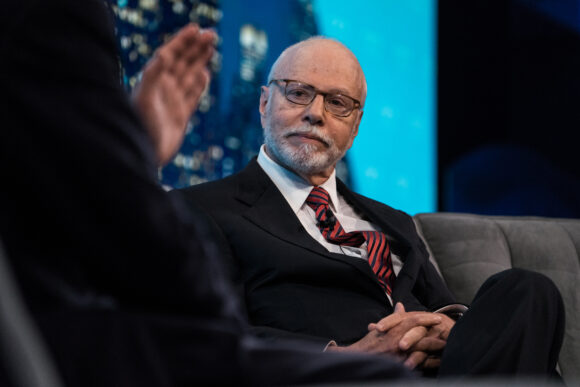

Paul Singer’s Elliott Investment Management escalated a legal fight with a Texas-based private equity firm it has accused of charging excessive expenses.

Stronghold Investment Management is being accused of improperly overcharging expenses to oil and gas-focused private equity funds that Florida-based Elliott had invested in and refusing to liquidate two of the pools in breach of an earlier agreement, according to a lawsuit made public Wednesday in Delaware Chancery Court. Stronghold has continued acquiring assets and ran up “excessive expenses,” Elliott alleged.

In earlier court filings, Stronghold has denied that it overcharged Elliott and has argued that it has sufficiently accounted for costs. The private equity firm has touted returns delivered to Elliott on a $532 million investment across several Stronghold-affiliated funds. Elliott made back its money and stands to potentially make another $379 million, a Stronghold attorney told a judge in May as part of a separate case.

Representatives for Stronghold didn’t respond to a request for comment on the lawsuit.

In March, Elliott filed a complaint seeking access to internal Stronghold company records to investigate the expenses it said were inflated by tens of millions of dollars. A judge has been weighing whether to grant Elliott access to those records. In its new complaint, Elliott asked the judge to award the funds damages and to order a receiver to oversee the wind down of the partnerships.

In a separate letter Thursday to the judge in the documents case, Elliott said its concerns have “only heightened” since the trial, citing Stronghold’s recent financial disclosures and its refusal to wind down the partnerships.

The court fight is rare in the world of private equity, where fund managers tend to have long-standing relationships with their investors given the long-term nature of the asset class. But Elliott isn’t a typical fund investor. With about $76.1 billion in assets as of June, it’s earned a reputation for challenging some of the world’s largest public companies to try to force change. Its fight highlights a persistent challenge that many fund investors have faced in trying to figure out costs that come on top of hefty management fees.

The books and records case centered around expenses tied to a $100 million investment Elliott made with Stronghold, which made oil and gas bets primarily in Texas. Elliott said it became suspicious when it saw costs jump dramatically following a 2022 settlement between the two firms that called for a winding down of the relationship through asset sales.

The settlement arose from a previous dispute where Elliott accused the private equity firm of misappropriating at least $27 million. Stronghold denied wrongdoing and said that an Elliott-controlled administrator was to blame for sending payments meant for Elliott to the private equity firm.

Stronghold has called the expense increase “a blip” driven by accounting costs and spending on a lawsuit filed to protect proprietary technology that has been used to help drive returns in its funds. Elliott said that it shouldn’t have to pay for technology that benefits Stronghold.

Elliott claimed it “had no visibility into the specific charges that Stronghold was charging the fund and its portfolio companies in each of these categories” until it brought legal action to obtain company records. Through that process, the firm obtained enough information to confirm “that Stronghold has been improperly charging expenses,” according to the new lawsuit.

Topics Texas

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio