Rising costs and changing customer expectations are driving satisfaction in the insurance and mortgage industry, according to an American Customer Satisfaction Index study.

Among the four industries studied — health insurance, life insurance, property and casualty insurance (P/C), and mortgage lenders — life insurance scored the highest, despite slipping 1 percent to a score of 78 (on a scale of 0 to 100).

Health (unchanged) and P/C (down 1 percent) nabbed the second and third spots at 76 apiece (considered the industry average for P/C).

Mortgage lenders ranked among the lowest-performing ACSI industries, sliding 1 percent to 74.

The main takeaway for all industries is that customers desire clarity, responsiveness and human interaction.

“The true industry leaders are those who meet people where they are and deliver seamless digital solutions without losing sight of the profound reassurance that human interaction provides, especially when it matters most,” said Forrest Morgeson, associate professor of Marketing at Michigan State University and director of Research Emeritus at the ACSI. “The future of insurance and mortgage lending lies in blending technological convenience with personal connection, empowering customers to feel understood and supported through every experience.”

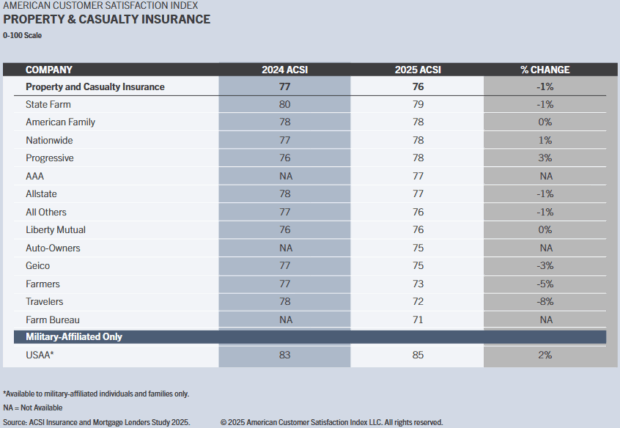

Focusing on P/C, military-affiliate USAA and State Farm continue to lead the P/C industry in customer satisfaction, the report found.

USAA improved by 2 percent to an ACSI score of 85, 6 points ahead of State Farm, which scored the highest among providers not limited to military-affiliated consumers, despite dipping 1 percent to 79.

Progressive scored the largest year-over-year gain, climbing 3 percent to 78, sharing a three-way tie with American Family (unchanged) and Nationwide (up 1 percent).

Geico (down 3 percent to 75), Farmers (down 5 percent to 73), and Travelers (down 8 percent to 72) all experienced considerable losses — but still outperform Farm Bureau, which finishes last with an ACSI score of 71.

“In a year marked by steep premium hikes, worsening storms, flooding, wildfires, and rapid technological transformation, customer experience metrics declined across the board,” ACSI stated.

While industry satisfaction remained relatively stable (declining by just 1 percent), the same can’t be said for customer satisfaction, the report noted.

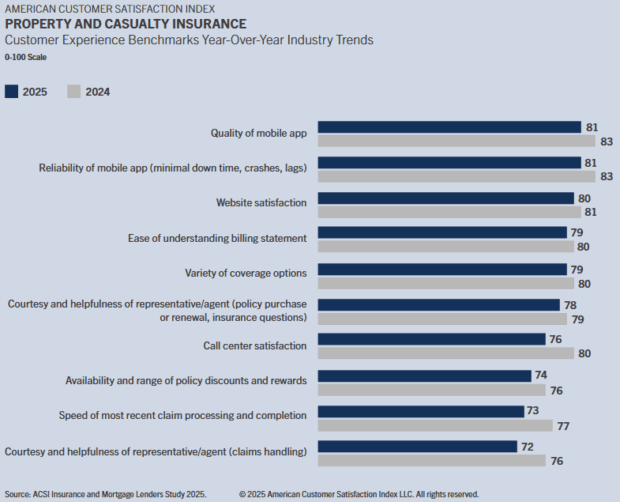

Claims processing speed (73), call center satisfaction (76), and agent courtesy and helpfulness (72) all plummeted 5 percent.

Policy discounts and rewards metric declined 3 percent to 74, while mobile app quality and reliability both slipped 2 percent to 81.

Topics Trends Carriers Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Deep Freeze and Drought Fueled a Massive Florida Wildfire

Deep Freeze and Drought Fueled a Massive Florida Wildfire  Commercial P/C Market Softest Since 2017, Says CIAB

Commercial P/C Market Softest Since 2017, Says CIAB  Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp

Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition