I remember talking with an agency owner a few years ago who had gotten upset with an insurance carrier with whom they were working. This has been a frequent occurrence in the last few years as the hard market has added frustration to the daily lives of practically everyone in the personal lines sector.

In this case, however, the agent had lost his temper and said several unfortunate things to the carrier’s local marketing representative. Though this unprofessional outburst did not end the agency or sever its carrier relationship, it certainly didn’t do anything to further business or the group’s reputation.

While most carrier-agency relationships do not reach such a level of stress and strain, there can certainly be challenges. Long-term, successful partnerships between an agency and the insurance companies it represents must be nurtured and carefully managed.

Here are some proven success strategies to maximize yours.

Play the Long Game and Don’t Lose Your Cool

It is important in any relationship to treat all parties with respect. When someone fails to apologize after an outburst, for example, the breach of trust and goodwill can never be fully healed. It is normal to get frustrated and even angry at times, but allowing those emotions to air in an unprofessional manner is simply inexcusable.

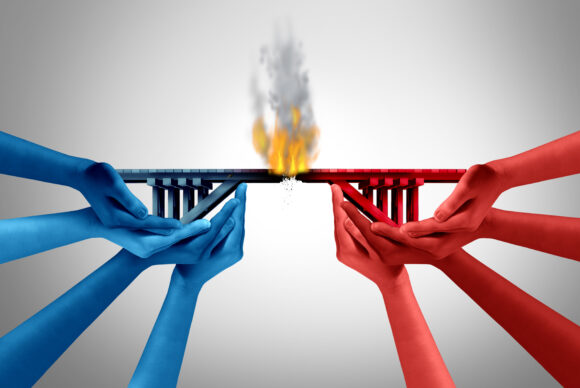

Every agency owner should know that what is communicated by you and your staff, whether in writing or verbally, is stored in a carrier’s customer relationship management (CRM) system–forever. Further, marketing representatives typically have careers lasting decades, and whether they remain a local representative, get promoted, or even change insurance companies, they could still impact your business. Burning bridges with a carrier representative may have negative consequences for an agency that may never go away.

Remember, in every interaction with carrier personnel, just like in a successful marriage, you are building a permanent relationship. Consequently, tact, timing, and careful consideration of what you say, do, and put down in words are non-negotiables if you want to sustain long-term, profitable carrier representation.

Follow the Rules

It can be frustrating for agency personnel when seemingly unreasonable company underwriting guidelines or marketing restrictions prevent them from placing business or helping a customer. Sometimes, this triggers the natural human tendency to cheat. Though not a popular notion to talk about, I’ve seen and heard of many cases from insurance company executives that prove it to be a real problem.

Integrity is required. You simply must not break the rules–no questions asked. And if you find a staff member doing so, the issue should be corrected immediately and their future employment brought into question.

Help

Everyone needs help at some point, even your carrier partners. Sometimes they need an agency’s help to solve their problems. Years ago, I recall, one of the best commercial carriers with which my agency worked needed to reduce their roof exposure but didn’t want to actively cancel business. They asked if we could move several accounts to help them out. While it was not particularly difficult for us to do, that act of assistance was appreciated and paid dividends in terms of our relationship.

Agents need help from time to time with hard-to-place risks, managing a claim, or other issues. The carriers that go out of their way to help us are the ones with which we want to do more business–and the same goes for insurance companies.

Don’t Overestimate

The annual planning process can be challenging, especially for new or rapidly growing organizations. It’s hard to know how your sales efforts may turn out a year in advance, and it’s natural to want to express confidence in your capabilities, especially when trying to interest a new carrier. But do not overpromise. Failing to deliver on commitments is unacceptable. It creates a business hole for the carrier’s local marketing representative, potentially impacting their bonus, and it prevents carriers from effectively allocating resources. It can also damage your agency’s credibility. Be conservative in your estimates.

Do Communicate Frequently and Completely

One complaint I often hear from agency owners is that carrier representatives ask too much of their time. Agency team members are always busy, but these visits are necessary and inescapable. So, manage the process by proactively scheduling visits when you can and use an agreed-upon agenda to keep the meetings effective and on track. Be sure to allow time in the agenda for both parties to share information and feedback to ensure an engaging two-way conversation.

It’s also important to be proactive in your communications with your carrier executives. Don’t let bad news–or good news for that matter–sit for too long. Email is a wonderful tool for many things, but some news, particularly when it is unwelcome, is best given over the phone, via Zoom, or in person.

Celebrate Success with Insurance Carriers

A big part of the success of any independent agency is maximizing the opportunities their insurance carriers provide, whether that’s special pricing, market access, or compensation. When your agency is successful, it can be beneficial to think about how your carrier(s) contributed to those achievements and recognize them for it. Something as simple as a thank-you email goes a long way in building long-term trust and strong partnerships.

If you decide to have more formal celebrations for achievements in the agency, why not invite carrier personnel to attend? Including them can make them feel appreciated and let them know they are a valuable part of your team.

Strong, longstanding, and mutually beneficial personal and organizational relationships between agencies and their insurance companies is the foundation upon which long-term business success is built. But in the urgent stress of getting everything on your to-do list accomplished, it’s easy to forget to nurture these critical relationships and all too easy to damage them with an ill-considered word or action. On the other hand, careful, thoughtful, and proactive management of these relationships may very well be a driver of incredible success for you and your agency.

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists  Marsh Awarded Injunction Against Former Employees Now With Howden US

Marsh Awarded Injunction Against Former Employees Now With Howden US  Cuts to Funding Mean Risks Will Pivot in Human Services Market

Cuts to Funding Mean Risks Will Pivot in Human Services Market  Anthropic’s Claude Chatbot Goes Down for Thousands of Users

Anthropic’s Claude Chatbot Goes Down for Thousands of Users