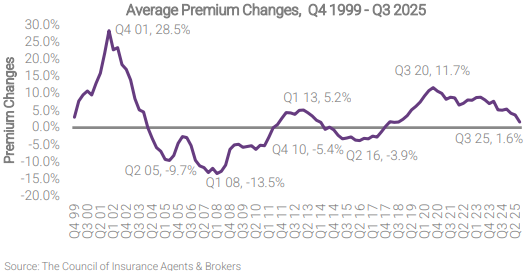

According to The Council of Insurance Agents & Brokers (CIAB) quarterly survey, commercial property/casualty premiums across all account sizes in the third quarter 2025 rose by 1.6%, as premium increases in all lines of business were either flat or lower than the last quarter when premiums for all accounts increased 3.7%.

“Q3 2025 showed clear soft market conditions across the board,” said CIAB in its report. Lines that saw premiums decrease in Q3 were business interruption, commercial property, cyber, D&O, employment practices, and workers compensation.

Survey respondents cited aggressive competition in Q3, notably for small business. Multiple respondents highlighted carriers’ appetite for smaller accounts, CIAB reported.

The cost of cyber insurance fell most out of all lines, down an average of 2.6% in Q3. CIAB said 43% of respondents indicated an increase in cyber underwriting capacity, with about 25% calling the increase “significant.”

Commercial property premiums decreased for the first time in eight years, down an average of 0.2%. The reason cited most by respondents was an influx of additional capacity, outweighing demand. New carriers and managing general agents have entered the market as well as returning carriers that left during hard-market conditions. Also, the commercial property reinsurance market has improved, which has trickled down as a benefit to insureds.

Even the rate of premiums increases for umbrella coverage decreased in Q3, CIAB said the line had seen average increases of 11.5% in Q2. In Q3, the increase was an average of 5.5%. “It’s not yet clear what may be influencing this abrupt reversal in the magnitude of average premium increases for the line,” CIAB added.

Topics Commercial Lines Pricing Trends Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows