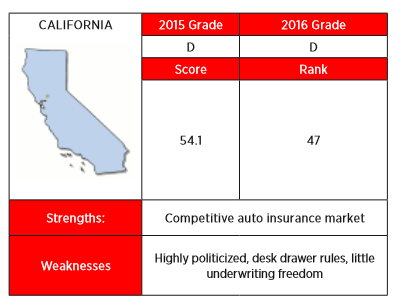

A report gives California’s insurance regulatory environment low marks for auto body repair rules, the insurance commissioner’s call for insurers to divest from coal, its prior approval law and being the “most politicized state in the country.”

California was given a D- by the 2016 Insurance Regulation Report Card from R Street Institute, a group that says it’s dedicated to the mantra, “Free markets. Real solutions.”

The annual survey tests which state regulatory systems “embody the principles of limited, effective and efficient government.”

It is the philosophy of the report’s authors that states should regulate only market activities in which government is best-positioned to act, and those activities should produce a little as possible financial burden on policyholders, companies and taxpayers.

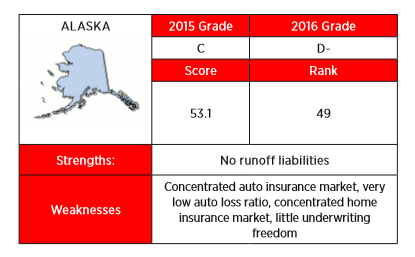

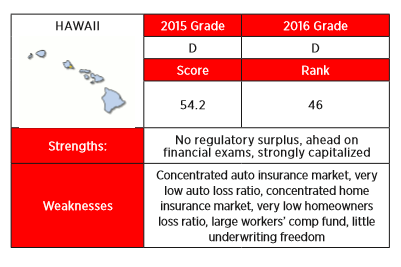

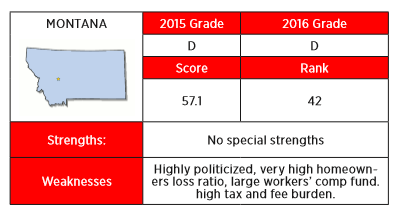

Other Western states that received poor grades were Alaska (D-), Hawaii (D) and Montana (D). A-grades were given to Arizona, Idaho and Utah. Nevada (B+), Oregon (B+), New Mexico (B) and Wyoming (B) followed. Colorado earned a C-grade and Washington received a C-.

Nationwide, Vermont graded out as the best regulatory system for insurance and North Carolina had the worst grades.

California’s poor grade didn’t sit well with the insurance commissioner’s office.

“These so-called report cards by these right-wing affiliates should be dismissed as nothing more than political garbage,” said Byron Tucker, deputy commissioner of the California Department of Insurance. “This is just another partisan study by a biased, self-serving organization. Nobody in California views R Street as objective and credible.”

R Street Senior Fellow R.J. Lehmann, who authored the report, said the state had points deducted because the office of insurance commissioner is politicized, which includes decisions made by the commissioner that he said were political.

The report, however, isn’t political, he added.

“We are free market advocates. That is not something we would hide,” Lehmann said. “We believe there is a role for regulation.”

A primary scoring consideration, for example, is solvency regulation. States not doing an effective job of regulating solvency have points subtracted.

“The largest single factor in our report is solvency regulation,” he said, adding that solvency is an objective topic, not a political one. “We’re not going to say it’s not ideological, but it’s not anti-government.”

Major deductions for California included a decision in January from California Insurance Commissioner Dave Jones, who asked all insurers that do business in the state to divest from thermal coal and to require insurance companies to disclose such investments.

To comply with this request would mean making no new investments, not renewing existing investments, and selling or withdrawing from existing investments in thermal coal, according to the California Department of Insurance. It should be noted that as of now, Jones’ divestment request is voluntary, and specifically requests a divestment from any entity that either extracts or burns thermal coal or that derives 30 percent or more of its revenues from thermal coal.

“His job as the insurance commissioner of California when it comes to investing is to look to see if they are prudent and they are effectively matched to the risk that the insurer takes on,” Lehmann said. “His job is not to pick industries.”

He said he finds the idea “somewhat ludicrous” that the commissioner believes he knows the risk of an investment and an insurer doesn’t.

This is one of the primary reasons the report declares California to be the most politicized state in the U.S.

More deductions came from a decision from Jones in March on a pair of auto-body regulations that would require insurance companies to inspect a damaged vehicle within six business days, and would limit companies’ freedom to comment about a particular auto-body repair shop where the effect might be to dissuade customers from choosing that shop.

The top reason Lehmann gave for California’s D- is a law that’s been around since 1988.

“It’s basically Prop 103,” he said. “Prop 103 does not permit the kind of market-based competition that we think works in most states.”

Prop. 103 requires, among other things, that property/casualty insurers justify their rates. The industry has challenged the law in the past. Last year a Sacramento Superior Court rejected an industry challenge on the commissioner’s regulations under Prop 103 that limit the amount of advertising costs insurers may pass on to consumers through insurance premiums.

This prior approval auto regulation makes it difficult to introduce products, and makes it hard for insurers to increase or even lower rates, Lehmann said.

An insurer responding to market conditions, for example, may want to cut rates. That would be unlikely, however, knowing they couldn’t easily raise them later.

“If you had the freedom to adjust your rates based on conditions in the market, you would see a lot more companies offer discounts,” Lehmann said. “California’s a very restrictive state and we think that is a concern.”

Those who support Prop. 103 say it has saved consumers lots of money.

A report in 2013 from the Consumer Federation of America that analyzed the auto insurance regulatory systems of each of the 50 states from 1988 through present singles out California and the landmark insurance reforms in Prop 103.

That report shows an estimated savings to California drivers of $100 billion, or $8,125 per household, since the law passed. The authors also called for prior approval regulations similar to Prop. 103 for the rest of the states.

Having an elected commissioner also cost points in the R Street report.

Lehmann said elected commissioners, like California’s, as well as those appointed by a governor, can get caught up in playing politics instead of regulating the industry.

“Among non-elected commissioners, in states where you serve a set term that can overlap multiple (gubernatorial) administrations, that seems like the independence that is the best,” he said, adding that this means a commissioner isn’t serving “at the pleasure of one executive.”

Three states in which commissioners don’t directly serve one executive got positive points in the grading: in Virginia the commissioner is nominated by the State Corporation Commission; in New Mexico the Public Regulation Commission has the say over commissioner; and in Florida the Department of Financial Services appoints the commissioner.

The report also dings California under the category of “residual markets” because of the California Earthquake Authority, which has an estimated 40 percent of the state’s earthquake market.

“The CEA is a product of a law that earthquake insurance must be offered in the first place,” Lehmann said. “We probably would ultimately disagree with that law.”

The CEA was created by Legislature following the 1994 Northridge Earthquake and the home insurance crisis the ensued. At that time the state also passed a law requiring insurers offering homeowners insurance in the state to also offer earthquake insurance.

Lehmann said he believes it’s appropriate for a bank to require earthquake insurance if it is holding an outstanding mortgage, but “if you’re not a lender who wants to secure their principal, then ultimately it should be up to the policyholder.”

He also believes insurers could craft more products to deal with earthquake risk if the market were freer, and that consumer deductibles would shrink if more insurers were able to compete in the earthquake market.

“I think CEA has gotten better,” he added.

In fact, the CEA, which is celebrating its 20th anniversary this month, has lowered rates by 55 percent combined in that time and has created a range of deductibles (5 percent, 10 percent, 20 percent, 25 percent), according to CEA CEO Glenn Pomeroy.

Several states, including California, were downgraded for practicing “desk drawer rules,” which are rules of thumb that regulators apply that are not on the books.

“If you know that there’s a certain kind of requirement that would always be denied, even if there’s no rule that it should be denied, we consider that a desk drawer rule,” Lehmann said. “If you try to obey the law as written, you still could be denied any number of business requests.”

The grading isn’t all bad for California. It graded out as one of the most competitive states in terms of the auto insurance market.

Alaska was another state that was hammered in the report.

The state received a D- overall. It was knocked for having highly concentrated auto and home insurance markets, and Gov. Bill Walker’s veto in July of SB 127, which would have allowed insurers to consider a consumer’s credit information during policy renewals.

Lori Wing-Heier, director of the state’s insurance department, said the state currently allows credit scoring to be used on new applications, but not on renewal business unless certain statutory procedures are met.

“SB 127 simplified the process for renewal business, when it was vetoed by Governor Bill Walker,” she wrote in an email reply to a request for comment for this article. “It did not eliminate or change the use of credit scoring on new applications or on renewal.”

She noted that Walker intends to introduce a revised bill at the start of the legislative session next month that will strengthen consumer protections.

“It is our hope to strengthen the personal lines market and provide additional consumer protections with the passage and enactment of this new bill,” Wing-Heier said.

Hawaii received a D for its low loss ratio, having a concentrated homeowners market, having a workers’ comp fund that accounts for more than a quarter of the market, having a prior approval system, banning the use of credit in auto insurance underwriting and ratemaking, and prohibiting the use of age and gender in underwriting variables.

A spokesman for Hawaii’s insurance department declined to comment.

Montana’s D was for having an elected commissioner, for having a state fund that writes more than half the workers’ comp market and prohibiting the use of gender and marital status in underwriting variables.

Laura Parvey-Connors, communications director for the Office of the Montana State Auditor, Commissioner of Securities and Insurance, responded in an emailed comment that the commissioner is elected according to the state constitution.

“The Office of the Montana State Auditor didn’t have the regulatory authority over the Montana State Fund until 2015,” she wrote.

Senate Bill 123, passed in 2015, assigned regulatory authority over the Montana State Fund to the auditor’s office with provisions that retained the state fund’s certainty for a certificate of authority, requirement to be a guaranteed market for workers’ compensation and exemption from paying the premium tax.

“The fact that State Fund writes more than half of the workers’ comp in the state is because they are the guarantee market for worker’s compensation,” she stated.

Lehmann and other fellows at R Street Institute are authors of the Right Street blog on Insurance Journal.com.

Related:

- Southeast Regulation Report Card: North Carolina Flunks; Florida, South Carolina Dispute Grades

- East Regulation Report Card: Vermont Ranks Best for 3rd Straight Year

- South Central Regulation Report Card: Texas’ Grade Rises, Arkansas’ Drops

- Midwest Regulation Report Card: States’ Grades Range from A to D

- State Regulation Report Card: R Street Grades Them All from Best to Worst

Topics Catastrophe California Carriers Auto Legislation Workers' Compensation Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says

Two-Thirds of Independent Agencies Plan to Increase AI Use This Year, Survey Says  Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups

Former Broker, Co-Defendant Sentenced to 20 Years in Fraudulent ACA Sign-Ups