Steady investor demand in Europe for environmental and socially responsible investments and wide-ranging regulation are helping Europe’s finance industry withstand political pressures that have pushed some U.S. peers to backtrack on their green agendas.

In the United States, conservative politicians have been successful in tamping down environmental, social and corporate governance (ESG) product marketing, in diluting regulations that promote ESG disclosures, and in discouraging financial firms from coordinating on curbing greenhouse gas emissions.

But Europe has so far largely resisted the anti-ESG tide, due to greater political and consumer support for greener products and a swathe of regulations that underpin the operations of the finance industry and companies in the real economy.

Some politicians have been active in Europe to soften environmental rules and legislation, highlighting the costs to consumers of going green.

This has led to the watering down of some new regulations promoting ESG in Europe. But fund flow data shows that Europe overall remains an ESG stalwart.

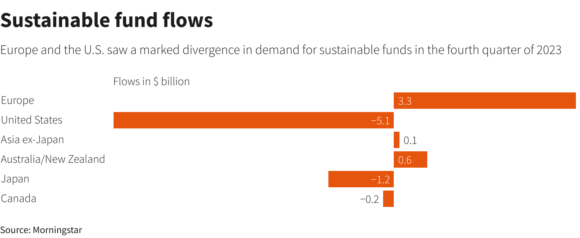

European investors have seven times as much capital in sustainable fund assets than U.S. investors, following five consecutive quarters of U.S. outflows, based on Morningstar data.

“We’ve seen faster regulations lead to faster conformity, which has shielded European financial institutions from ESG headwinds,” said Nathan Abela, head of research at sustainability data tracker ESG Book.

Across Europe’s financial services sector there are 20 rules and 25 voluntary guidelines pertaining to ESG, compared to just two rules and five voluntary guidelines in the United States, according to ESG Book.

There is also more investor demand for ESG in Europe, driven by public pension funds. Some 73% of European pension schemes said climate change was an investment priority in 2023, compared with 53% of U.S. schemes, based on a 2023 LSEG survey.

European financial firms’ commitment to ESG could prove crucial to the survival of international climate alliances. Initiatives such as Glasgow Financial Alliance for Net Zero (GFANZ) and Climate Action 100+ have seen defections by U.S. firms, but their European membership has largely remained intact.

This is important because most of their members are European. One of the GFANZ coalitions for example, the Net-Zero Banking Alliance, has 71 European members but only nine from the U.S. The Net-Zero Insurance Alliance, has eight European firms as members but none from the United States.

Regulatory Support

ESG has a solid framework of regulation in Europe, including the European Union’s Taxonomy, which defines climate-friendly investments. Other key EU rules are the Sustainable Finance Disclosure Regulation, which forces financial groups to disclose their sustainable investments, and the Corporate Sustainability Reporting Directive (CSRD), which applies to companies in the real economy.

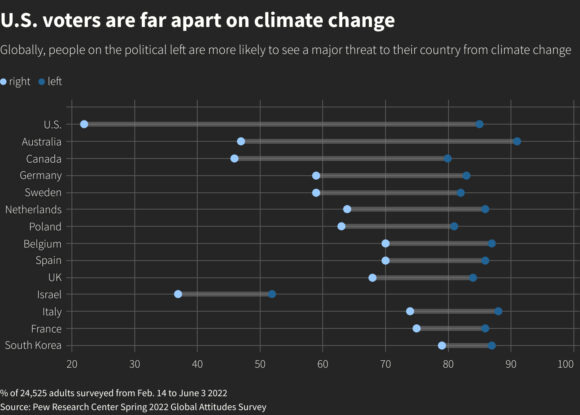

Also, people in Europe tend to be more united in their support for climate action.

A 2022 study from the non-profit Pew Research Center, showed Europeans of whatever political leaning were more likely to consider climate change a “major threat.” In the U.S., the study found a big divide on climate views between people on the right and left of the political spectrum.

“In the EU or in Europe, there is disagreement about the importance of this (ESG) but the disagreements are not as wide as that in the U.S.,” said Kamiar Mohaddes, associate professor of economics and policy at the Cambridge Judge Business School.

But Europe has not been immune to attacks on ESG regulations. CSRD and a separate law aimed at ensuring that corporate supply chains are environmentally friendly and protect human rights changed over the past year to cover fewer companies and provide more time to comply.

There has been a dent in European investor demand for ESG but it has been small. New ESG fund launches fell 10% in Europe in 2023, but the slide in the United States was even more pronounced, down 75%, according to Morningstar.

U.S. outflows from sustainable investment funds in the fourth quarter hit $5.1 billion versus $3.3 billion of inflows in Europe, making Europe’s assets under management seven times as great as that seen in the United States.

“What we’re seeing in Europe is everyone continues to be quite focused on ESG and how it is implemented,” said David Zahn, head of sustainable fixed income at asset manager Franklin Templeton.

Zahn said, however, that ESG is not investors’ only concern.

“It’s not just ESG that they care about. They want to see portfolios that take into account ESG, that maybe have some constraints, but they also want performance.”

(Reporting by Simon Jessop in London, Ross Kerber in London and Isla Binnie in New York; editing by Greg Roumeliotis and Jane Merriman)

Was this article valuable?

Here are more articles you may enjoy.

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance