Rank-and-file US Securities and Exchange Commission workers have returned to face the paperwork that piled up during the longest government shutdown in US history, and supervisors say the order of the day is “triage.”

Deal first with the tasks still lingering on pre-shutdown to-do lists, according to an email sent to staffers reviewed by Bloomberg News. Only then should they move on to the avalanche of filings that came in while 90% of the agency’s workforce was furloughed.

SEC staffers were told to focus on so-called registration statements, which companies file when they want to raise money such as in an initial public offering. More than 900 rolled in during the shutdown, the SEC said when the government reopened. Routine reviews of public company financial statements, required under post-Enron regulatory reforms, were to be pushed to the bottom of the pile, the email showed.

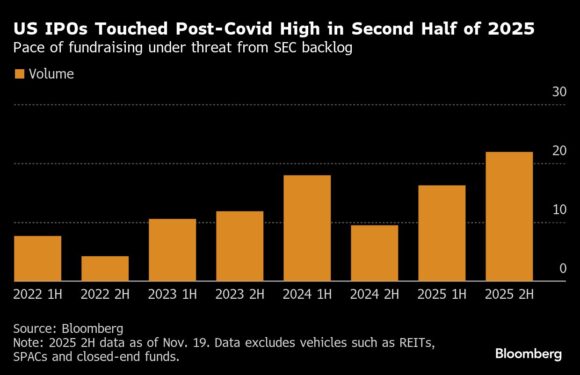

At stake is this year’s increase in listings, threatening SEC Chairman Paul Atkins’ pledge to “make IPOs great again.” More than a dozen companies had to revise timelines for their public market debuts after the SEC was shuttered, and lawyers are working the phones to rescue their clients’ deals from limbo. With a busy slate of holidays, and market volatility climbing, further delays from the regulator would pressure more IPO candidates to shift their plans to next year.

“Unfortunately most pending IPOs will be 2026 because there’s not a lot of time for deals where the SEC hasn’t already finished their comment process to get out by year-end,” said Michael Kaplan, a partner at law firm Davis Polk & Wardwell. “We have a couple would-be IPOs that could go in case we get lucky and the reviews are quick, but most will likely have to wait.”

The first-come, first-served plan has created some uncertainty for IPO candidates, according to Jeffrey Karpf, the managing partner-elect of law firm Cleary Gottlieb.

“Some companies have called to plead their case to the SEC because they are on the cusp of wanting to move ahead,” Karpf said. “The SEC returned those calls but did not make any promises.”

The SEC didn’t immediately respond to a request for comment. In post-shutdown guidance, the agency said staffers were “working expeditiously to clear the backlog of filings.”

Obstacles to Going Public

The SEC’s priorities during President Donald Trump’s second term include removing obstacles that keep companies private; the number of publicly traded companies in the US has fallen by nearly half since the 1990s. Things were moving in the right direction according to one measure, with $32.2 billion raised in the year through Oct. 1 when the shutdown began, up 47% from the same period in 2024, data compiled by Bloomberg show.

A handful of deals were pushed through in the 43-day impasse, with companies opting to take advantage of a workaround to sidestep the SEC’s traditional role in the IPO process, which can involve a lengthy back-and-forth list of formal questions and comments, until the regulator’s attorneys and accountants are satisfied. The shutdown alternative allowed registration statements to automatically clear, or go effective, after 20 days.

MapLight Therapeutics Inc., a California-based biotech company, debuted on Oct. 26 using the SEC’s shutdown relief. Atkins touted the move on X, writing “the IPO market is still open for business.”

Still, most companies avoided that path to public markets, in part because they wanted the final sign-off from the SEC to ensure all the regulator’s questions were answered.

“Unless you were really down to very few comments, there was a real risk,” said Eddie Best, partner at Willkie Farr & Gallagher.

Some of the companies using the regulatory workaround may have regretted it. Beta Technologies Inc. and Navan Inc., the two largest such listings, and MapLight are all trading below their IPO prices.

The weighted average return of 2025 US IPOs is now at a paltry 6.1% — down from more than 20% a week ago — as volatility is whipped up and the market’s riskiest corners tumble. The confluence of factors risks closing an already tight window to go public. That’s been top of mind for bankers and lawyers who are advising companies, with every day’s selloff presenting risks that may ultimately drive advisers to lean toward getting deals done next year.

“Did the shutdown interfere with a really good window to go public and when things are settled will things in the market look worse?” Kaplan said. “We’ll have to wait and see, but that’s the worry.”

Another potential hold-up that could limit the number of companies that are able to go public if they wanted to is the impact of planned vacations and holidays for the SEC staff. The year-end holidays are “always a bit of a wild card,” according to Dave Peinsipp, co-chair of Cooley’s global capital markets practice.

Peinsipp is optimistic that the SEC will work to expedite reviews of deals that were closer to being ready for showtime, with hopes that deals can still be completed before the calendar turns to 2026.

“There’s a bit of company-by-company analysis to look at what is best to meet as many peoples’ timetables as possible,” he said.

Topics USA

Was this article valuable?

Here are more articles you may enjoy.

Commercial P/C Market Softest Since 2017, Says CIAB

Commercial P/C Market Softest Since 2017, Says CIAB  Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M

Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes  Waiting for Hormuz, More Oil Tankers Gather in the Persian Gulf

Waiting for Hormuz, More Oil Tankers Gather in the Persian Gulf