Direct premium written (DPW) for property/casualty insurance companies continues to increase, albeit gradually. At year-end 2015, approximately $585 billion DPW was reported, a record-high. For 2015, total DPW for all P/C insurers aggregately increased 2.5 percent over 2014, an increase of nearly $14.4 billion. Through the second quarter (Q2) of 2016, the insurance industry’s growth trend has continued, as DPW for all P/C insurers aggregately increased 3.6 percent over 2015.

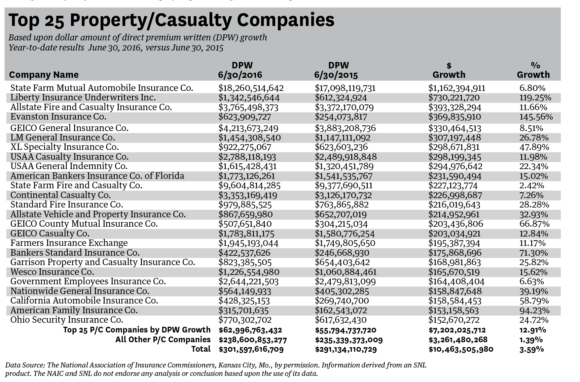

For the six months ended June 30, 2016, P/C companies comprising the top 25 insurers in terms of DPW increased their DPW 12.9 percent over the first six months of 2015. This continues their impressive display of premium growth and financial stability. The top 25 accounted for nearly 69 percent of the growth in the P/C industry’s DPW. The remainder of the industry reported an increase in DPW of 1.4 percent, or $3.3 billion year-over-year.

While increasing DPW, P/C companies have aggregately maintained a sufficient level of policyholders’ surplus (PHS). The DPW to PHS ratio is indicative of an insurer’s premium leverage on a direct basis, without consideration of the effect of reinsurance. Since 2010, this ratio for P/C companies has remained stable at approximately 70 percent.

Although the market continues to exhibit signs of firming and DPW continues to increase, P/C insurers should not expect a traditional hard market. The double-digit premium growth experienced in the historical hard market cycles may have created unrealistic premium growth expectations for this current recovery.

It is more realistic that expectations should relate to gradual, stable growth. If the industry holds to its 10-year historical pattern, growth in 2016 will result in the highest level of year-end DPW ever reported by the P/C industry.

Topics Trends Carriers Pricing Trends Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

Death and Destruction at Orlando I-4 Project But Punitive Damages Not Allowed

Death and Destruction at Orlando I-4 Project But Punitive Damages Not Allowed  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends  Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say

Trump’s Hormuz Assurances Are Only a Partial Fix, Shippers Say  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition