Authorities are describing the takedown of a massive auto insurance fraud ring in New York the largest of its kind involving New York’s no-fault law.

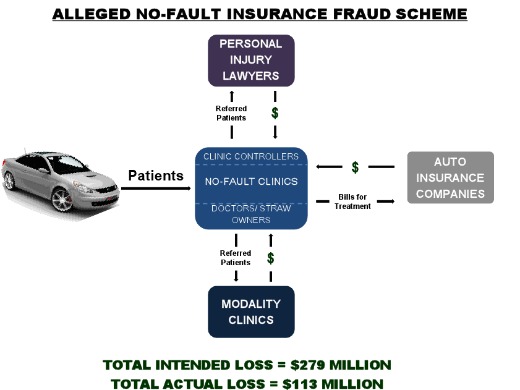

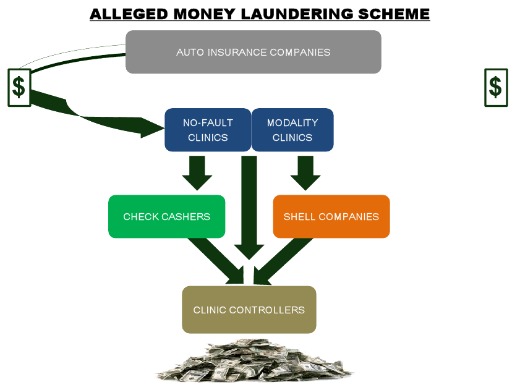

The fraud scheme involved 10 licensed medical doctors, three personal injury lawyers, thousands of patients, clinics in the Bronx, Brooklyn and Queens, and 105 legal corporate entities in an alleged attempt to bill more than $275 million in fraudulent charges to no-fault auto insurers.

The actual loss to auto insurance companies was $113 million, according to the authorities.) The fraud ring was led by a criminal gang based in New York City.

Federal and local authorities said at a press conference yesterday that all 36 defendants have been arrested in connection with the charges and are being arraigned in federal courts. Defendants named in the indictment unsealed in U.S. District Court in Manhattan include: Mikhail Zemlyansky, Michael Danilovich, Yuriy Zayonts, Mikhail Kremerman, Matthew Conroy, Michael Barukhin, Mikhail Ostrumsky, and Boris Treysler. Medical doctors who were allegedly involved in the scheme include Billy Geris, Joseph Vitoulis and Lauretta Grzegorczyk, the indictment shows.

“We believe this is the single largest no-fault insurance fraud case in history,” said Manhattan U.S. Attorney Preet Bharara at the press conference. The investigation into the alleged conspiracy was spearheaded by the Federal Bureau of Investigation, the N.Y. Police Department and the office of U.S. Attorney Bharara in Manhattan.

Scheme Relied on ‘Corrupt Doctors’

“Charges exposed a colossal criminal trifecta, as the fraud’s tentacles simultaneously reached into the medical system, the legal system, and the insurance system, pulling out cash to fund the defendants’ lavish lifestyles,” Bharara said.

“As alleged, the scheme relied on a cadre of corrupt doctors who essentially peddled their medical licenses like a corner fraudster might sell fake IDs, except those medical licenses allowed unlawful entry, not to a club or a bar, but to a multi-billion dollar pool of insurance proceeds.”

Janice Fedarcyk, FBI assistant director, also explained that the “runners” were paid to find passengers from real auto accidents and steer them to the clinics managed by the criminal gang.

“Unlike some other insurance fraud schemes we have seen, the enterprise charged today is not alleged to have engaged in staged auto accidents. Staging accidents runs the risk of being discovered before the victims even start the claim and treatment process,” Fedarcyk said.

“The runners here were paid to find passengers from real auto accidents, although the crux of the fraud was that the treatments prescribed were medically unnecessary. The accidents were real. The injuries claimed were not.”

New York City Police commissioner Ray Kelly noted during the press conference that “the runners were literally ambulance chasers who often found their victims at accidents, in hospitals and on the street.”

Commissioner Kelly added that the investigation involved NYPD undercover investigators who posed as accident victims and received unnecessary treatments or medical equipment for a payment. Sometimes, these undercover agents were asked to simply sign their names at the clinics and leave without any treatments. He said that when the agents were steered to a chiropractor’s office, they were expected to just “sign in, say hello and leave.”

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen

Trump Demands $1 Billion From Harvard as Prolonged Standoff Appears to Deepen