European policymakers should fuel market turbulence to pressure US President Donald Trump to back down from his Greenland claim, according to a senior executive at Allianz Global Investors.

“If I were an adviser to some European governments, I would say you almost need to create a little bit of market volatility because Donald Trump cares about that a lot, probably more than other politicians,” said Michael Krautzberger, the chief investment officer for public markets at the Allianz SE subsidiary, which manages €580 billion ($680 billion) in assets.

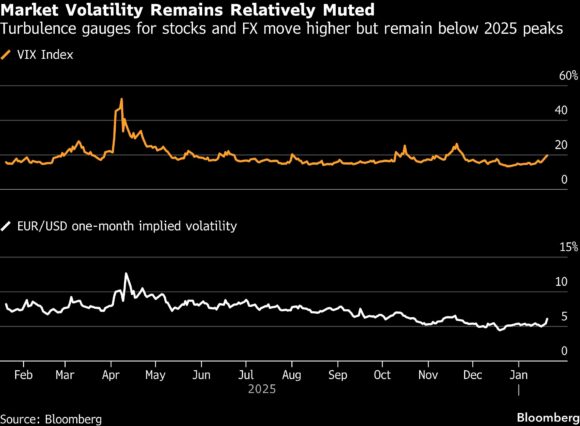

Retaliatory measures that create financial turbulence could encourage Trump to make “a face-saving compromise,” Krautzberger said at the firm’s London office. So far this week, gauges of volatility have been rattled higher but remain well below the peaks last year after Trump’s “Liberation Day” tariff announcements.

European policymakers are debating how to respond to Trump’s demand to take Greenland from Denmark, citing security issues. Trump said Tuesday he will meet with “various parties” over his claim during the World Economic Forum in Davos.

Krautzberger suggested Europe should “at least threaten access for US companies to European markets,” among other potential counter-measures. That refers to the European Union’s so-called anti-coercion instrument, which if triggered could impose curbs on US investments, goods and services across the bloc.

AllianzGI operates separately from Allianz SE’s California-based asset management unit PIMCO.

“If you hold that up up for a while, the market will react,” he said, citing the upcoming US midterm elections as impacting Trump’s “tolerance” for large financial market volatility.

Krautzberger’s suggestion is notable given such market turbulence would potentially dent returns for European investors, at least in the short term. US and European stocks are already falling as a result of the tensions, with Trump threatening eight European countries with tariffs for opposing his Greenland demands.

One extreme measure that has been floated is the possibility of policymakers pushing European funds that hold US assets to sell down their holdings. US Treasury Secretary Scott Bessent said Tuesday such a move would defy logic and that he “could not disagree more strongly on that.”

US Treasuries dipped after Danish pension fund AkademikerPension said Tuesday it plans to exit its US Treasuries holdings by the end of this month. However, the move faded as the firm only holds about $100 million of such securities, a tiny fraction of the $30 trillion market.

Allianz’s Krautzberger believes an EU coordinated policy to take such action would be difficult to implement given that holdings are spread over an array of investors, many of which are private funds outside the direct control of governments.

“I think it’s a hard to coordinate instrument,” he said. “The theoretical threat is there, but there’s a lot of non-government players.”

Photograph: The offices of Allianz in the La Defense financial district of Paris; photo credit: Nathan Laine/Bloomberg

Was this article valuable?

Here are more articles you may enjoy.

Marsh Awarded Injunction Against Former Employees Now With Howden US

Marsh Awarded Injunction Against Former Employees Now With Howden US  Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent

Kyle Busch and Wife Settle Lawsuit With Pacific Life and Insurance Agent  Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale

Zurich Insurance Said to Near Beazley Deal Funded by Equity Sale  Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates