The company that helped make driver safety monitoring ubiquitous among auto insurers is now offering a product that can write accident reports within minutes of a crash.

Cambridge Mobile Telematics (CMT) announced the launch of Claims Studio, an accident reporting system that the company says will speed up claim processing times. Claims Studio uses CMT’s existing telematics technology, which monitors driving habits, to automatically write narrative accident reports when it detects a crash.

“What happens when you’re a claims adjuster is you spend a lot of time interviewing people to find out what happened,” said Ryan McMahon, CMT’s vice president of insurance and government affairs. “How fast were you going? What exact time did this happen? It usually takes awhile. This tool speeds up that process.”

CMT said by providing key details such as speed, severity, and vehicle impact location early in the process, insurers can spend less time collecting information from drivers and third parties, and more time confirming facts and accurately assessing loss.

Claims Studio also can be used to send an alert to CMT’s servers if it detects a crash. When an alert is signaled, customers who signed up for the service will receive a call from their insurer to find out if an emergency response is needed.

Several insurers, including Liberty Mutual, Nationwide and State Farm, already use CMT’s DriveWell product to offer discounts or rewards to drivers who score well by avoiding excessive speeds, hard braking and abrupt turns. McMahon said Claims Studio uses data collected by DriveWell to detect collisions. Customers who have installed DriveWell in their smartphones can add Claims Studio by downloading the app.

Several insurers, including Liberty Mutual, Nationwide and State Farm, already use CMT’s DriveWell product to offer discounts or rewards to drivers who score well by avoiding excessive speeds, hard braking and abrupt turns. McMahon said Claims Studio uses data collected by DriveWell to detect collisions. Customers who have installed DriveWell in their smartphones can add Claims Studio by downloading the app.

McMahon said one insurance carrier, Discovery Insure in South Africa, is already offering Claims Studio to its customers. Some of its U.S. customers have also tested the Claims Studio product in pilot projects. He said CMT has also intentionally crashed cars, under controlled conditions, to test the functionality.

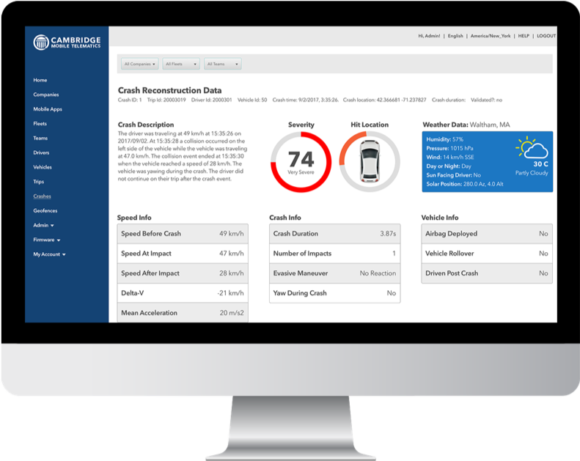

Claims Studio uses four sensors — an accelerometer, global positioning system, gyroscope and a barometer — to detect when an impact occurs and reconstruct the crash event. Data is sent to CMT servers, which validate the initial data and assess the severity of the accident from the data.

The system produces claims reports that include a description of the crash, the duration, the location and number of impacts, acceleration, evasive maneuvers, weather conditions and the time of day.

Claims adjusters can use the data to produce a first notice of loss and get a head start on the investigation. He said normally claims adjusters must interview the insured to start adjusting a claim.

“This tool speeds up that process,” he said. “Instead of waiting for the insured, the information can be transmitted from the crash.”

He said the data also helps with subrogation by providing data that can show how the crash happened and who is responsible.

CMT, based in Cambridge, Mass., introduced mobile usage-based insurance to the auto insurance market in 2012. The telematics technology is now used in more than 50 active programs with insurers and other partners in 25 countries, the company said.

Topics Claims

Was this article valuable?

Here are more articles you may enjoy.

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims

Gun Accessory Company to Pay $1.75 Million to Buffalo Supermarket Shooting Victims  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’