One of the blogs that I love to read is the Property Insurance Coverage Law Blog by Merlin Law Group. You may not like this, but I find many of the insights by Chip and the team to be compelling enough to make me stop and pay attention to what they have to say before I disagree. I’ve even found myself agreeing with them, especially that one time when Chip quoted me.

So when I read a recent blog entry entitled Insurance Policies Should Be Easy To Read, by Amy Currotto, I found myself wanting to agree wholeheartedly. Insureds should be able to read their insurance policies. It shouldn’t take a law degree, three dictionaries and a team of consultants to read a policy. Yet that’s kind of where we are, isn’t it?

While I agreed with the headline of the article, that’s where our agreement stopped. Her thesis came out fairly quickly.

“Insurance companies have long used convoluted legal language to deny claims and mislead policyholders about what is actually covered and excluded within their policy. Insurance companies know that many policyholders will not understand the complex legal jargon and paragraph-dense provisions packed into a policy. Even more so, insurance companies are betting policyholders don’t know the intricacies of insurance law and will avoid the expense of hiring specialized insurance counsel.”

So I can’t deny that there have been insurance companies that have written policies that would at least obfuscate coverage. I can’t even deny that there aren’t insurance companies that try and deny, low ball, delay paying legitimate claims.

There’s still room to state that its not just insurance companies that make insurance policies hard to read.

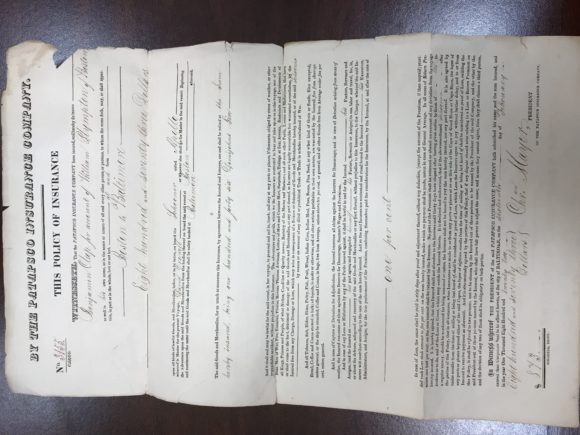

Let’s start with this truth. Insurance policies are hard to read because of the cat and mouse game that has been going for several hundred years between the insurance companies and the coverage attorneys. Insurance companies draft policies that they think will cover the anticipated exposures. Then a claim happens and there’s a disagreement over coverage. That disagreement turns into a suit between the insured and the insurance company.

The insured filed a claim with their insurance company for their loss of business income because their city closed all businesses for fear of the spread of the coronavirus. The insurance company denies the claim because there was no direct physical loss of or damage to property causing the shut down of the business. The insured doesn’t like that answer so they hire an attorney who promises to get the evil insurance company to pay.

Maybe the attorney argues that the existence of the virus and the potential that it could live on a surface for some time constitutes direct physical loss of or damage to property. If we suppose that the attorney is successful with that argument, the next step for insurance companies is to attempt to define what direct physical loss of or damage to property means. This creates more complicated insurance language because on the front end we couldn’t agree that the terms of the policy were fairly clear to start with until we decided to play with the meanings of words.

Add to this that legislatures get involved in mandating specific policy language (more attorneys involved) in some states. Then you have to consider that insurance policies have to be written as specifically as possible because any potentially ambiguous language turns into extra claims paid, even if it could be reasonably interpreted that there was no coverage. You know that any insurance policy language that is determined to be ambiguous is ruled against the insurance company because, “you wrote the policy, you must have meant for that to happen.” That’s more dealing with lawyers, but that’s another digression.

I’m not trying to say that the only reason insurance policies are hard to read is the involvement of different attorneys, I’m just saying that it’s not just the big bad insurance companies making insurance policies hard to read.

There’s plenty of room to blame several groups for how hard it is to read an insurance policy. Maybe rather than finding someone to blame, we could work together and figure out a way to make them easier to read.

PS – It’s also not the company’s fault that everyone doesn’t read their policy, but that’s a topic for another day.

Topics Carriers

Was this article valuable?

Here are more articles you may enjoy.

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed