A softer reinsurance market will prevail during the Jan. 1 reinsurance renewals. The only question is how much more softening will happen and how fast, leaders of Guy Carpenter said during a recent media briefing.

Laurent Rousseau, Guy Carpenter’s chief executive officer of EMEA and Global Capital Solutions, kicked off the briefing, held ahead of the Monte Carlo Rendez-Vous, noting a key driver of the softer conditions: “Reinsurance capital—supply—has been growing faster than demand for reinsurance,” he said, pointing to trends that started in 2023.

In view of these conditions, the answer to the question of how far and how fast the market will soften during 2026 renewals, he said, “will depend on catastrophe and economic risks through the rest of the year.”

“Our current view is that the likely scenario is continued softening in the market,” he added. “In particular, it is likely that price decreases will accelerate, and terms and conditions will broaden, but in an orderly manner,” he stated.

“The reinsurance industry is clearly and increasingly in a buyers’ market,” he said, also pointing to a shift in the strategic priorities of reinsurers—toward growth—as a factor favoring buyers.

“As returns continue to increase, insurers and reinsurers are looking to grow further, both organically and through M&A, he said.

“As reinsurers push for growth, now is the time for clients to optimize their reinsurance protection,” he advised.

Jay Dhru, Guy Carpenter’s global head of Business Intelligence, gave more details of the supply side of the market equation, and Rousseau offered more color on demand dynamics, with both stressing the need for reinsurers to remain relevant to clients.

According to Dhru, Guy Carpenter projects nearly $650 billion of capital committed to the reinsurance sector for 2025, up from just over $600 billion in 2024, with $535 billion of the 2025 figure coming from the traditional reinsurance market and $114 billion from alternative capital providers.

“Profitability has allowed reinsurers to build up the capacity,” Dhru said, noting that retained earnings from disciplined underwriting and surging investment income have fueled capital growth over the last two years. Since the “historic reinsurance reset” of 2023, featuring higher attachment points on property programs, the reinsurance industry combined ratio has fallen to 90 and lower for three years straight, according to Guy Carpenter’s calculations. Forecasting that the industry combined ratio will remain below 90 through 2027, Dhru asserted that reinsurers “made up for the underperformance of the sector during the five year period of 2017 to 2022 in just two years.”

“Reinsurers now have the ability to absorb an estimated $250 billion in total catastrophe-related insured losses without depleting their capital.”

“However, the long-term relevance of reinsurers is at stake,” he said, going on to note that reinsurers’ share of natural catastrophe losses declined to 12% in 2024 from 20% in 2022—and has remained low, even considering significant loss events like the California wildfires in January of this year.

Reinsurers “have an opportunity to strike a balance between maximizing profitability and maintaining their role as reliable long-term partners,” he said

Offering some insights on the demand side of the reinsurance equation, Rousseau noted that demand for reinsurance is actually increasing—”mostly to cover frequency risks and earnings volatility”—but at a slower pace than capital supply. He cited insurers’ moves to increase retentions as a means to fuel their earnings growth as one particular dampening effect on reinsurance demand.

“Ceding less premiums to the reinsurance markets is a lever to grow bottom-line earnings” for insurers, he said. At the same time, however, “increased retentions have already translated into increased volatility.”

“This is a normal course of business we’ve seen in the past cycles, and we should [expect] that to continue, requiring insurers to have scale and diversification to absorb increased risk and volatility,” he said.

Other speakers highlighted specific conditions in the property, casualty and specialty reinsurance markets, for the most part noting ample available capacity and repeatedly tossing out advice to reinsurers to lower program retentions.

Summing up property market conditions, David Duffy, president, Global Clients, reported “pronounced reductions” in risk-adjusted pricing for risk-remote layers in 2025, noting that both reinsurers and insurance-linked securities investors show strong appetites in those layers.

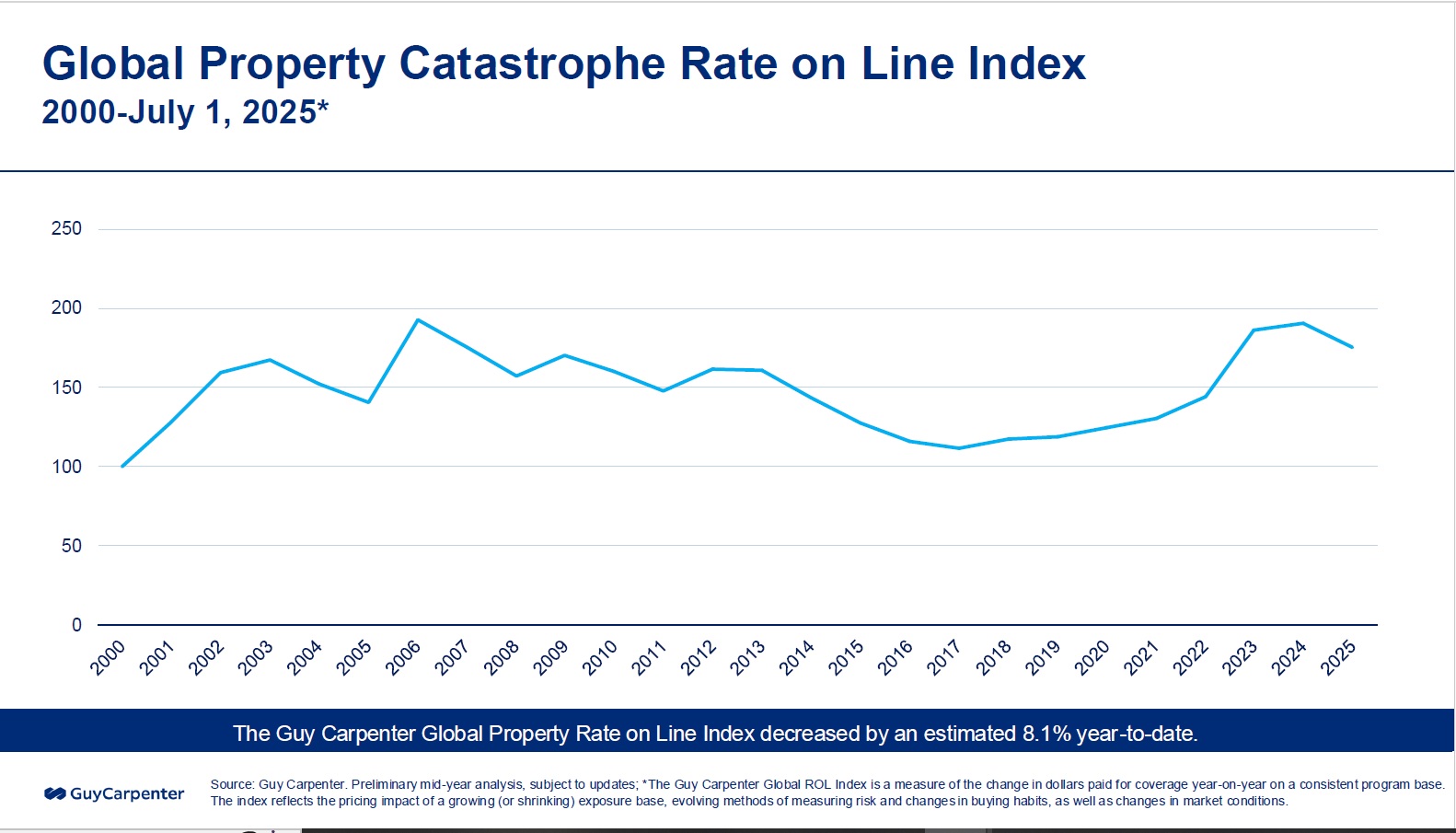

Focusing specifically on property-catastrophe and moderating pricing for property-cast business, Duffy said that during mid-year renewals, Guy Capenter’s U.S. property-catastrophe rate-on-line index decreased by just under 7% year on year, and the Asia Pacific index decreased by approximately 16%.

Putting these shifts in the pricing for key geographies that have high levels of midyear activity, together with other regions “remaining largely stable from Jan. 1, the global property-catastrophe rate-on-line index decreased by an estimated 8 percent for 2025 renewals between Jan. 1 and July 1, he reported.

Like other speakers, Duffy pointed to the challenge of absorbing the financial volatility associated with the frequency and severity of catastrophic loss as the primary one for global insurers seeking property reinsurance coverage.

“During 2025, we saw growing willingness on the part of reinsurers to provide frequency cat protection to insurers to meet this challenge. In 2026, we expect to see increased demand from insurers for coverage to protect earnings against cat frequency,” he reported.

“Reinsurer’s ability to meet client coverage needs in this area will be an important differentiator for reinsurers seeking to grow in a competitive market environment.”

James Boyce, CEO of Global Specialties, offered similar market observations about property retrocession market dynamics, noting that recent rate reductions and some catastrophe losses haven’t dented profitability for providers of retro occurrence cover. While profits have fueled increased property retro occurrence capacity, aggregate excess-of-loss capacity has been more constrained. Conditions, however, “are improving for buyers of aggregate with an increase in both capacity and the average number of reinsurers participating on aggregate placement,” he said.

Boyce also said Guy Carpenter has witnessed increased reinsurer interest in non-cat specialty classes beyond marine and aviation. The supply of capacity for credit and political risk, for example, “remains well in excess of demand, leading to improved quota-share commission levels and target excess-of-loss pricing being readily achieved during renewals,” he said.

As for casualty reinsurance, Carolyn Morley, managing director, Global Casualty, described a marketplace characterized by “ample capacity, disciplined underwriting and evolving risk landscapes.”

“Reinsurers recognize the upside of strong underlying pricing fundamentals and the underwriting actions” that cedents have taken.

With underlying insurance company portfolios continuing to improve, original pricing continuing to rise for loss-impacted lines, and continued control over deployed policy limits, Guy Carpenter and its clients “will expect reinsurers to respond with capacity and terms and conditions that reflect the current portfolio” moving forward, she said.

Casualty “clients retain much more risk than reinsurers accept and are just as motivated to counter the social inflation dynamic” as reinsurers are, she said, suggesting that both reinsurers writing pro-rata casualty and excess-of-loss are benefitting from insurers’ continued discipline.

Commenting specifically on XOL programs, Morley noted “the significant reduction in original policy limits by 30 to 50% over the past five years,” stating that “higher attaching excess-of-loss layers will be in focus as they attract disproportionate volatility loadings from reinsurers without transferring the requisite risk.”

Rousseau started the session by highlighting the complexity and volatility of the macroeconomic environment as a backdrop to reinsurance market conditions.

“The complexity of the moment is what stands out. That is trade wars, ground wars, cultural wars, promise and risk around AI and emerging technologies, extreme weather events, supply chain risks—you name it. Navigating that complexity is a challenge at the moment. In uncertain times there is a tendency to focus on the short term and on local issues, whereas reinsurance is all about diversification over time, the long term, and the world, the global risks universe,” he said.

After introducing the key question on the minds of buyers of reinsurance—about how fast and far the reinsurance market will soften—Rousseau teed up a different question for reinsurers: How can they keep on their growth trajectories without deteriorating the quality of their underwriting?

“Excessive and uncontrolled risk appetite expansion is a well-trodden path for our industry over the years,” he reported.

Predicting the M&A will be one path for reinsurers as price increases no longer fuel organic growth, Rousseau said two other paths to success will involve “client centricity” and “risk insights.”

“To be best positioned for growth with their insurers, reinsurers need to play across the board with proportional shares on client treaties in all classes where they have appetite,” he said, explaining client centricity. “To create value, reinsurers must truly share the fortunes of their clients.”

As for better risk understanding, he said, “Actionable insights are vital to identify and capitalize on emerging growth opportunities and [to] allow for more agile capital deployment across underwriting cycles.”

“Our industry is not immune [from] the deep technology and AI transformation that is going on, but our industry is still rather slow to treat technology as a paradigm shift opportunity. Insights generated by greater data quantity and quality and the ability to process business in a smooth and reliable way will continue to play growing roles,” he predicted.

Topics Pricing Trends Reinsurance Market

Was this article valuable?

Here are more articles you may enjoy.

Accuweather: Winter Storm to Cause Up to $115B in Damage, Economic Losses

Accuweather: Winter Storm to Cause Up to $115B in Damage, Economic Losses  Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion  GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half  Why Power Outages Do More Economic Damage Than We Think

Why Power Outages Do More Economic Damage Than We Think