Deep-red Texas needs to build power plants at an astonishing speed and scale to keep its economy humming. President Donald Trump just made that much harder.

So many data centers, crypto-mining operations and factories are planned for the Lone Star State that its peak electricity demand is poised to surge in the next five years — perhaps even double. The vast majority of new power capacity planned there would utilize the sun, the wind or batteries. But Trump’s One Big Beautiful Bill kills tax credits for renewable projects starting in 2028, making them more expensive to build.

Other states face the same problem, as power demand nationwide is expected to soar after decades of minimal growth. But it’s particularly acute in Texas, which has been rapidly adding renewable energy while it struggles to build gas-burning power plants. The state’s bustling economy will be threatened if it can’t add more electricity. Texas’ gross domestic product jumped 51% from 2020 through 2024 — compared to 37% for the country as a whole — fueled by cheap power.

“We’re in an energy crunch,” said Joshua Rhodes, an electricity expert and research scientist at the University of Texas at Austin. “We should be doubling down on everything we can build right now. Making things more expensive is antithetical to that.”

Clean power is expected to continue growing across the US, despite Trump’s tax and spending bill. But the legislation will cut the amount installed. BloombergNEF, for example, forecasts that annual deployment of new solar, wind and energy storage facilities in 2035 will be 23% lower than it would have been without the bill.

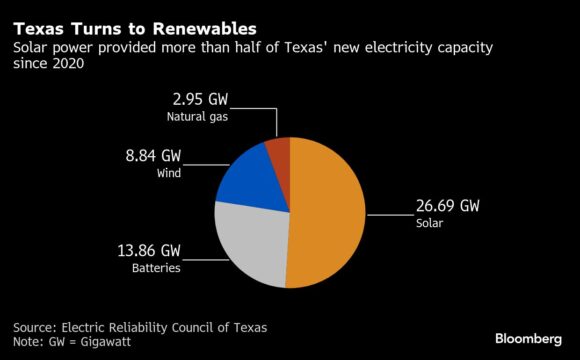

Oil and gas get most of the attention, but green energy has been the Texas economic boom’s secret ingredient. All but 6% of new electric capacity added to the state’s grid since 2020 has come from renewables or batteries.

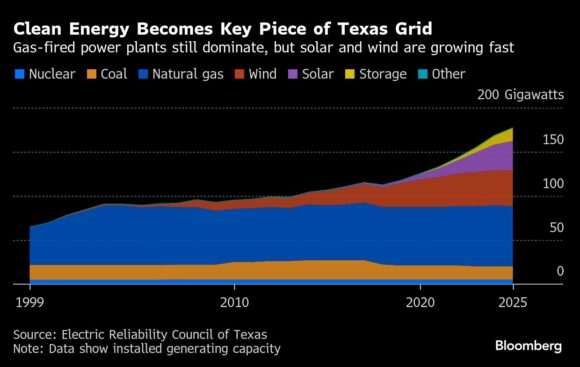

With vast, windswept plains, Texas has long been the top market for wind power. Solar surged as panel prices declined almost 50% in the past five years. It certainly helps that renewables are fast and relatively easy to install, compared to fossil fuel power plants that take years to build. Texas now has more clean energy and storage systems than any other state, supplying more than 30% of its electricity.

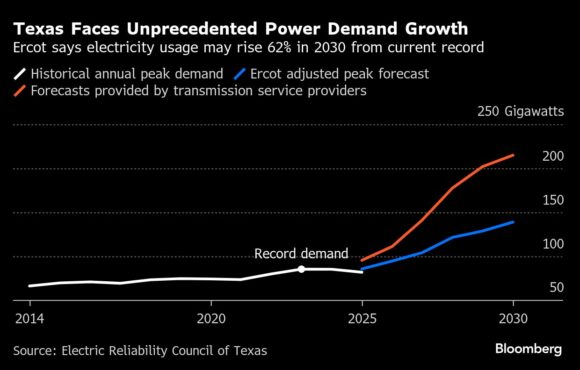

Texas enjoys relatively low electricity prices — which have become a magnet for energy-hungry facilities like data centers. The state’s power grid manager, known as Ercot, forecasts peak demand to approach 150 gigawatts by 2030, up from a record of 85.5 gigawatts in 2023. Transmission service providers, including utility companies, say demand could get even higher, topping 200 gigawatts in 2030. For a sense of scale, a gigawatt is the output of one commercial nuclear reactor and can power about 200,000 Texas homes.

The state now has about 178 gigawatts of installed generating or storage capacity, but not all of that electricity is available at any given moment. Gas and coal plants need to be taken offline for maintenance, batteries must recharge after use, and the output of solar and wind facilities varies with the weather and time of day. There always needs to be a comfortable cushion between installed capacity and actual demand. Texas’ grid is largely cut off from the rest of the country, so meeting expected demand growth will require adding lots of generation within the state — quickly.

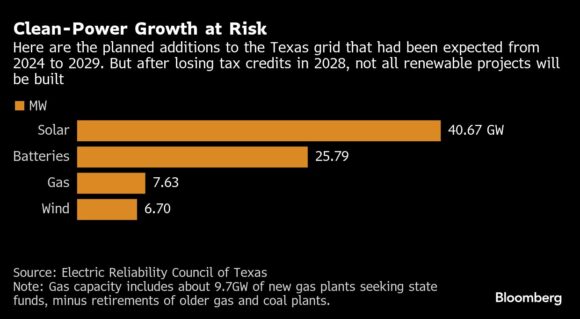

The state’s clean-energy boom had been expected to continue. But with Trump’s budget bill, wind and solar projects that go into service after the start of 2028 will no longer qualify for key federal incentives, unless they begin construction by July 5, 2026. Less-profitable projects will likely be cancelled.

A White House spokesman said that depending on “unreliable energy sources” could lead to reliability issues. The new policies will prompt developers to focus instead on domestically produced coal, gas and nuclear energy, Deputy Press Secretary Harrison Fields said in an emailed statement.

Led by Republican Governor Greg Abbott, Texas officials have tried to encourage construction of power plants burning natural gas. They’ve even set aside $5 billion of public money to offer gas plant developers low-interest loans. But projects keep dropping out of the loan program due to cost uncertainties and problems procuring equipment. Indeed, there’s currently a global manufacturing shortage of the turbines used in gas-fired plants, with a five-year backlog for new orders. Anyone planning a new gas plant faces a long wait for the gear.

A spokeswoman for Ercot said the state continues to see new power-generating projects being proposed to address growing demand. But any obstacle to new supplies poses a threat to the Texas economy, which would be the world’s eighth-largest if the state were considered as a country. Curtailing renewables would mean less electricity added to the grid. The renewable plants that do get built will cost more than before the One Big Beautiful Bill, driving up prices. Residential ratepayers in Texas could pay about 23% more in 2035 than they would have if the bill hadn’t upended the market, while industrial customers could see bills surge 54%, according to Energy Innovation Policy & Technology, an energy and climate think tank. Higher utility bills for consumers will mean less money to spend elsewhere every month.

“We will severely restrict economic growth,” said Doug Lewin, a Texas energy expert and president of Stoic Energy Consulting. “Because we can’t grow without energy.”

Topics Texas

Was this article valuable?

Here are more articles you may enjoy.

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion

Longtime Alabama Dentist Charged With Insurance Fraud in 2025 Office Explosion  Winter Storm Fern to Cause Up to $6.7B in Insured Losses

Winter Storm Fern to Cause Up to $6.7B in Insured Losses  Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’

Trapped Tesla Driver’s 911 Call: ‘It’s on Fire. Help Please’  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market