Surplus lines may not be the most widely understood segment of the property/casualty insurance industry but for risk managers of large organizations it’s often the go-to market for complicated risks for which standard insurance markets have little appetite.

That was the case for Norma Essary, the former risk manager of the third largest airport in the United States and now the executive director of the Surplus Lines Stamping Office of Texas (SLSOT).

“I bought in the surplus lines market because of the capacity and the excess levels that I had for an international airport,” Essary said.

Though not a state agency, SLSOT was created by the Texas Legislature in 1987 and tasked with the job of processing every surplus lines policy written in the state. The agency is entirely funded by the processing, or “stamping” fees, charged on each Texas surplus lines policy filed. It is one of 14 stamping offices across the United States.

Upon taking over the reins at SLSOT in March 2015, one of the first things Essary wanted to accomplish was an across-the-board update of the agency’s technology systems in order to better capture and understand the vast amount of data that flows into the organization.

To help accomplish that goal, she brought in Tara Mitchell from the Texas Department of Insurance as director of Information and Technology Services. Among other things, at TDI Mitchell oversaw the surplus lines market and was “involved in some of the rule-making, and perhaps, interpretation and compliance with surplus lines. I hired her here to manage some of the operational and some of the technology areas,” Essary said.

Mitchell said SLSOT now is seeking “to help others understand the data that we collect and do something with it, make it a positive decision for their organization, their company, or their business. We have a lot of different stakeholders.”

Those stakeholders include Texas Department of Insurance, the state comptroller and legislature, insurance agents and brokers, insurance companies, trade associations, large commercial purchasers and the public, she said.

The plan is to use data mining to “look for and identify trends and patterns. … But we really have to have strong data governance in place, to be able to share that with others so that they understand what our data means,” Mitchell said.

Essential Communication

Another one of Essary’s goals for SLSOT is to communicate better with all the stakeholders not only about what the organization does, but what the surplus lines industry itself is all about.

From a communications perspective it’s difficult, she said, “because if we talk to anyone who walks in the door, even from another industry perspective, they don’t understand what surplus lines is, much less a stamping office.”

For example, people may understand what Lloyd’s of London is, but they don’t necessarily know that it’s part of the surplus line market unless they are actively involved in the industry, she said.

“We’re challenged to be able to really show and get the value out of what the surplus lines market does and how it impacts consumers from larger commercial purchasers to, perhaps, individual ones who have a unique or capacity need,” Essary said. “We see that with all of our peers in the U.S. It’s a very difficult industry to make sense of sometimes.”

Flood Insurance and Surplus Lines

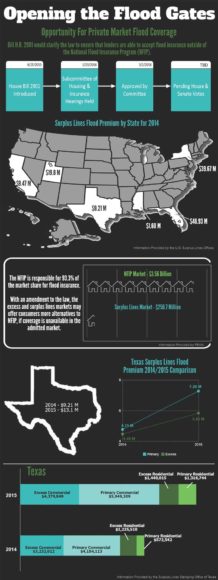

Federal flood insurance legislation currently making its way through Congress has provided an opportunity for Essary and Mitchell to utilize collected data to communicate more effectively about how further opening the flood insurance market to surplus lines insurers can help increase capacity where it is sorely needed.

Mitchell explained that the Biggert-Waters Flood Insurance Reform and Modernization Act of 2012, which reauthorized and reformed some aspects of the National Flood Insurance Program (NFIP), outlines who can participate in underwriting flood risks.

“The financial institutions that back the mortgages or the loans on these properties took a very strict interpretation of the federal law. Their interpretation was, you could only underwrite that risk if you were getting that coverage through the NFIP program,” Mitchell said.

Therefore, the bulk of flood insurance coverage is written through the NFIP, even though it’s not required by law.

The current legislation, the Flood Insurance Market Parity and Modernization Act (H.R. 2901), passed the House of Representatives in April. The Senate has yet to vote on the bill, which is sponsored by Rep. Dennis Ross (R-FL) and Rep. Patrick Murphy (D-FL).

The Independent Insurance Agents and Brokers of America (IIABA or the Big “I”), which supports the bill, stated in a news release praising House passage of H.R. 2901 that “the legislation clarifies that a private flood policy can satisfy the mandatory purchase requirement for flood insurance. It also “clarifies that state regulators have authority over private flood insurance and ensures that policyholders can return to the National Flood Insurance Program (NFIP) without losing their grandfathered status or subsidy if they had previously left the program and obtained coverage in the private market and that coverage no longer meets their needs.”

In addition to agents’ groups and the insurance industry in general, supporters of the bill include state insurance commissioners, and taxpayer and environmental groups such as Taxpayers for Common Sense and SmarterSafer. Supporters believe that in addition to fostering competition in the flood insurance market, the bill offers an alternative for the 5 million property owners who rely on the NFIP, which is $23 billion in debt.

The legislation would define as acceptable a policy issued by a private insurance company that is licensed, admitted, or otherwise approved in the state in which the insured property is located. A policy issued by a non-admitted insurer would also qualify.

Essary said H.R. 2901 would enable the surplus lines market to participate in underwriting flood risk to a larger extent. She said SLSOT is “extremely excited about what this will do from the industry perspective in terms of spreading the risk, providing a viable option for consumers and, too, ensuring that we’re able to manage the loss at an effective capacity level, as the NFIP may not be able to manage a huge, difficult loss.”

To illustrate the advantage to both consumers and the surplus lines industry of increasing the opportunity for flood coverage to be written in the surplus lines market, Mitchell and her team created an infographic, “Opening the Flood Gates.”

Essary said the ability to harness and analyze data and to communicate what it means is a capability SLSOT has not had in the past.

“That is new for us. It’s taken it a step further to ensure we can get the word out. We’re not a lobbyist, but it is important that we provide better facts on areas that really fall into the surplus line or specialty market,” she said. “Again, it really is about where is the value and how can we utilize our abilities to capture information to support better rules, better decisions.”

It “definitely goes back to the data mining piece and looking for what we’re charged to do under our plan of operation, reporting patterns or trends to our stakeholders. We’re taking that role and expanding it some to help people make better decisions regarding our industry,” Mitchell said.

Related:

Topics USA Texas Agencies Legislation Excess Surplus Flood Market

Was this article valuable?

Here are more articles you may enjoy.

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Preparing for an AI Native Future

Preparing for an AI Native Future  Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions