“You can’t cut yourself to greatness.”

Simon Wilson, chief executive officer of Markel Insurance, made the simple statement at a Markel Group brunch meeting for investors in Omaha, Nebraska on May 4 to convey the idea the hard work of reducing underperforming insurance business has been largely done in recent years.

Markel Insurance is now intent on growing its “bread-and-butter” excess and surplus lines insurance business, written through wholesale brokers.

While Markel has been busy correcting underwriting mistakes, like cutting back on U.S. construction business, the E&S market has experienced industrywide growth of 20% for the last five years, said Wilson, the former head of the international insurance business, who ascended to the role of CEO of Markel Insurance in March.

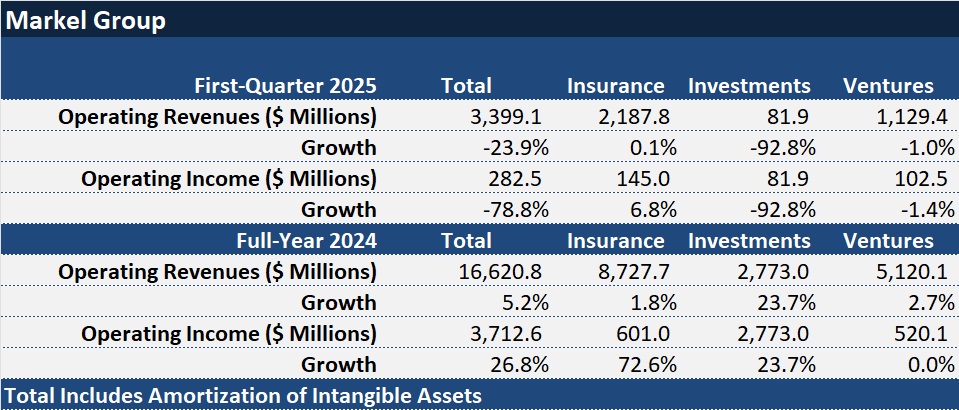

Markel Group CEO Tom Gayner and Michael Heaton, chief operating officer of Markel Group, preceded Wilson with separate presentations during the meeting, describing the three profit-producing engines of the group: Insurance, Investments (returns from equity and fixed maturity investment of insurance float) and Ventures (a division made up of 21 noninsurance businesses). Heaton said Markel will “seek to be a market leader in each of our pursuits,” noting Markel Insurance’s No. 4 position in the U.S. surplus lines market (based on direct written premiums) and referring to Markel Insurance as the “biggest diamond” in Markel Group.

Still, both executives expressed disappointment in the results of the “crown jewel” insurance engine in recent years, and alluded to corrective actions Wilson is putting in place now.

“Our core insurance business has not reached its full potential. And to deliver on our promise to you, it absolutely must,” Heaton told shareholders. “Speaking candidly, we had to begin by mopping up a few messes in the aisleways” several years ago, he said.

“While we have not been top quartile in recent years, make no mistake, we aim to return to the front ranks,” Gayner said, referring to the specialty insurance businesses that include admitted and nonadmitted programs written through managing general agents in addition to E&S wholesale.

Wilson referenced combined ratios of competitors—Kinsale, averaging 78.7 over the last five years, and RLI, averaging 87.2. Markel’s average combined ratio was 94.7 over the same period, he said, setting out profit aspirations that will accompany renewed growth in E&S wholesale business, as well as moves to grow workers compensation and surety programs.

On the day that Markel announced Wilson would take the reins of the insurance engine, the holding company also announced that RLI’s former Chair, CEO and President Jon Michael would fill a spot on the board of directors vacated by former Vice Chair Tony Markel, who is retiring.

“We’re going to learn a lot from him as to how they produce,” Wilson said.

Markel Insurance’s underperformance against its peers is one of the issues that sparked a board-level review of all the businesses, which Markel Group announced in February.

Related: Markel’s Board Commencing Review of Go-Forward Business Structure

On the Agenda: Simplify and Empower

After presenting examples of the types of risks that Markel underwriters had tackled in the last week—a container vessel voyaging in the Red Sea, the builder of a floating wind farm near the coast of South Korea, and the owner of 10 gas stations in Richmond, Va. seeking pollution liability cover—Wilson outlined his plan to refocus on this type of core specialty insurance expertise by simplifying the organizational structure and empowering business unit leaders. He also provided some specifics on what ill-performing accounts are no longer part of the Markel Insurance portfolio.

Jokingly suggesting that the school nickname “Simple Simon” may have gotten him his new job, Wilson introduced the new simplified structure of Markel Specialty, which will now be divided into two core business units—U.S. Wholesale and Specialty led by Wendy Houser, and Programs and Services led by Alex Martin. Houser’s division is responsible for all U.S. specialty insurance business that flows through the company’s core wholesale and retail channels, and Martin’s encompasses a collection of businesses that include personal lines, Bermuda, surety, workers compensation, small commercial general package, programs and insurtech.

Related: Markel Insurance Restructures Markel Specialty, Appoints Leaders

The restructuring serves to clearly align core businesses with the buying behavior of customers and distribution partners, Wilson suggested. He also said that Markel Insurance will ditch a shared-service model, progressively shifting services like IT away from the corporate center and into frontline underwriting divisions.

Within the two broad specialty divisions, encompassing some 50 or 60 individual specialty businesses, not only will there be stronger alignment between underwriting and technology, but underwriting business leaders, each responsible for “a clear set of accounts,” will also have full accountability for their individual profit and loss statement, he said.

“When you give someone a clear task to go and get done, and the tools to go and do it, if they’re good enough, nine times out of 10 they will get the job done. And that’s what we’re going to be doing here,” he said.

“We’ve got to start really pushing growth into this business again, Wilson added. “Core strategy is something that we need to think about.”

“We’ve got this fabulous business at the center,” he said, referring to U.S. E&S Wholesale and Specialty as the biggest diamond within the insurance business. “We’ve almost taken it for granted that we will just continue to win in that area. We’ve gone after other bits of the market saying, ‘Oh, there’s lots of premium over here, there’s lots of premium over there. And meanwhile, Kinsale has gone right into that wholesaling specialty E&S market and started making money at a 70-something combined ratio.”

“We’ve taken our eye off the ball of our bread and butter business….We’ve had a little bit of a grass-is-greener strategy for a few years.”

Wilson also said that as Markel Insurance grew, it’s structure became overly complex, confusing the strategy. He promised “absolute clarity” going forward

“We are a specialty insurer and we’re going to put the [task] of driving the strategy in the [hands of] leaders who are closer to the customer and understand how their businesses are run. We’re going to empower those people to get it done.”

The U.S E&S market is “where we made our reputation, and this is where we are perceived by brokers to have the greatest strength.”

Topics Excess Surplus

Was this article valuable?

Here are more articles you may enjoy.

World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley

Zurich Insurance Profit Beats Estimates as CEO Eyes Beazley  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan