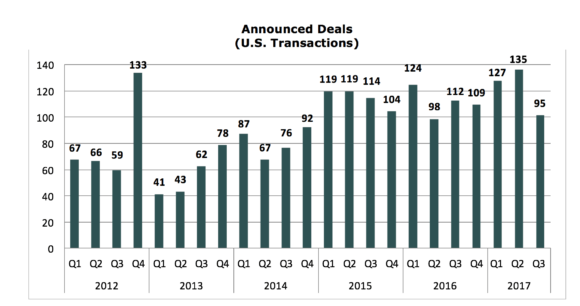

Deal count is on record pace for the first nine months of 2017 (year-to-date, Sept. 30, 2017). There were 357 transactions during this period. By comparison, 334 transactions closed during the same year-to-date period in 2016, and 352 deals year-to-date closed during the same period in 2015.

Deal count for the third quarter (Q3) of 2017 was down relative to Q3 for both 2015 and 2016. There were 95 announced transactions in the Q3 2017, compared to 112 in Q3 2016 and 11 in Q3 2015. Thirty-seven deals closed in July, 29 in August, and 29 transactions occurred in September. By comparison, historical Q3 deal counts during the past five years averaged 91.8 per year.

For year-to-date (Sept. 30, 2017), 48.7 percent of acquired agencies were property/casualty firms, 30 percent were multiline agencies and 21.3 percent were employee benefits firms. Specialty distributors made up 14.8 percent of the activity year-to-date, a decrease from Sept. 30, 2016’s 15.8 percent.

Private equity-backed buyers continue to drive the market with 174 closed transactions year-to-date, Sept. 30, 2017, which is slightly higher than the 171 transactions that closed during the same time-period in 2016. This represented 48.7 percent of all deal activity in the first nine months of the year. Independent agencies completed 112 transactions and public brokers accounted for 32 deals over the indicated period. Insurance carriers, banks and other buyers closed 39 deals year-to-date, Sept. 30, 2017.

The top five buyers this year represented 36.1 percent of total deal activity through the first three quarters of 2017 and the top 10 accounted for 44.8 percent. Acrisure LLC was the most active acquirer so far in 2017. Acrisure is listed as having 30 announced transactions. However, Acrisure has a strategy of not announcing deals to preserve autonomy post-closing. It can likely be assumed that Acrisure has closed more deals than what has been announced to the marketplace.

Hub International Ltd. was the second most active acquirer with 27 deals year-to-date, Sept. 30, 2017. Historically, Hub has been the most active acquirer during the past five years with 146 announced transactions since 2012.

BroadStreet Partners Inc. was the third most active acquirer, with 23 deals closed as of Sept. 30, 2017. BroadStreet typically applies a co-ownership structure to its acquisitions and allows agency owners and/or key employees to retain some ownership in the agency. The principals operate autonomously, and the agency preserves brand identity.

Arthur J. Gallagher & Co. (AJG) was the fourth most active acquirer and the most active public broker with 21 deal closings in the first nine months of 2017. In the past five years, AJG has been the second most active acquirer with 143 closed transactions.

There was a tie at the fifth spot between NFP Corp. and Seeman Holtz Property and Casualty Inc., each with 14 announced deals. Seeman Holtz, a new buyer to the marketplace, increased its deal flow from two in 2016 to 14 for the first nine months of 2017. Seeman Holtz, headquartered in South Florida, is a retirement planning company that received private equity backing and is aggressively focused on expanding its product lines through acquisition.

Rounding out the top 10 are AssuredPartners Inc. (10), RSC Insurance Brokerage Inc. dba Risk Strategies Company Inc. (8), Hilb Group LLC (7), OneDigital (6), and Confie Seguros Inc. (6).

Was this article valuable?

Here are more articles you may enjoy.

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation  Marsh, Aon in Talks With US on Insuring Tankers in Hormuz

Marsh, Aon in Talks With US on Insuring Tankers in Hormuz  Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M

Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes