Executive Summary: Insurers and reinsurers are responding to heightened risks of civil unrest with better calculations of their probable maximum losses, careful risk pricing, clear contractual wordings, and by using new modeling tools to help grasp this potentially costly risk. Here, International Editor L.S. Howard offers a look at one of the modeling tools—Verisk Maplecroft’s SRCC Predictive Model—and an underwriter’s view of policy and reinsurance contract wordings that need special attention. Related articles: “Geopolitical, Election Risks Have Insurers on High Alert,” and “What Role Does Insurance Play in a Politically Charged Climate?“

Insured losses from civil unrest can reach levels equal to some natural catastrophes—and the costs are growing every year. Of particular concern this year is the unprecedented “super-cycle” of elections when nearly half the world’s population will go to the polls—which could provide many potential flashpoints across the globe.

There has not only been a trend toward more frequent civil unrest events, but the strikes, riots and civil commotion (SRCC) events are also more severe, according to Torbjorn Soltvedt, associate director at Verisk Maplecroft, a provider of geospatial data, modeling and risk intelligence, in an interview with Carrier Management. He pointed out that four SRCC events had an insured price tag of more than $10 billion: the riots in Chile in 2019, in the United States in 2020, South Africa in 2021 and France in 2023.

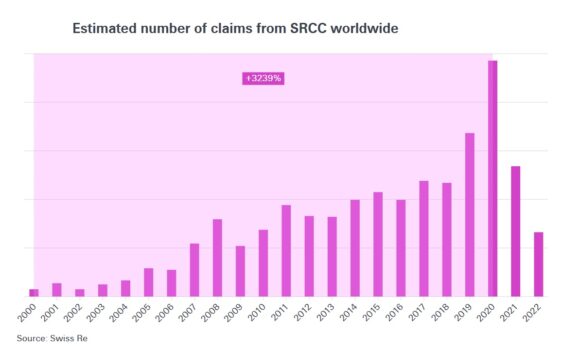

The number of claims from SRCC worldwide saw more than a 3,000 percent increase in the past two decades from 2000 to 2020, which are being exacerbated by a rise in polarization among populations and a greater willingness to protest, said Mohit Pande, Swiss Re’s Chief Underwriting Officer Property, in a blog published in March 2024. Flashpoints can run the gamut from poor public services to corruption and authoritarianism, to ill will about the current cost-of-living crisis, “with squeezed consumer budgets, rising inflation, higher food and energy prices, and tax increases all exacerbating the problem,” Pande added.

Previously, said Soltvedt, a lot of the focus of political violence insurance has been related to terrorist attacks. “But what we’ve seen over the last 10 years or so is that losses from SRCC events have greatly exceeded losses from terrorism events. We’re seeing much fewer of the large-scale, highly organized terrorist attacks.”

Indeed, he said, some SRCC events have started to rival smaller natural catastrophes with insured price tags more than $3 billion.

Modeling Accumulation Risks

The insurance industry “needs to develop better models to take control of accumulation risks and identify where exposure concentrations exist within their portfolio for a specific geographic area or industry,” said Pande in his blog.

Verisk Maplecroft has been doing just that since 2021 when it began developing an SRCC predictive model, starting with its participation in the Lloyd’s Lab innovation accelerator. “We recognized that there was a need for a more rigorous and comprehensive way of looking at SRCC risk,” Soltvedt said, explaining that most of the available modeling solutions at the time tended to be backward looking and reactive.

The aim was to develop a model that would specifically enable underwriters, exposure analysts and specialty reinsurers “to forecast and monitor geospatial SRCC risk,” he added.

By September of 2023, the company had launched its predictive SRCC model for political violence insurers, which uses an algorithm to estimate the number of properties that are affected during protest events. “We then take the forecasted severity and validate the predictions against actual insured losses. We get that data from Verisk’s Property Claim Services to help ensure the model is accurate.”

In essence, he said, the Maplecroft model predicts and estimates the number of properties that are going to be damaged in a particular location.

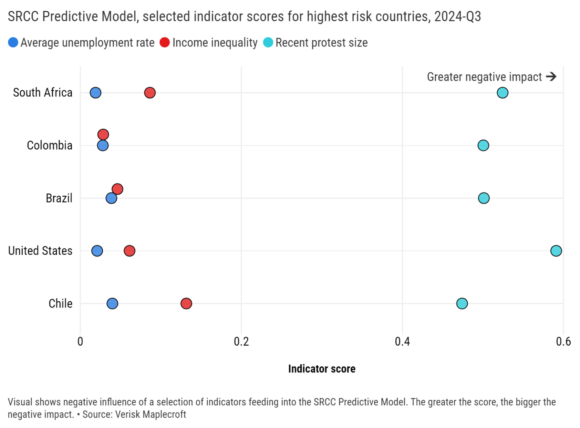

Data about historic protest sizes, as well as a country’s current socioeconomic and developmental factors are factored into the model, Soltvedt said. “It will include things like changes in income inequality, changes in inflation and changes in unemployment—these kinds of dynamic issues that change, month to month, and can give us an indication of what is driving risk in a particular country.”

When these factors are all considered together, the model provides a national level score for every country in the world, which can be downscaled further—for example, to the county level (in the U.S.) and the borough level (in the UK), Soltvedt continued. The company currently is working to make the model even more granular so that it eventually includes property analysis at the block or street level.

Typically, the highest local SRCC risk scores are where there is a high concentration of people and economic value, he said, noting that the biggest insured losses are predominantly the result of the looting and burning of commercial properties on high streets, shopping malls and similar properties.

Quantitative and Qualitative Analysis

Maplecroft combines quantitative and qualitative methods to better understand the risk of SRCC events, which help reveal “how dry the tinder is and how big is the powder keg in a particular location. And then we have a team of analysts who will then look at potential flashpoints like an election,” Soltvedt said.

“When we are dealing with things like SRCC risk, conflicts between states and terrorism, these are the functions of very complicated human and social processes. So, there’s always going to have to be a qualitative element to the analysis as well,” Soltvedt said. He noted, however, that with the help of technology and modeling, the assessment of political violence risks is becoming more quantitative.

Past Is Prologue

“When we look at a particular country, we can analyze the specific risk drivers for that country. But for most countries, it tends to be the previous log of protests that is the biggest predictor and indicator of risk,” he said.

“When you look at all of the big SRCC events in the last few years since 2019, they have similar but very unpredictable triggers,” he said, pointing to the case of Chile’s 2019 riots, which were sparked by a 4 percent increase in metro ticket prices, while the shooting of a teenager by police in France in 2023 brought riots and mass protests.

On the other hand, the likelihood of future SRCC events is often related to high levels of income inequality in combination with high levels of unemployment and inflation, Soltvedt added. “South Africa is a good example of that. With some of the world’s highest unemployment levels and very high levels of income inequality, South Africa is one of the highest risk countries in the world for SRCC risk.”

Indeed, Soltvedt said that South Africa topped the list of 10 countries carrying the highest risk of SRCC claims, followed by Colombia, Brazil, Chile, the United States, India, Bangladesh, France, Pakistan and Peru.

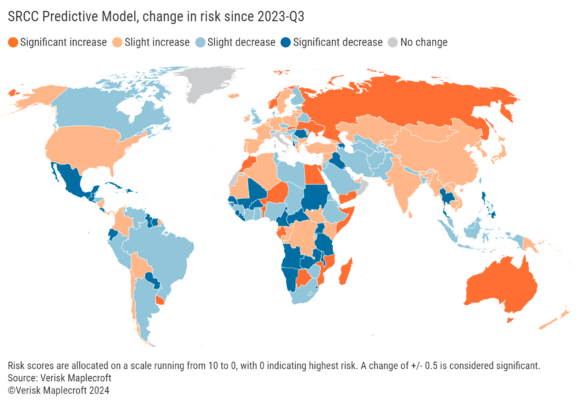

Soltvedt said the Maplecroft SRCC model can be used to understand risk trends globally, regionally, nationally or at the local level. The model can help underwriters identify what’s driving changes in risk or perform quantitative assessments of SRCC risk to try and price and review premiums.

This helps insurance and reinsurance underwriters determine and set exposure limits, he said. “It also can be used to anticipate losses and to refine probable maximum loss estimates.”

An underwriter might determine, with the help of the model, that a particular location is too high risk and should be excluded, based on its risk accumulation, damage ratios and the underlying SRCC score, he explained. (Damage ratios are the metric that assesses the extent of loss relative to the value of an insured property or portfolio.)

On the other hand, other locations might be revealed as providing good opportunities for underwriting and offer good value, Soltvedt added.

By factoring in underlying SRCC risk for each location, “you can get more differentiation between different locations and assets than you would by just looking at accumulation and damage ratios.”

Models and Event Definitions

Another important factor in managing SRCC risks is for insurers and their reinsurers to have clarity in their contractual wordings so that legal disputes and coverage gaps are avoided.

Swiss Re recommended revisiting definitions of SRCC that are “included within contracts to avoid carrying for anything outside of the expected parameters,” said Pande in his blog. “Transparent and accurate definitions can help in distinguishing key differences, such as between riots and terror events, for example.”

Tim Strong, head of Crisis Management for Aspen Insurance, said SRCC models can help show carriers how different event definitions could be materially affecting how much net risk they’re running on their balance sheets, which ultimately could hit earnings and their capital bases.

“It’s important to make sure that the SRCC event definitions in the direct market, which are being sold to the clients, match the SRCC event definitions that exist on any outward reinsurance,” Strong said.

He explained that some insurers just may be monitoring their SRCC exposure at country level. “The models allow for more granular analysis and, therefore, greater insight to how the event definitions could play out.”

Strong cautioned that there can be a gap between the expectations of the direct market and the reinsurance market. “I think that’s where the modeling can be really helpful because the event definitions don’t always marry up between what insurers are selling to direct clients versus what reinsurers are offering to the insurers via potential event definitions,” he said in an interview.

Insurers could discover that they have retained more on their balance sheets than they realized, he emphasized.

Strong cited typical policy wording for standalone SRCC coverage, where an event is defined as: “A loss or series of losses arising out of and directly caused by one event.” In this particular example, the policy said an event has a duration of 72 hours.

The problem is that this policy doesn’t define what one event is, he said. So, if there was civil unrest in the U.S. around the upcoming election, is that one event because it’s an election or 10 separate events that all occurred in a 72-hour time period across the U.S.?

While the insurer has had multiple losses from what it views as the same event, the reinsurance contract may stipulate that one event is limited to a 25-mile radius over 72 hours. So, all those riots would be viewed by the reinsurer as 10 separate insured events, he said.

To explain the situation further, Strong provided a hypothetical example. If an insurer is running $200 million of SRCC exposure in the U.S., and it buys $200 million of reinsurance while retaining the first $20 million, it might think it has just $20 million of net exposure for one event. In reality, it could be paying a multiple of $20 million because it could be multiple net events in the eyes of the reinsurer.

As a result, he indicated, it’s important to determine how much net exposure is being held by the insurers when those event definitions are played through to their reinsurance contracts—something that SRCC models can help insurers determine.

Models help insurers understand what risk they’re running on their balance sheet in terms of how much net exposure they’re running. “I think that’s useful for conversations with reinsurers because then it can enable more effective event definitions in the reinsurance contracts.”

Some reinsurers may not be willing to have a conversation around event definitions for their insurer clients, but models will begin to help bridge the gap, he said.

He explained that, historically, losses in the SRCC space have been picked up for the most part by property carriers. But as losses grow, property carriers are excluding SRCC risks, which are now coming through to the standalone SRCC market.

The standalone SRCC market “hasn’t really been tested in terms of some of these gray areas or ambiguity around the net exposure from multiple events versus one event. But I think modeling brings us more focus and enables more sharing of the risk between the insurers and the reinsurers and ultimately a more effective risk transfer.”

Given the number of elections this year, Aspen has positioned its book for the worst-case scenarios. “If we are concerned about a region, we model it and underwrite it to the worst case. So, we’ve definitely gone a bit risk-off with SRCC this year, particularly in the U.S.,” said Strong.

“But that said, it is important that we’re offering continuity to our clients, and if we’ve got a long-term relationship with the client, we can’t just not offer them the coverage. We just have a bit more of a conversation around their risk practices and ultimately how they’re mitigating the impact of some of these events.”

The image at the top of this article was created by Carrier Management’s graphics design team using artificial intelligence.

This article first was published in Insurance Journal’s sister publication Carrier Management. It was featured in the third-quarter 2024 magazine, “Election Year Geopolitical Risks.“

Related articles include:

- Underwriting in a Politically Charged Climate

- The Double-Edged AI Sword: Spreading Misinformation and Detecting Threats

- Managing Your Team in a Polarized World

All of the articles in the magazine are available on the magazine page of Carrier Management’s website. Click the “Download Magazine” button for a free PDF of the entire magazine.

To be able to read and share individual articles more easily, consider becoming a Carrier Management member to unlock everything.

Topics Carriers Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Preparing for an AI Native Future

Preparing for an AI Native Future  Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles