The market for workers’ compensation insurance is in a recovery phase of the underwriting cycle after several years of poor results. In particular, premium rates continued to increase meaningfully through the first half of 2013, coupled with stabilizing loss trends promoting improved near-term underwriting performance. The potential for enduring industry underwriting gains, however, remain less likely, given competitive forces, inherent claims expense and reserving uncertainty, and regulatory and legislative complexity.

Chronic Underperforming Segment

As the largest individual commercial lines segment, based on premium volume, workers’ compensation is a key driver of underwriting performance for the U.S. property/casualty insurance industry. Relative to other large commercial lines, including other liability, commercial auto and commercial multi-peril, workers’ compensation has stood out in recent years as one of the weakest industry segments in terms of underwriting performance and loss reserve strength.

The past economic recession greatly impacted workers’ compensation revenues as premiums are typically based on payrolls, which sharply deteriorated with expanding unemployment levels. These economic factors, coupled with several years of price competition and consistent loss cost growth, which exceeded inflation, promoted strong underwriting loss expansion from 2007-2011. The industry aggregate statutory calendar-year combined ratio in workers’ compensation peaked at a highly unprofitable 117 in 2011.

For the five-year period 2008-2012, workers’ compensation generated an average statutory combined ratio of over 110, nearly 7 points worse than the commercial lines industry aggregate for the same period. Loss reserves from prior underwriting periods in the workers’ compensation line have developed unfavorably in each of the last four consecutive years, compared with continued favorable loss experience in all other lines combined over that period.

Underwriting Loss

The U.S. commercial lines underwriting cycle tilted toward a hardening phase in the second half of 2011 as market participants responded to growing underwriting losses and a declining investment contribution to earnings from persistent low interest rates. Premium rate increases have endured in commercial lines through the first half of 2013, and the worst-performing market segments — including workers’ compensation — have experienced the most substantial price hikes. According to the quarterly commercial lines market survey published by the Council of Insurance Agents and Brokers, workers’ comp rates have increased for the last nine consecutive quarters. The most recent (second-quarter 2013) survey reported an average quarterly rate increase of 8.3 percent in workers’ comp.

Premium rate increases and a modest economic recovery have promoted a return to healthier premium growth in the workers’ compensation line. Industry workers’ compensation net written premium volume increased by 7 percent in both 2011 and 2012 — the largest change of all major commercial insurance market segments.

Premium revenue improvement, coupled with relative stability in 2012 claims costs, led to material improvement in the industry combined ratio to 110 for the year. Overall workers’ compensation claims cost trends have tied more closely to general inflation levels recently. The historical downward trend in workers’ compensation claims frequency tied in large part to benefits from greater risk management sophistication and safety processes resumed in 2012, following a recession-related boost in frequency.

Results Vary Considerably

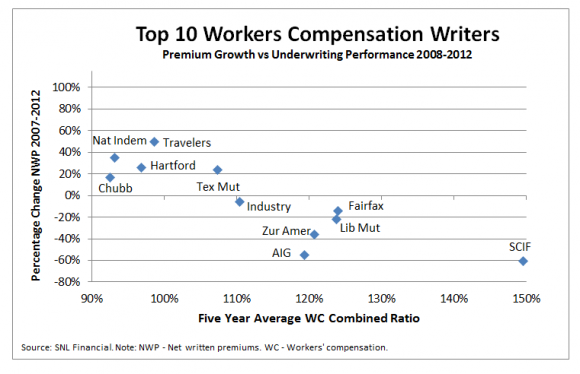

A review of statutory underwriting results for the top 10 writers of workers’ compensation at year-end 2012 reveals significant disparities in company underwriting performance. The chart below shows the average statutory combined ratio from 2008-2012 and the change in net written premiums over the last five years in workers’ compensation insurance by company, revealing a distinct relationship between underwriting performance and premium growth over this period.

Companies with weaker underwriting performance, such as Liberty Mutual Insurance Co., American International Group Inc., Zurich American Insurance Co. and California’s State Compensation Insurance Fund, have reduced workers’ compensation premium volume over this period. The reduction in writings in less profitable lines is a significant contributing factor to recent market underwriting and pricing improvements.

Despite past unfavorable market conditions, several insurers have generated consistent underwriting profits in this line. Companies among the leading writers of workers’ compensation that have combined ratios below 100 over the last five years include The Chubb Corp., Hartford Fire Group, National Indemnity Co. and Travelers Cos. Inc. These companies have expanded their premium bases over the period, while the industry’s aggregate workers’ compensation premiums declined by 14 percent from year-end 2007-2012.

Market share across companies has shifted significantly in recent years. Liberty Mutual continues to reduce its workers’ compensation book of business but remains the largest individual writer of workers’ compensation, and AIG’s premium base declined markedly from its prior leading market position. National Indemnity reported the most notable recent increase in workers’ compensation market activity, nearly doubling written premium volume in 2012 from expansion of regional operations. Recent movements by National Indemnity to bolster its U.S. primary commercial and excess and surplus lines operations will likely lead to further workers’ compensation expansion going forward.

Future Uncertainty

The cumulative effects from successive renewal-price increases and generally stable economic trends are likely to promote further performance improvement going forward. However, the workers’ compensation segment historically has produced an underwriting profit only once in the last 15 years. The likelihood of the market generating consistent underwriting profits going forward remains slim.

The durability of the current market hardening phase remains in question due to factors tied to pricing and loss costs.

- Workers’ compensation remains a very competitive segment of the insurance industry with a large number of market participants.

- Current favorable pricing movement is tied more to a collective reaction to weaker profitability than a reduction in market underwriting capacity.

- As capital allocated to commercial lines remains robust, competitive forces are likely to promote a return to flat or declining premium rates.

- Most recent pricing indicators are showing that the level of renewal rate increase in commercial lines, including workers’ comp, remains positive but is already slowing.

From a claims and loss costs perspective, medical costs remain a key cost driver of workers’ compensation claims. Medical severity was relatively stable in 2012 but historically has been a more volatile cost factor. Going forward, the impact of implementation of the Patient Protection and Affordable Care Act (PPACA) on the U.S. healthcare market and healthcare costs remains highly uncertain.

Besides potential changes in traditional regulatory and legislative requirements inherent to the workers’ compensation business, looming expiration of the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) at year-end 2014 creates additional uncertainty. Workers’ comp writers may have large aggregations of underwriting exposures to terrorist events occurring during the work day, particularly in larger urban centers. TRIPRA and its predecessor programs since November 2002 have provided a risk-sharing mechanism between private insurers and the federal government in the event of a large-scale terrorist event.

Elimination of this government-sponsored reinsurance protection would increase net exposures to terror events for many domestic commercial insurers. Unlike commercial property and other lines, workers’ comp insurers are not allowed by statute to exclude terrorism in policy coverage. In the event of a TRIPRA non-renewal, the inability to exclude terrorism may induce workers’ comp underwriters to withdraw from the market, creating greater difficulty for policyholders to find coverage and increasing premium rates.

Topics USA Profit Loss Claims Workers' Compensation Underwriting Talent Market

Was this article valuable?

Here are more articles you may enjoy.

Smith Brothers Has Acquired Charter Oak Agency in Connecticut

Smith Brothers Has Acquired Charter Oak Agency in Connecticut  Travelers Q2 Net Income Soars on Less Losses, Favorable Reserves

Travelers Q2 Net Income Soars on Less Losses, Favorable Reserves  First-Half 2025 Insured Losses From Natural Cats Hit $100B, Driven by US Events

First-Half 2025 Insured Losses From Natural Cats Hit $100B, Driven by US Events  New Book Proposes Four-Prong Legal Strategy to Negate Nuclear Verdicts

New Book Proposes Four-Prong Legal Strategy to Negate Nuclear Verdicts