A Berkshire Hathaway Energy Co.-owned utility is at risk of losing its investment-grade credit rating as it expects to have to pay up more money for litigation brought by victims of 2020 wildfires in Oregon.

PacifiCorp recently warned that it might need to borrow more money to cover legal judgments. The utility faces a quicker pace of “mini-trials” designed to assess how much it’ll have to pay over its role in the Labor Day wildfires, which burned more than 1 million acres and destroyed thousands of homes.

The utility, which is the largest grid operator in the Western U.S., said it has to post bonds to appeal the damages awards and has posted $479 million in bonds for 91 wildfire victims so far, according to a regulatory filing.

If PacifiCorp’s payouts continue at that level, it would have to put up about $9 billion to appeal judgments tied to a total of 1,700 victims through 2028. The company has more than $13 billion of secured bonds, though only about $1.4 billion of that is maturing in the next five years, according to data compiled by Bloomberg.

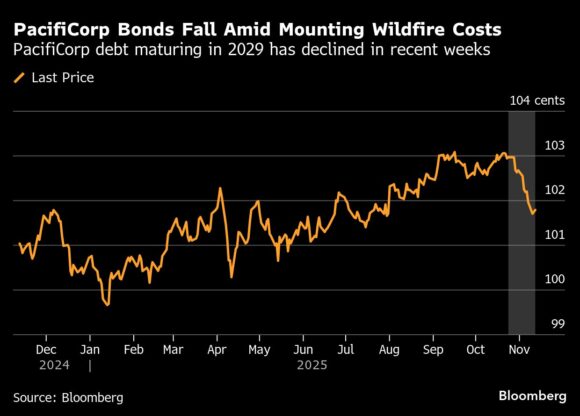

On Friday, S&P Global Ratings downgraded PacifiCorp to BBB-, just one rung above junk, and said it could downgrade the company further. Bank strategists also warned in reports last week that the utility’s bonds are likely to under-perform.

The disclosure outlines “significant and increased risks” for PacifiCorp’s cash position, Barclays Plc analysts wrote in a report. JPMorgan Chase & Co. analysts wrote they see “more risk to the downside” on PacifiCorp’s outstanding corporate bonds.

PacifiCorp acknowledged that the expedited trial pace “will cause significant financial strain,” according to the filing. “Weakening of PacifiCorp’s credit metrics could result in a downgrade, potentially below investment-grade.”

“The company remains willing to settle all outstanding reasonable claims related to the Echo Mountain, 242 and South Obenchain fires,” a PacifiCorp spokesperson said in an emailed statement. “PacifiCorp continues to meet its obligations and provide our customers with an essential service. This includes diligently managing our finances.”

As climate change has made wildfires across the American West more frequent and destructive, PacifiCorp’s decision to take its chances with a jury in 2023 marked the first time that a lawsuit over large-scale devastation blamed on a utility’s equipment went to a trial.

The company was found liable for failing to heed weather warnings and shut off electricity in its service areas ahead of a wind storm that toppled power lines. PacifiCorp has settled some claims over the 2020 fires but still faces others.

The judge overseeing the ongoing litigation has accelerated the schedule of “mini-trials” — for small groups of property owners to seek monetary damages — to once a week starting in February and twice a week in 2027 until their expected completion in March 2028, according to a July court filing. The utility is asking a state appeals court to halt further damages trials until its appeal of the 2023 verdict is resolved, which could take several years.

Given the schedule and damages that have been awarded so far, PacifiCorp estimates that future damages awards could be more than the amount it can cover with its existing bonds and letters of credit. It sold $3.8 billion of U.S. investment-grade bonds early last year to help fund litigation settlement claims.

“PacifiCorp is now teetering on the brink of junk bond status — and it has no one to blame but itself,” said Jay Edelson, whose law firm Edelson PC is representing the wildfire victims in court. “The company should never have taken this case to trial, much less doubled down again and again trying to fight individual survivors in court.”

Top photo: A burned vehicle near a motel destroyed by wildfires in Gates, Oregon in 2020. Photographer: Go Nakamura/Bloomberg.

Was this article valuable?

Here are more articles you may enjoy.

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say  Greek Oil Tanker Exits Hormuz Shipping Strait With Signal Off

Greek Oil Tanker Exits Hormuz Shipping Strait With Signal Off  Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures

Property, Auto Insurance Shopping Up as Consumers Feel Economic Pressures  Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes

Georgia Insurance Law Is About to Get an Upgrade With Multiple Changes