Demotech’s review of second quarter 2016 data, as recently reported by insurers to the National Association of Insurance Commissioners, shows that workers’ compensation insurers reported a 2.3 percent increase in direct written premiums during the first six months of 2016 versus the same period in 2015.

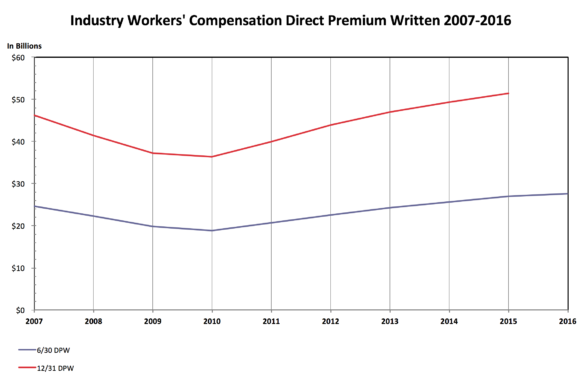

Workers’ compensation direct written premiums have increased for six straight years. Written premiums at mid-year 2016 of $27.5 billion are at an all-time high from the mid-year 2010 low of $18.8 billion. However, the growth rate has consistently slowed over the period, from a 9.5 percent change in 2011 to a 2.3 percent change in 2016.

The top 25 workers’ compensation insurers, ranked by the highest dollar amount of direct written premium growth, reported an 18.9 percent premium increase during the first six months of 2016 versus the same period in 2015. For all other workers’ comp insurers combined, reported premium decreased by 0.7 percent.

Eleven of the insurers in this year’s top 25 were also in last year’s top 25. Texas Mutual Insurance Co., which had been in the top 25 for five consecutive years, is no longer in the top 25; its premium decreased as a result of rate reductions and lower payrolls reported by its insureds.

Insurer groups having three or more insurers in the top 25 include AmTrust, Berkshire Hathaway and Chubb. AmTrust has three insurers in the top 25 this year; these were also in last year’s top 25. Berkshire Hathaway has four insurers in the top 25, three of which were in last year’s top 25. Chubb Group, which merged with ACE earlier this year, has three insurers which are all newcomers to the top 25. Several of the other top 25 insurers are members of large national and international insurer groups.

Two of the top 25 insurers are not part of an insurer group. Benchmark Insurance Co. is a multiline insurer which specializes in fronting arrangements and program business. LCTA Casualty Insurance Co., which writes only in Louisiana, is a group self-insured fund that converted to a stock insurance company earlier this year.

Five of the top 25 insurers wrote more than 80 percent of their total workers’ compensation premium in California: Insurance Co. of the West, Redwood Fire and Casualty Insurance Co., Security National Insurance Co., Pacific Compensation Insurance Co. and StarStone National Insurance Co. Premium growth from these insurers is notable since the Workers’ Compensation Insurance Rating Bureau of California has been reducing its advisory pure premium rates since July 1, 2015, and the Bureau had expected premiums to flatten or decrease accordingly.

Interest rates remain at historically low levels and investment income continues to decline. Premiums will need to continue growing in order to offset this loss in investment income so insurers can hope to achieve profitability targets.

Challenges to premium growth include changes in the workforce and opt-out legislation. The labor participation rate is near a 38-year low. Companies are using more part-time employees (lower payrolls), and independent contractors (generally not insured under workers’ compensation). The opt-out legislation, which has been proposed in several states, would permit employers to use an employee benefit program to cover work-related accidents instead of the workers’ comp system.

Society and technology are rapidly changing what, how, and where work is done. Workers’ comp insurers and insurance legislators will need to respond to these changes.

Was this article valuable?

Here are more articles you may enjoy.

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp

Florida Appeals Court Pulls the Plug on Physician Dispensing in Workers’ Comp  What to Know About Killing of Powerful Cartel Leader ‘El Mencho’ in Mexico

What to Know About Killing of Powerful Cartel Leader ‘El Mencho’ in Mexico  Cuts to Funding Mean Risks Will Pivot in Human Services Market

Cuts to Funding Mean Risks Will Pivot in Human Services Market