An exchange-traded fund tied to bets on natural disasters has started trading in London, after becoming the first such ETF to attract a lead market maker.The KRC Cat Bond UCITS ETF was launched with the goal of drawing more retail investors into the rapidly growing market for catastrophe bonds, says Rick Pagnani, chief executive of King Ridge Capital Advisors, which is behind the new ETF. King Ridge, whose platform provider is HANetf, has tapped London-based Goldenberg Hehmeyer LLP as lead market maker.

“We want to make catastrophe bonds accessible to the general public,” Pagnani, who co-founded King Ridge in 2024 after half a decade running the insurance-linked securities desk at Pacific Investment Management Co., said in an interview.

The market for cat bonds has soared in recent years as increasingly costly natural disasters drive insured losses well above historical norms. That’s forcing insurers and reinsurers to offload part of their risk to the capital markets in an effort to hedge their exposure. Investors in the bonds make money if a pre-defined catastrophe doesn’t materialize.

Cat bond investors have largely dodged major payouts of late, thanks in part to highly calibrated models that only acknowledge trigger events after a certain loss level has been breached.

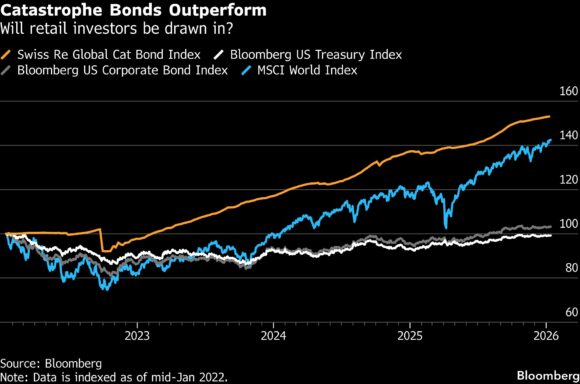

Over the past four years, the Swiss Re index tracking cat bonds has soared more than 50%, exceeding gains in the MSCI World Index over the period. Even in 2022, when Hurricane Ian caused significant losses in Florida, the Swiss Re index only dipped about 2%.

King Ridge’s ETF, which started trading in London on Tuesday, marks something of a milestone. An equivalent ETF that went public in New York in April — the world’s first such listing — failed to attract a lead market maker. That ETF — the Brookmont Catastrophic Bond ETF, which is overseen by Brookmont Capital Management LLC and run by King Ridge — has since drawn about $36 million in investor capital.

Pagnani says initial uncertainty surrounding the US ETF has now subsided, allowing it to exceed its break-even mark of $25 million. That’s a key reason why Goldenberg Hehmeyer felt “comfortable” taking on the lead market maker role for the European ETF, he said.

Europe “has been in the forefront of cat bond investments relative to the US, so there’s open space” for such funds to target a wider array of investors, according to Pagnani. His new ETF, which is domiciled in Ireland and also trades in Frankfurt and Milan, has so far only lured $3 million. The expectation is that it will hit its $25 million break-even mark “in short order,” he said.

“We’re not going anywhere” and “we’ve got plenty of reserves to stay in the game,” Pagnani said. For now, the fund’s small size leaves it exposed to sudden price moves. The ETF slipped 3.8% on Thursday, according to data compiled by Bloomberg.

Read More: Catastrophe Bonds Linked to Wildfires Lose ‘Untouchable’ Status

A record $20 billion in new cat bonds were issued in 2025, marking a 45% increase on the previous year, according to a report published by Artemis, a data provider that tracks the market for insurance-linked securities. That helped push the total market to an all-time high of about $60 billion last year.

“The cat bond market is in roller-coaster mode at the moment,” Brad Adderley, Bermuda managing partner at law firm Appleby, said in the report. “I can’t see why it would not reach $20 billion again” in 2026.

The cost of catastrophe protection, meanwhile, is rising so that it exceeds realized losses, according to an analysis by the Anthropocene Fixed Income Institute.

That may be because “markets are anticipating more severe losses ahead,” AFII’s head of research, Josephine Richardson, said in a note. At the same time, “cat bonds have offered the most attractive risk-adjusted return, higher even than those provided by the US equity market,” before taking liquidity into account, she said.

Against that backdrop, retail investors are steadily increasing their presence in the market. The value of cat bonds in funds sold under the UCITS label, which is a European Union designation intended to protect retail investors, soared almost 40% last year to $19 billion, according to Artemis.

That spike in retail interest has prompted regulators to start monitoring the market more closely. The European Securities and Markets Authority says cat bonds shouldn’t be in such funds, arguing that their inherent complexity is ill-suited to the retail audience targeted in the UCITS market. The decision is now with the European Commission, the bloc’s executive arm.

Those warnings led Brookmont to abandon earlier plans to launch a cat bond ETF in Europe. But Pagnani says he’s undeterred by ESMA’s recommendation.

King Ridge moved ahead because “we thought it was a risk was worth bearing, given the market opportunity,” he said.

What Bloomberg Intelligence Says…

A glut of alternative capital in the reinsurance market is setting up a more volatile 2026 for catastrophe-bond investors, with market pricing suggesting an upside return of 7%, a 6.3% yield and 0.7% of potential spread compression. Cat bonds may struggle on a relative-value basis since insurer risk spreads are trading below high-yield peers.

Related:

- Catastrophe Bonds Absorb ‘Black Swan’ Event Dealt by Melissa

- Jamaica Catastrophe Bond Headed for Full Payout After Hurricane, World Bank Says

- Ex-PIMCO Executive Plans to Launch Europe’s First ETF Based on Catastrophe Bonds

Topics Catastrophe

Was this article valuable?

Here are more articles you may enjoy.

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions