“It’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds.”

That headline on top of an announcement about the release of the J.D. Power 2025 U.S. Auto Insurance Study this week summed up a key takeaway of the customer insights J.D. Power gathered from over 48,000 auto insurance customers surveyed across 11 geographic regions between May 2024 through April 2025: More of them are considering not renewing with their current insurers.

That’s especially true for customers with higher overall lifetime value profiles—described by J.D. Power as those having higher annual premiums, long tenure and multiple policies with their current insurers. While just over half—51%—of high-value lifetime customers say they “definitely will” renew with their existing insurer, that 51% level falls below the “definitely will” responses for medium-value lifetime customers (53%) and low-value lifetime customers (54 percent).

Now that insurers are writing at profitable levels and “shifting back into [policy] growth mode, they really need to focus on cultivating and keeping high-value customers,” said Stephen Crewdson, managing director of insurance business intelligence at J.D. Power, in a media statement about the latest study.

Among many of those customers, “overall satisfaction this year is not particularly high. To shift that perception after the past few years of significant rate increases, insurers need to focus on delivering a tailored, seamless customer experience across all channels,” Crewdson said.

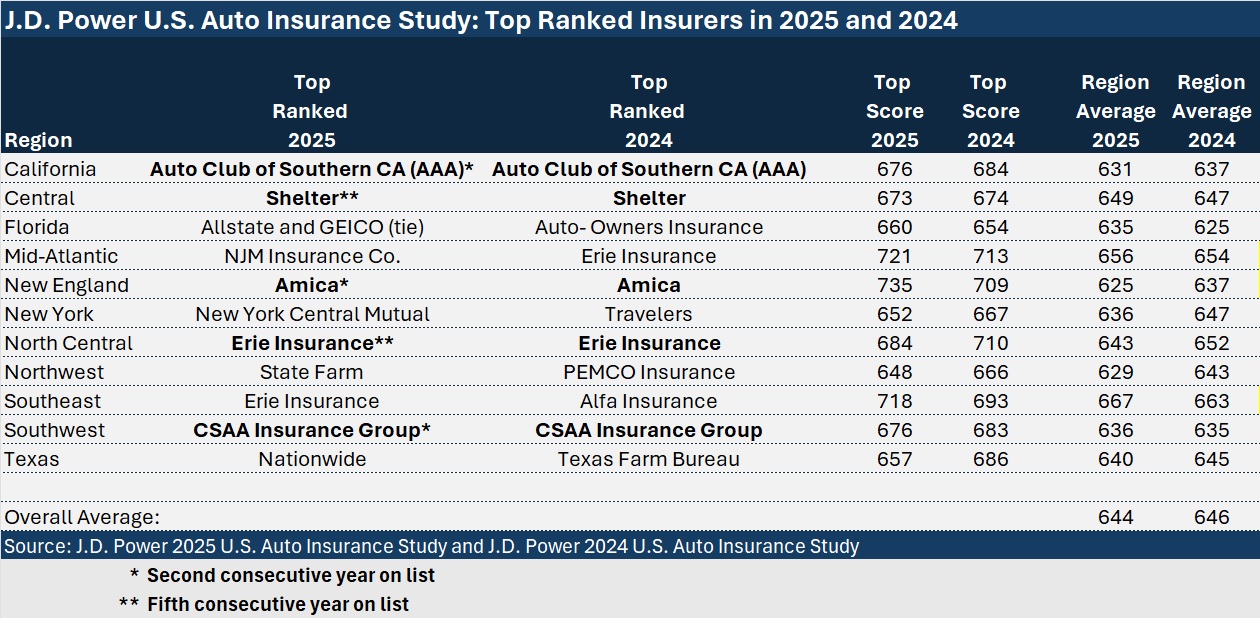

Overall customer satisfaction with auto insurers only declined 2 points to 644 (on a 1,000-point scale) from 646 a year ago. But according to J.D. Power, more than one-third of customers, 38%, fell into the bottom segment of customer satisfaction scores. Those in the bottom segment are “exceedingly less likely to renew their policies” with their current insurers, J.D. Power said.

As in prior year’s studies, the latest installment offers rankings of insurance companies based on their satisfaction scores in each of the 11 regions. Below, Carrier Management has summarized the top-ranked insurers for 2025 and 2024, also presenting their scores vs. the average scores in the regions where they ranked first.

Also consistent with prior rankings, smaller insurers (writing across less than half the states, and some in just one state) tended to dominate the top spots in the 2025 listings, with the names of only five national writers show up as a No. 1 ranked insurer in any region. (Among the five, Allstate and GEICO tied in Florida.)

The best-ranked national insurer—and in fact the best-ranked insurer in any region included in the study—was Amica, which took the top spot in New England for the second straight year with a satisfaction score of 735 this year.

Regional insurer NJM Insurance and Erie Insurance, which writes in about a dozen states, also achieved scores that were more than 70 points above the study average of 644—NJM garnering a 721 in the Mid-Atlantic region and Erie, 718, in the Southeast.

Erie has the distinction of being top-ranked in two regions—North Central and the Southeast—while ranking just behind NJM in a third region, the Mid-Atlantic, with a score of 706 there.

Erie and Shelter are the only two insurers to rank No. 1 in satisfaction in any one region for five consecutive years—Erie, in the North Central region and Shelter in the Central region.

The U.S. Auto Insurance Study, now in its 26th year, measures customer satisfaction with auto insurers based on performance in seven core dimensions on a poor-to-perfect rating scale. Individual dimensions measured are (in order of importance):

- Level of trust

- Price for coverage

- People

- Ease of doing business

- Product/coverage offerings

- Problem resolution

- Digital channels

Commenting on the various dimensions for measuring satisfaction, J.D. Power said seamless experience across service channels is the most important driver of overall satisfaction among auto insurance customers. “When insurers deliver on this key performance indicator, customers are significantly more likely to have higher levels of trust in their insurer; feel better about the people they are working with; and feel like it is easy to work with their insurer.”

The J.D. Power report summary also noted that while insurance customers cited good rates (lower prices) as the top reason for buying from a particular insurer, good service and positive claims experience were the top drivers of client retention, according to survey results.

Prior to 2024, the J.D. Power scoring model considered only five factors to measure customer satisfaction (non-claims interaction; price; policy offerings; billing process and policy information and claims), with customers grading insurers on a 10-point scale. With introduction of a newer poor-to-perfect rating last year, survey takers are offered six choices to grade auto insurers in responding to questions: poor, just OK, good, great, excellent or perfect.

Because of the introduction of the new rating scale, satisfaction scores in 2023 and prior studies are higher and not comparable to the 2024 and 2025 scores.

For more explanation of the changes, see the related article, “J.D. Power UBI Scores vs. Overall 2024 U.S. Auto Insurance Satisfaction Scores”

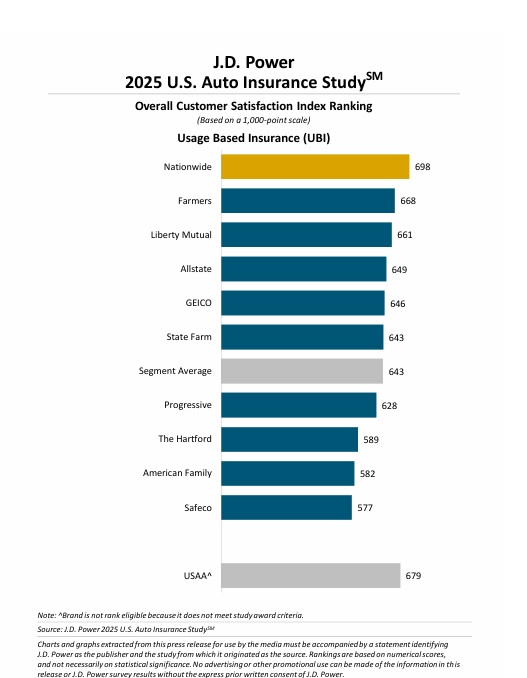

The J.D. Power 2025 U.S. Auto Insurance Study also includes a ranking of usage-based insurers, with Nationwide coming in with the highest score (698 in 2025) for the second consecutive year.

Last year, a J.D. Power representative told CM that the UBI scores are based on these factors:

- Initial program setup/onboarding (for drivers that signed up for UBI within the past year)

- Ease of participating in the program

- Usefulness of the information received

- Functionality of the app/website

- Discounts received for participation

Unlike the overall scores, the calibration scale used for UBI satisfaction scores did not change from a 10-point to a 6-point scale until this year. As a result, 2024 UBI satisfaction scores are not comparable to those shown in the current report. (Nationwide scored 842 last year, for example.)

Topics Auto

Was this article valuable?

Here are more articles you may enjoy.

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears