China’s giant electric vehicle insurance market is flailing. Losses are piling up, as companies’ risk models haven’t kept up with changes in vehicle economics and driver behaviors.

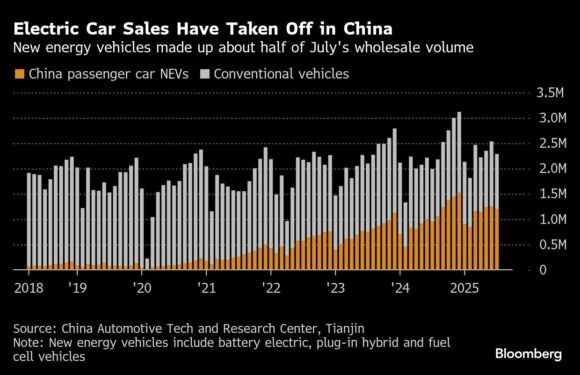

The country now has tens of millions of electric cars on its roads, and sales are rising at a rapid clip. Chinese insurers have found that new energy vehicle owners — which tend to be younger on average — are about twice as likely as owners of gasoline-powered cars to file claims. The repair costs are also significantly higher.

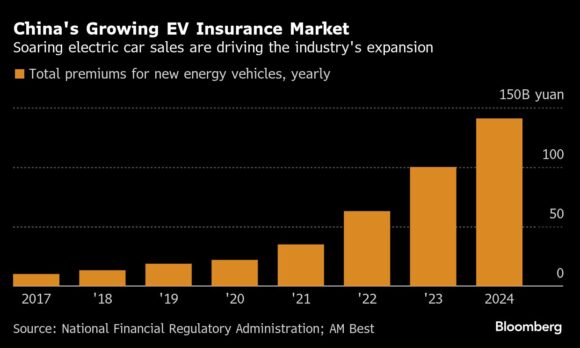

But despite EV drivers paying anywhere from 20% higher to double the premiums for traditional cars, China’s auto insurers have been nursing losses from covering new energy vehicles for at least three years. The industry lost 5.7 billion yuan ($802 million) from underwriting NEV policies in 2024, according to data compiled by the China Association of Actuaries, and is on track to lose money again this year.

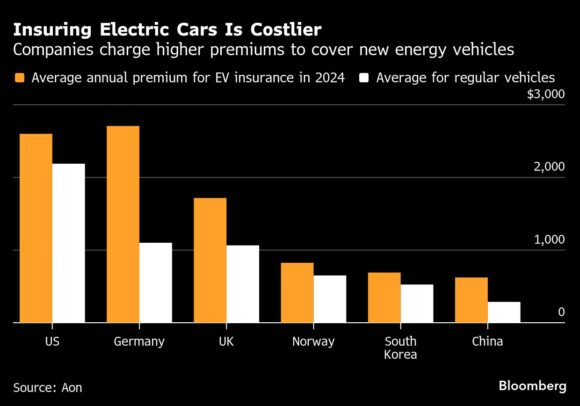

The companies’ experience mirrors what insurers in other parts of the world are starting to grapple with, and the Chinese firms’ difficulty turning a profit in the world’s largest and most developed EV market shows the difficulty of pricing risk accurately. In China, some insurers are trying to discern which car owners are using their vehicles to provide ride-hailing services — which increases their likelihood of getting into accidents — and whether some models are riskier than others.

EVs accelerate faster than gasoline-powered cars, and their batteries that are usually located under the floor can be easily damaged if drivers go too fast over bumps. Their complicated battery systems also can comprise as much as a third of a car’s value, and have expensive or niche parts that aren’t widely available.

Some ride-hailing drivers have categorized their vehicles as “residential” when applying for insurance to pay lower premiums, presenting a challenge for insurers. Historical data on car types and driving habits also becomes quickly outdated when new vehicle models are constantly being rolled out.

The upshot is that “insurers have not really managed to fully differentiate between different brands, different models, and different loss patterns, to find a way to make a profit,” said Qin Lu, head of North Asia at insurance broker Aon Plc.

“It’s a very challenging area,” added Lu, who predicts that many insurance companies won’t be able to turn things around for at least another three years. With EVs now overtaking gasoline cars in sales volume, a solution needs to be found, he said. “We are just right now in the middle of it. The industry as a whole is trying to find its way to make it work.”

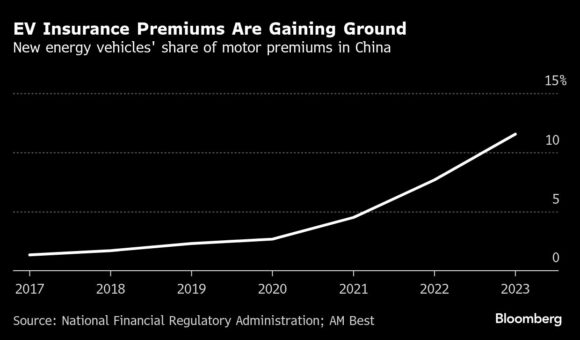

Insurance companies in China collected 141 billion yuan in premiums from covering electric vehicles last year, according to the actuaries’ association. Expectations are for them to reach 500 billion yuan by 2030 and to make up more than a third of the auto insurance market then, according to research from Bocom International Holdings Co.

“EV insurance pricing is still in a trial-and-error phase,” said Wenwen Chen, an analyst at S&P Global Ratings, even as their premiums are set to be “the future growth engine” for auto insurers.

Higher Premiums

Nicole Wu, a 38-year-old who works for a media firm in Hangzhou, said she bought an imported Tesla Model 3 in 2019 and had several accidents afterward that required significant repairs. In one case, she said her insurer paid more than 70,000 yuan for the car’s damage, in part because the vehicle could only be fixed at a Tesla Inc. body shop.

Over the years, her insurance premium increased fourfold to almost 30,000 yuan annually. “It’s just horrifying!” she said. Wu decided to opt for a plan that was about a fifth of the cost and provided mandatory liability insurance for traffic accidents with minimal third-party coverage. “But then it really made me anxious when I drove the car,” she recounted.

Wu said she ended up selling her Tesla last year and buying a cheaper electric car from Nio Inc. She now pays about 7,000 yuan for insurance from a company recommended by Nio, whose after-sales service can handle repairs.

In China, the average EV insurance premium is about 4,487 yuan a year, according to data compiled by Aon. That’s about a quarter of what EV owners pay in the US on average.

New energy vehicles in China also cost significantly less than in America; their average price was 158,900 yuan in August, about 80% the price of hybrids and 90% that of fuel cars, according to Autohome Research Institute, an industry analysis provider.

Over the past year, some Chinese insurers have hiked premiums or backed away from selling EV policies, leaving vehicle owners struggling to find affordable coverage. So far, there has been no discernible impact from costlier EV premiums on overall electric vehicle sales.

To address the issue, Chinese authorities in January launched a platform called “Easy to Insure” to connect EV owners with insurers. It has so far helped insure more than 500,000 vehicles, with total coverage of about 494.8 billion yuan.

The platform doesn’t guarantee that users get the lowest premiums, but ensures applicants are not rejected, said Zhang Lei, chief executive officer of Cheche Group Inc., an insure-tech company that developed it.

Auto insurers can’t freely price policies in China. The authorities set base premiums depending on factors including vehicle type and usage. Companies can adjust those premiums up or down within a specific band, based on drivers’ risk profiles.

In January, Chinese authorities released a broad set of guidelines, telling companies to lower the costs of replacement parts and repairs for new energy vehicles, and promote “cross-industry data sharing” and cooperation. Insurers also cannot refuse customers or deny them compulsory traffic insurance, they said.

Big Three

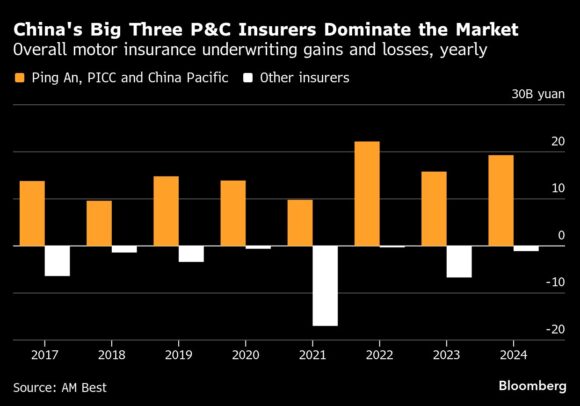

There are over 60 auto insurance companies in China, and the three largest players together have at least a 65% share of the market, according to Aon.

Some carmakers are also eyeing the market. Xiaomi Corp., BNP Paribas SA and Volkswagen AG have teamed up to form a new property and casualty insurer while Tesla, which sells about a third of its cars to customers in China, registered an insurance brokerage last year. BYD Co. also operates its own insurance company in the country.

The insurance industry had an average combined ratio of 107% for new energy vehicles in 2024, versus 109% in 2023, according to official data. A combined ratio over 100% reflects an underwriting loss — it means companies are paying out more in claims and expenses than they are collecting in premiums. Many smaller insurers in China have struggled to profit even from traditional auto insurance, because they lack scale and pricing power.

Ping An Property & Casualty, a unit of Ping An Insurance Group Co., one of the country’s biggest insurers, said its EV business produced underwriting profits in 2024 and the first half of this year. It said it’s developed technology that helps distinguish ride-hailing drivers from other car owners, and it has been researching the “economics of repair” and working with automakers “to identify accident scenarios to improve vehicle design.”

Ping An’s biggest rivals, PICC Property & Casualty Co. and China Pacific Insurance Group Co., recently reported that their combined ratios from insuring commercial EVs were above 100%, while their underwriting of EV policies for private and household use was profitable.

“Profit is important, but insurance companies also have social responsibilities to fulfill,” said Paul Low, CEO at the Asian Institute of Insurance. “China’s national agenda is to push for EVs and affordability is important.”

Top photograph: Cyclists and vehicles travel along a road in Beijing on Sept. 2, 2025; photo credit: Qilai Shen/Bloomberg

Related:

- China’s EV Automaker Xiaomi to Fix Assisted Driving Issue for Over 115,000 SU7s

- China Considers Safety Rules for Driving Assistance Systems

- Xiaomi EV Sales Fall After Deadly Crash, False Advertising Claims

- China Bans ‘Smart’ and ‘Autonomous’ Driving Terms From Vehicle Ads

- China to Tighten EV Battery Rules to Reduce Fire and Explosion Risks

- China Calls for Smart Driving Vigilance After Fatal Crash of Xiaomi Corp. EV

Topics Carriers Auto Profit Loss China

Was this article valuable?

Here are more articles you may enjoy.

World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial