Fueled by continued, albeit moderate, economic growth in a historically low interest rate environment and an increase in the number of well-capitalized acquirors, deal-making in the insurance distribution sector hit yet another all-time high in calendar year 2019. This marks the third year in a row when the number of publicly announced deals outpaced the prior year.

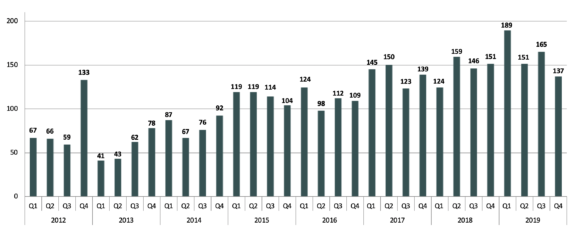

With 642 publicly announced deals, 2019 was the most active year of merger and acquisition (M&A) transactions on record. For perspective, since 2013 during which publicly announced transactions totaled just 224 annual deal counts have increased on average over 19% in comparison to their respective prior year.

2019 didn’t waste any time racking up transactions. Ninety-three of the year’s 642 deals were closed in January 2019, 18 of which were the result of the formation of private equity (PE) backed Patriot Growth Insurance Services LLC. From February through December, monthly deal counts averaged just under 50, a remarkable number when compared to historical averages.

PE-backed buyers continue to lead the pack with 400 of the 642 announced transactions for the calendar year, or 62.3% of all deal activity. Non PE-backed independent firms completed 153 transactions in 2019, and public brokers accounted for 52 deals or approximately 8% of the total. Insurance carriers, banks and thrifts, and other buyers rounded out the numbers with a total of 37 transactions.

The top five buyers for the year represented approximately one-third of the total deal activity, and the top 10 buyers accounted for roughly half.

Acrisure LLC retained its long-standing title as the year’s most active, having completed a total of 68 announced transactions in 2019.

Hub International Limited was the second most active buyer with 45 closed transactions in calendar year 2019. It has closed 234 publicly announced deals since 2012, trailing only Acrisure that had 303 during the same period.

Broadstreet Partners Inc., AssuredPartners Inc. and Arthur J. Gallagher & Co. rounded out the top five buyers and collectively closed 96 deals in 2019.

Other buyers in the top 10 include Patriot, The Hilb Group LLC, Alera Group Inc., Risk Strategies Co. Inc. and Brown & Brown Inc. Patriot led this group with 27 closed transactions, followed by Hilb with 25, Alera with 24, Risk Strategies with 19 and Brown & Brown with 17. The geographic locations of the sellers generally tracked the most populous U.S. states, including California, Texas, New York and Florida, which accounted for 224 of the 642 announced deals in 2019.

Topics Mergers & Acquisitions

Was this article valuable?

Here are more articles you may enjoy.

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial