The effects of climate change are intensifying but businesses globally are struggling to make transition plans that they can implement in the real world, according to a report released Wednesday by the London School of Economics and Political Science.

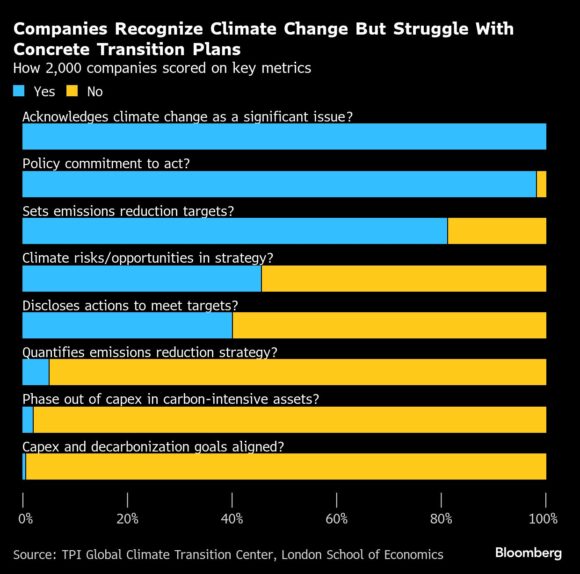

The study of corporate climate performance looks at disclosures from 2,000 publicly traded companies, which together represent three-quarters of publicly listed equities worldwide and $87 trillion of market capitalization. The authors find that only 2% have disclosed plans to shift capital away from high-carbon assets or to align their spending with their long-term decarbonization goals.

Recognition of climate change is far more common than not among the companies included. More than 95% have a policy commitment to act on climate. But only about 10% received the authors’ highest score for management quality, indicating that a company has begun to strategically integrate climate change into its business. And 22% failed on one or more of the following tests: to establish a climate policy, disclose operational emissions or set an emissions target.

Corporations are expected to play a large role in decarbonizing the economy, but results so far have been lackluster. Some regions have disclosure requirements for emissions and transition plans, and greater regulatory scrutiny in Europe is pushing companies to do more. But the report shows that a majority of their plans aren’t credible. This is for multiple reasons. Many companies aren’t putting enough capital towards decarbonization, and some rely too much on unproven technologies, according to the report. About a third don’t disclose material scope 3 emissions, which measure the carbon impact of their supply chains.

“As the pace of required emissions reductions accelerates,” the authors of State of the Corporate Transition 2025 write, “credibility will increasingly depend on plans that are both ambitious and actionable.”

Following the hottest year on record, severe storms, droughts, fires and floods have inundated different parts of the world, racking up billions of dollars in losses. Researchers have estimated a 17% decline in global economic output by mid-century due to climate change; by 2100 that figure jumps to 60%. Climate disasters could dent global economic growth by up to 3% within the next five years, according to the Network for Greening the Financial System (NGFS).

But political backlash against climate change has “weakened the momentum” of global companies to mitigate the cause, according to the report. The Trump administration has lambasted environmental, social and governance efforts in investing and has moved to make environmental laws weaker in the world’s largest economy.

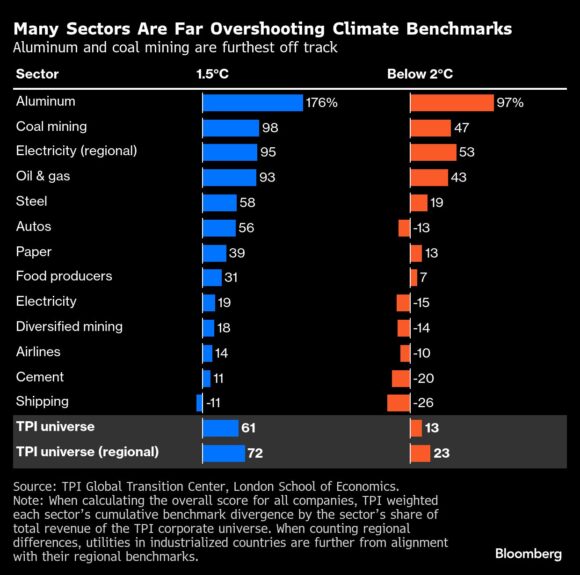

The study also analyzes a smaller group of about 550 companies and how well their emissions pathways are aligned with Paris Agreement goals, taking a sector-specific approach. Many companies have set net-zero targets for 2050, but a larger number have either not set long-term targets or their targets have a limited scope relative to the lifecycle emissions of their products.

As a group, these companies are set to outstrip by 61% emissions-intensity budgets compatible with 1.5C of warming.

Now in its sixth edition, the report does point to progress: Thirty percent of the companies assessed are aligned with a 1.5C pathway, compared to only 9% in 2020. The oil and gas sector made the slowest progress in reducing its emissions intensity between 2020 and 2023, the authors say. Shipping is the only sector undershooting its 1.5C benchmark, driven by two large firms with relatively ambitious net-zero targets.

Photograph: Electricity pylons next to solar panels in Bramford, UK, on Tuesday, Aug. 26, 2025. Photo credit: Chris Ratcliffe/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears