Two separate reports published this month show that while quarterly insurtech deal counts have plummeted from heights attained in 2021 and 2022, dollar levels invested in insurtechs have stabilized since late 2022.

While their deal-dollar and deal-count tallies are slightly different from one another, analysts at CB Insights and Gallagher Re reached the same conclusion in their separate reports, “State of Insurtech Q3’25 Report | CB Insights Research” and “Global Insurtech Report for Q3 2025 | GallagherRe.”

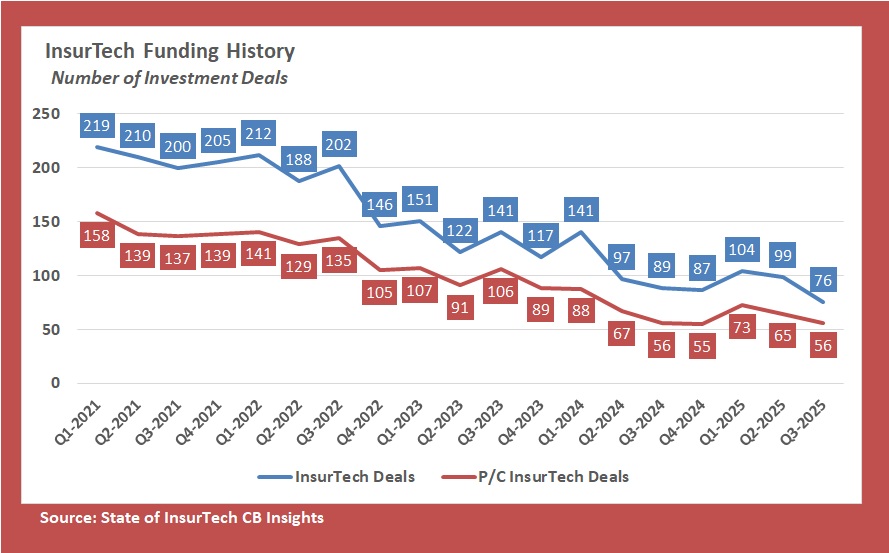

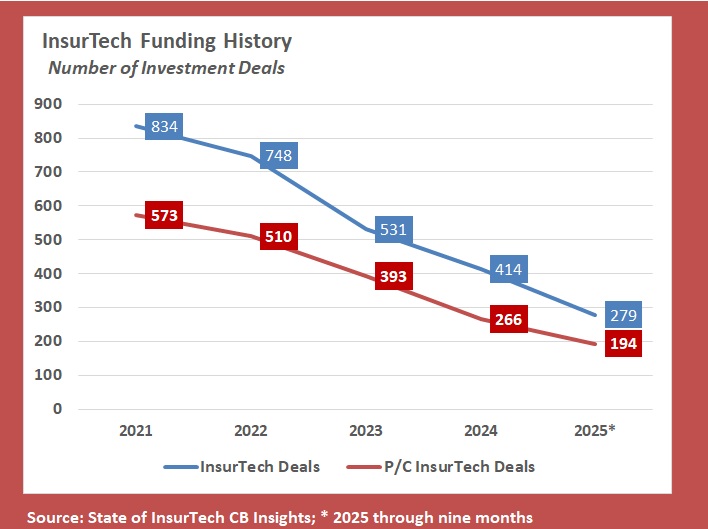

Both reports put the overall deal count to third-quarter 2025 at 76 deals, with CB Insights showing that number representing a decline of 65% from a peak of 219 deals in first-quarter 2021. Gallagher Re counts the same number of deals—76—for third-quarter 2025, but measured against a peak of 162 deals that Gallagher shows occurring in second-quarter 2021, the drop is roughly 53%.

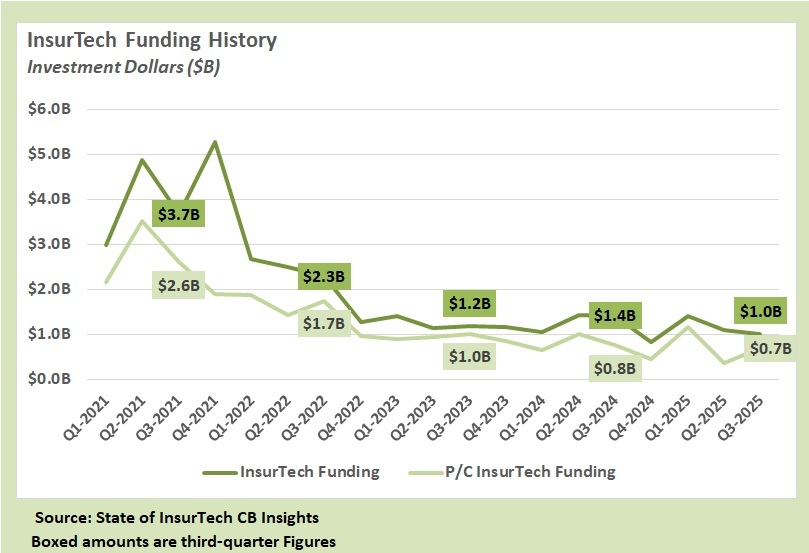

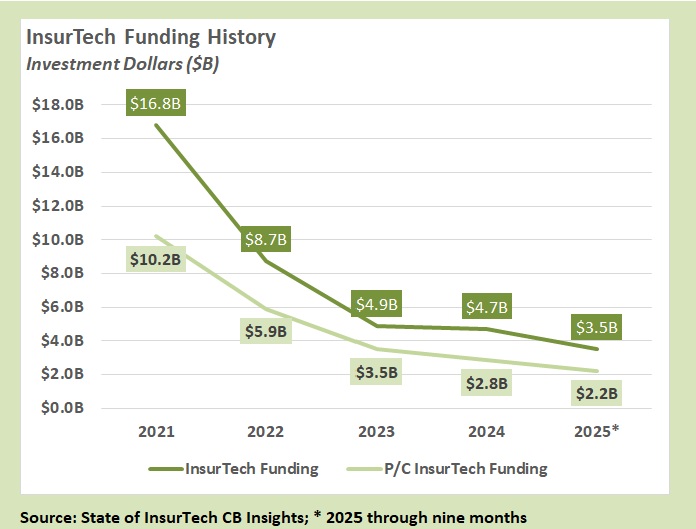

Adding up the dollars, both reports show just over $1.0 billion invested in insurtechs in third-quarter 2025—and a quarterly average of $1.1 billion or $1.2 billion for the last 12 quarters (Q42022 through Q32025).

“While the data underlying this trend has only been recorded in the past three years, there are signs that this consistency of investment could continue, such as an ongoing lack of mega-round funding, [and] the closeness of individual deal totals to the mean average deal,” Gallagher Re said in a media statement summarizing its report.

The Gallagher Re report shows that over the past three years, each quarter’s funding total was within 20% of the mean average ($1.1 billion).

“There is also a general pivot among InsurTechs toward business models that enhance and enable incumbents, and away from competing with them directly for customers (an incredibly cash-intensive business). This also suggests potential longevity in the trend,” the report observes.

The Gallagher Re report includes two bar graphs of funding levels by quarter—one for the period extending from first-quarter 2020 through third-quarter 2022, and a second bar graph for each of the quarters from fourth-quarter 2022 through third-quarter 2025. The juxtaposition of the two graphs illustrates the changing trends. While the heights of the bars on the second graph all fall roughly in line around the $1.1 billion mark, the early period is marked by swings in funding levels from quarter to quarter, ranging from highs near $5 billion for two quarters in 2021 (Q22021 and Q42021) to lows of $900 million for first-quarter 2020 and $2.2 billion-$2.4 billion for the first three quarters of 2022.

Below we have graphed quarterly figures from the CB Insights report, which provides details of investment dollars for property/casualty insurtechs alone.

With respect to P/C deals, the CB Insights report notes that 56 third-quarter 2025 P/C deal counts matched prior lows tallied in third- and fourth-quarter 2024. Third-quarter 2025 funding dollars for P/C insurtechs, however, rebounded from an eight-year low recorded in second-quarter 2025. P/C insurtech funding dollars in the second quarter of this year were roughly $369 million, while the third-quarter 2025 level came in at $687 million.

Below we consolidate the quarterly figures into annual periods for 2021-2024 and the first nine months of 2025.

Investors and Investor Strategies

Both reports comment on changes in the investor universe and their strategies over time.

According to CB Insights, the insurtech sector overall (P/C and life) saw just 186 active investors in third-quarter 2025, the fewest since first-quarter 2017 (184).

In third-quarter 2025, just four investors made two or more insurtech investments, the CB Insights report said, identifying them as American Family Ventures, ManchesterStory Group, Munich Re Ventures, and OperaTech Ventures.

That’s a stark difference from second-quarter 2025, when 13 investors made multiple investments.

Over at Gallagher Re, report author Andrew Johnston, global head of insurtech at Gallagher Re, said, “Investor strategy has shifted away from massive, high-risk bets on a few companies to a more balanced approach. While the huge ‘winner-takes-all’ funding rounds are less common, the underlying market is still very active, shown by strong deal flow and early-stage funding volatility.”

“This signals that while the appetite for pure venture risk is alive and well, funding for growth stage companies is maturing and becoming more selective.”

The report includes an analysis of investments by Silicon Valley VCs over time vs. insurtech funding from insurers and reinsurers. Graphs show a widening gap in deal counts and funding dollars provided by VCs vs. insurers over the period from 2012 through 2021, with the VCs investing more dollars in more deals. But in recent years, the gap has narrowed.

Over the entire 13-year period, insurers and reinsurers have invested $15.3 billion into 663 deals, according to Gallagher Re’s records. This represents about one-quarter of all funding dollars, and just about 18% of all deals. Silicon Valley, in contrast invested 56% of all the capital that went into insurtechs over the same time frame, accounting for one-third of all deals done.

Other Takeaways

The reports each have additional takeaways for insurtechs and incumbents alike.

For example, the CB Insights report advises that incumbents should closely monitor recently-funded insurtechs, many of which exhibit operational strength. “Insurtechs with 10-plus employees that raised [funds in Q3’25 grew headcount 15.8% over 12 months, signaling capital flows to companies with measurable traction,” the report says.

CB Insights also reveals that insurtechs mergers and acquisitions increased from 16 in second-quarter 2025 to 21 in the third quarter, noting that the third-quarter 2025 marked the highest number of M&A transactions since third-quarter 2022 (23). There were 15 exits via M&A in third-quarter 2025 for the P/C insurtechs alone.

The increase reverses the trend of decreasing M&A activity within insurtech between 2022 and 2024, CB Insights reports.

In addition to deal statistics, the Gallagher Re report puts a spotlight on commercial-focused insurtechs, and describes top use cases and hurdles for AI in commercial insurance and in property reinsurance.

According to the Gallagher Re report, commercial-focused insurtechs raised $470.7 million in third-quarter 2025. In addition, since 2012, Gallagher Re estimates that $9.3 billion was invested into commercial-related insurtech companies globally, out of more than $60 billion that has been invested into insurtechs overall.

Topics Mergers & Acquisitions InsurTech Tech

Was this article valuable?

Here are more articles you may enjoy.

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup

State Farm Adjuster’s Opinion Does Not Override Policy Exclusion in MS Sewage Backup  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’