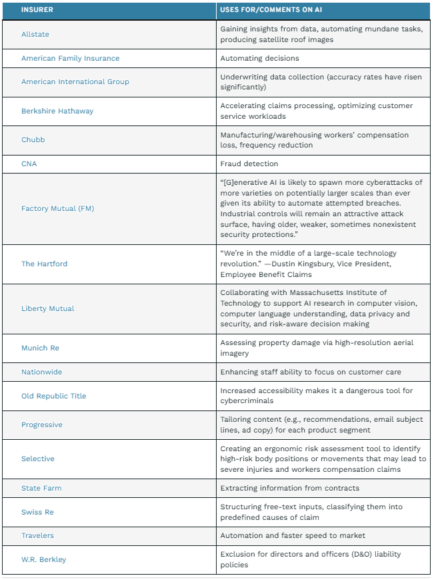

An examination of company disclosures from the 18 largest property and casualty insurers shows they are using AI for many functions—not just underwriting and claims.

A Cautionary Note

Three of these insurers acknowledged potential downsides of AI use in the industry. W.R. Berkley indicated it is excluding AI-related losses from its D&O policies, which cover lawsuits filed against company directors and officers (and the companies they serve) alleging failure to observe their duty of care.

FM, a large insurance company that insures large industrial risks, showed concern that criminals might take advantage of AI to mount more deleterious cyberattacks that destroy critical infrastructure. Old Republic also pointed to the potential for bad actors to commit malicious acts using AI.

Other dangers include fraudsters generating AI images of damage where there was no loss or accident or producing phony claim documents and invoices. In a study commissioned by claims automation company Sprout.ai, 94 percent of claims adjusters in the United Kingdom reported that over 5 percent of claims likely include AI-manipulated elements. (No similar study has been done in the United States.)

Fraud potential notwithstanding, the benefits of AI are real—unlike the failed efforts of dot-com companies or most insurtech ventures. As with other innovations, there will be visionaries, early adopters, fast followers, slow followers, and laggards, who have the most to lose as their competitors build better portfolios and operate more efficiently. The insurance AI arms race is on—may the best companies win.

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  AI Needs Its Own Risk Class: Lockton Re

AI Needs Its Own Risk Class: Lockton Re  State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles