Progressive posted $2.6 billion in third-quarter net income last week in spite of taking a nearly $1 billion charge to account for excess profits the carrier will have to return to Florida auto insurance policyholders.

“Despite actions to lower rates in the last year, it is probable that our personal auto profit in Florida for the 2023 to 2025 period will exceed the statutory profit limit that a Florida statute imposes on the profit that any insurance group can earn on personal auto insurance over any three-calendar-year period,” Progressive said, explaining the decision to record a $950 million policyholder credit expense.

The $950 million is Progressive’s current estimate of the profit it will earn on the three-calendar-year period over the permitted profit limit, necessitating cash refunds or credits toward future insurance purchases to the policyholders on record as of Dec. 31, 2025.

According to Florida statutes, excessive profit “has been realized if there has been an underwriting gain for the three most recent calendar-accident years combined which is greater than the anticipated underwriting profit plus 5 percent of earned premiums for those calendar-accident years.”

Progressive anticipated the possibility of the givebacks earlier this year in its second-quarter 10Q filing with the Securities and Exchange Commission. “Since Florida insurance reform was enacted in early 2023, we have seen lower loss costs on certain types of personal auto accident claims and favorable reserve development, and we have experienced strong profitability in our Florida personal auto business,” the insurer said in the SEC filing and in the third-quarter earnings announcement last week.

Related: Progressive Could Soon Breach Excess Profits in Florida Auto, Triggering Refunds

At the time of the second-quarter SEC filing, Progressive had indicated that it couldn’t yet be certain that it would breach the excess profits threshold because the risk of hurricanes impacting Florida through the end of November remained relatively high, and also because loss reserve development on the accident years impacting the statutory calculation—2023-2025—could be recorded through the first quarter 2026. That filing also noted that Progressive Florida auto insurance profits had occurred after actions to lower Florida personal auto rates twice in the last year.

Echoing some of the language in the 10Q, Progressive’s commentary in the third-quarter earnings release indicated that the excess profits calculation will continue to be refined through the end of the fourth quarter to reflect reserve adjustments and any Florida hurricane loss impacts. After the refinements, Progressive expects to provide credits to policyholders active at Dec. 31, 2025 in early 2026.

As of Sept. 30, 2025, Progressive said it had roughly 2.7 million personal auto policyholders active in Florida.

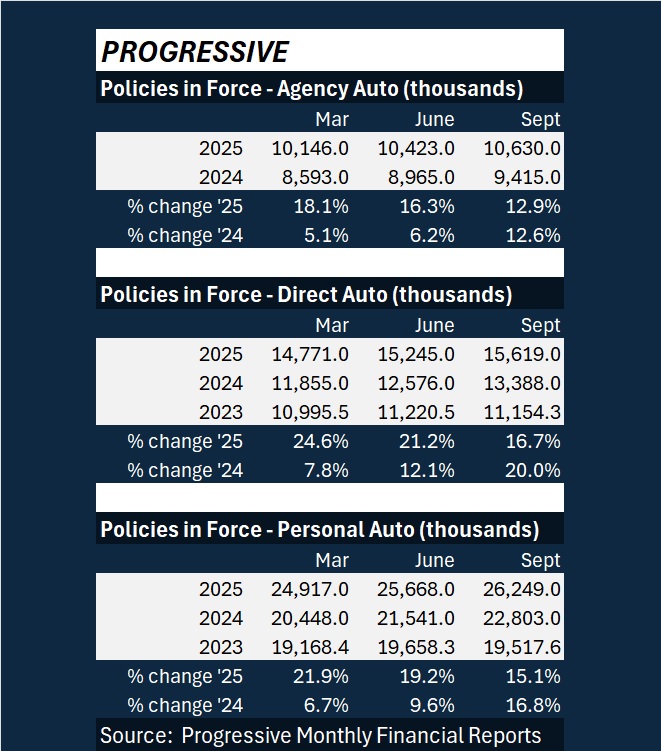

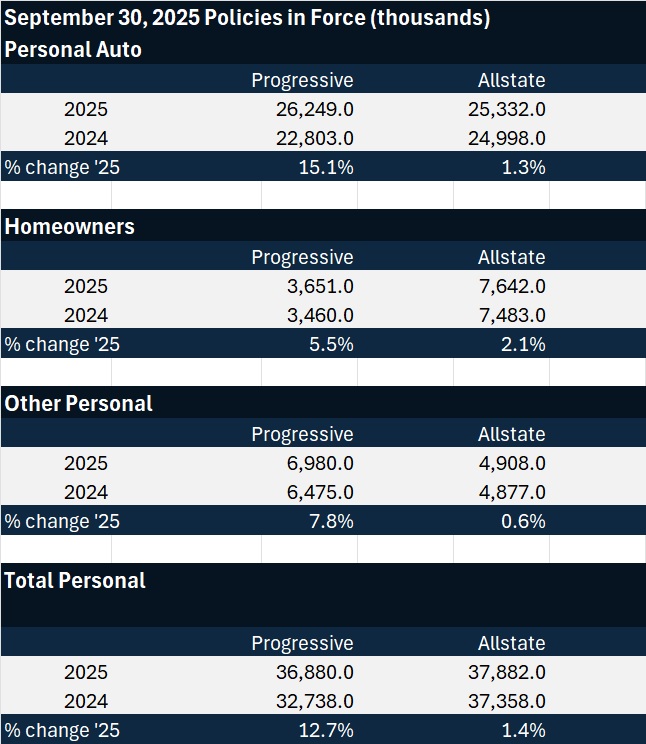

Across all states, Progressive had nearly 10-times that amount—over 26 million policies in force as of Sept. 30, 2025. While the level of policies rose 15.1% over policies in force at the end of September last year, the amount is below the policy growth rates of roughly 20% that Progressive recorded at the end of the first- and second-quarters.

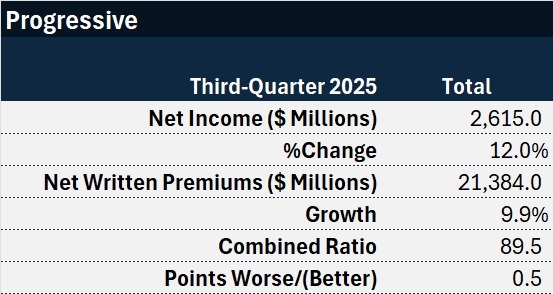

On the top line, Progressive reported net written premium growth of 9.9% to $21.4 billion for the third-quarter across all lines of business, including its biggest contributor personal auto.

While Progressive doesn’t provide a breakdown by line-of-business until it files a 10Q (expected in early November), the earnings release does include premiums, loss ratios, expense ratios and combined ratios separately for personal auto, personal property and commercial lines.

The $950 million charge for Florida shows up in the nine-month 2025 personal lines auto expense ratio, which increased by 2.5 points over the expense ratio recorded for the same time period in 2024. With the loss ratio improving 2.6 points, the overall personal auto combined ratio across all states still came in more than 12 points below breakeven (87.6).

Across all lines, Progressive easily achieved the combined ratio target embedded in the insurer’s long-term strategy often expressed by CEO Tricia Griffith on earnings conference calls: To “grow as fast as we can at or below a 96 combined ratio.”

Growth in net written premiums, however, is slower than last year, according to the earnings reports for this year’s first nine-months and the comparable period last year. Net written personal auto premiums for the first nine months grew 16.3% in 2025, compared to 25% in 2024. Across all lines Progressive writes, year-over-year growth in net written premiums for the first nine months is 13%, compared to a 21% YOY jump reported for the first nine months of 2024.

Separately, last week, personal line competitor, Allstate, also reported growth in policies in force by line in advance its third-quarter earnings report set for Nov. 6. Comparative growth figures for both companies are set forth below.

Topics Florida Profit Loss

Was this article valuable?

Here are more articles you may enjoy.

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows

Lemonade Books Q4 Net Loss of $21.7M as Customer Count Grows  AI Needs Its Own Risk Class: Lockton Re

AI Needs Its Own Risk Class: Lockton Re  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’