Nippon Life Insurance Co. sees its overseas project finance lending climbing 11% to a record high this year due to surging demand to fund AI data centers in the US and elsewhere.

The outstanding amount of such loans provided by Japan’s largest life insurer is likely to reach ¥1 trillion ($6.8 billion) for the first time in the fiscal year started April, said Akira Shibata, the company’s global head of structured finance. That total has grown by about ¥100 billion annually in recent years after subtracting loans repaid, he said.

The Osaka-based insurer isn’t the only Japanese financial firm chasing profits from artificial intelligence investments. Mitsubishi UFJ Financial Group Inc., for one, is working with JPMorgan Chase & Co. to lead a loan of more than $23 billion to support a massive US data-center campus, according to people with knowledge of the matter. SoftBank Group Corp., meanwhile, got the green light in May for a loan from lenders including Mizuho Bank Ltd. for AI-related investments.

A big part of Nippon Life’s project financing so far is for solar and wind power operations, but the rapid creation of new data centers, especially in North America, is boosting the attraction of AI-related loans, said Shibata. The deals offer spreads of about 200 basis points or more, he said. By contrast, Japanese yen corporate bond spreads when issued averaged about 50 basis points, Bloomberg-compiled data show.

Data centers for AI are part of “the new social infrastructure,” Shibata said in an interview. “They are big in scale and spreads are relatively good.”

Overseas project finance is a growing segment of Nippon Life’s ¥80 trillion investment portfolio. It’s managed by the company’s structured finance team that was created in 2017, when insurers desperately hunted higher yields overseas during years of ultra-low interest rates in Japan.

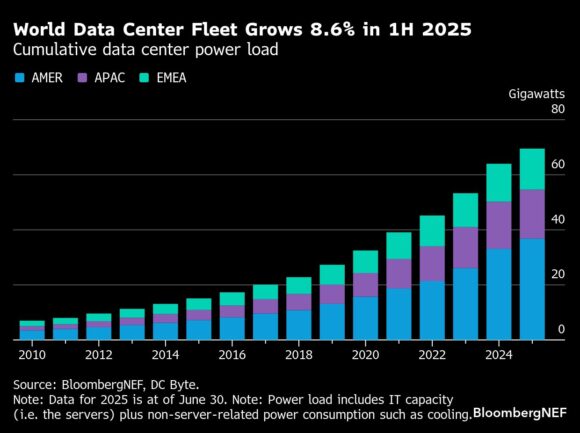

Data center IT capacity, which measures the computational power of those facilities, grew by 8.6% globally in the first half of 2025, almost 70% of which was in the US, according to a BloombergNEF report.

In project finance, lenders offer loans specifically for projects like data centers rather than to companies. The creditors recoup loans and interests from revenues generated by these projects.

Compared with bond investments, project finance can command higher spreads given the complexity of the deals, including the need to forecast risks and cash flows from projects, as well as having to monitor operations during the lifetime of the loans that span five to eight years, Shibata said.

Still, occasional price swings in traditional assets show why it may make sense for investors to get more exposure to alternative investments such as infrastructure and private equity.

That could be seen in two-year bonds, which are especially sensitive to Bank of Japan interest moves: the debt tumbled and yields jumped to the highest since 2008 after the BOJ announced Friday it will start selling its stockpile of exchange-traded funds valued at more than ¥75 trillion, in the latest sign it’s moving to “normalize” monetary policy. The emergence of two dissenters who pushed for a rate increase at this week’s policy meeting added to the view that a hike may be coming soon, causing the broad Topix share index to drop and the yen to inch higher against the dollar.

Japanese insurers typically hedge their overseas investment against foreign currency fluctuations since most of their insurance obligations are in yen. The cost for such protections shot up after the US Federal Reserve started aggressively raising rates in 2022.

Construction of AI data centers isn’t limited to the US but is being planned in Europe and Asia as well, Shibata said. “Looking ahead, there is the issue of electricity to power data centers, including transmission systems. I think there will be a lot of project finance opportunities for data centers and surrounding ecosystems.”

Photograph: The Nippon Life Insurance Co. headquarters in Osaka, Japan, on Thursday, Jan. 11, 2024. Photo credit: Kentaro Takahashi/Bloomberg

Topics InsurTech Carriers Data Driven Artificial Intelligence

Was this article valuable?

Here are more articles you may enjoy.

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles