Flood risk is ubiquitous. In any given week, a storm with the potential to produce flooding is occurring somewhere in the United States. The transfer of flood risk from the National Flood Insurance Program (NFIP) to the private (re)insurance and capital markets is beginning and, as a result, flood risk management has become a focus of attention. A probabilistic modeling approach is the only method that can account for the complex interplay of all the variables and factors associated with flood risk assessment and management.

This approach can be helpful in understanding the impact of extreme events including the August 2016 Louisiana flood, which AIR estimated to cost between $8.5 billion and $11 billion. Unprecedented rains caused catastrophic flooding in southern Louisiana during August 2016. From August 9 – 16, a record-breaking downpour dumped more than 30 inches in some areas, which resulted in accumulations of around 7 trillion gallons in Baton Rouge and environs. The federal government declared 20 parishes major disaster areas. This event is considered the most damaging flood event since Superstorm Sandy hit the Northeast in 2012.

For seven days, slow-moving torrential downpours plagued much of southern Louisiana. The culprit, a tropical depression-like low pressure system that slowly drifted across Louisiana, intensified as it moved west. The counter-clockwise (southerly) flow off the Gulf of Mexico, where sea surface temperatures were at almost record high levels, brought tremendous amounts of moisture inland across southern Louisiana. The combination of these factors, with the large-scale rising motion provided from the low pressure system, resulted in slow-moving torrential rainfall and thunderstorms that spread from Lafayette to Baton Rouge.

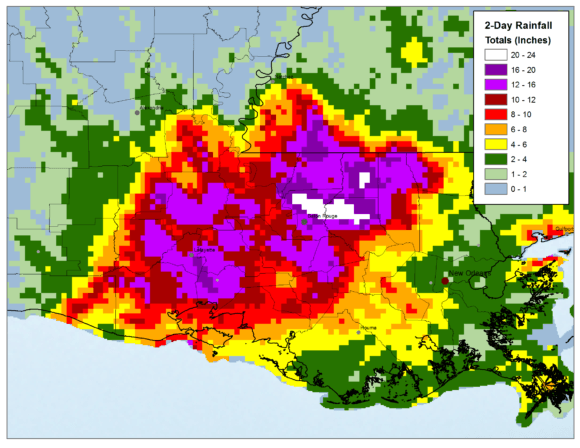

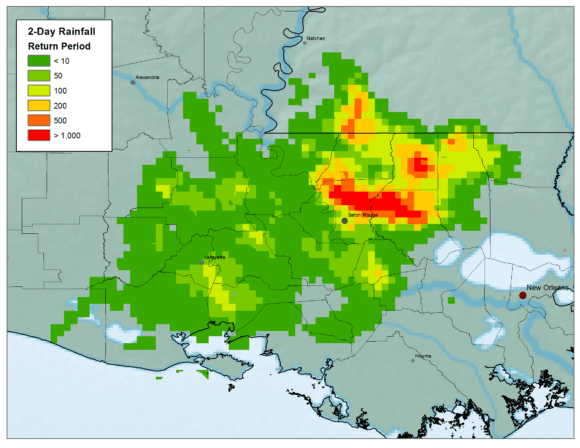

Record rainfall totals fell across a large portion of southern Louisiana as the system crawled across the region (see Figure 1). As a result, some rainfall values were in the range of a 1,000-year return period in the parishes of St. Helena, Livingston, and East Baton Rouge (see Figure 2). Parts of the region received two to four times the average total monthly rainfall for August in just three days. As the storm moved west, the heaviest rainfall moved with it, but localized downpours continued to plague the area through the weekend of August 13 and 14.

With 26.97 inches of precipitation, August 2016 was the wettest month for Baton Rouge since record-keeping began 174 years ago. The Louisiana statewide precipitation total for August 2016 was 12.91 inches, 8.27 inches above average for that month, and surpassed the previous record of 9.71 inches set in 1948.

As a result of the record-breaking rainfall across a vast area of more than 50 miles by 100 miles — covering Baton Rouge, Lafayette, and adjoining suburbs — historic crests at several river gauging stations of the USGS in Louisiana were surpassed.

The very heavy rainfall in the watersheds of the Amite, Comite, Tickfaw, and Tangipahoa rivers resulted in flood levels up to 6 feet over their previous historic records. The estimated flows at these flood levels correspond to a 1,000-year return period (i.e., an exceedance probability of 0.1 percent) in several river segments. As a result, there were riverine flood events at the Amite River near Denham Springs, the Comite River near Olive Branch, the Tickfaw River at Montpelier, and the Tangipahoa River at Robert.

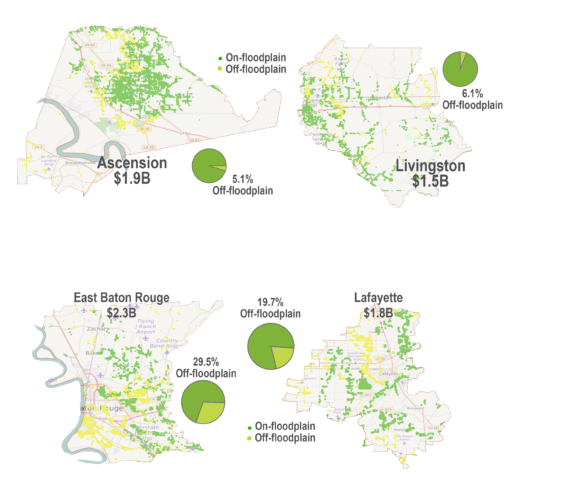

The historic flooding in and around Baton Rouge and other parishes was a combination of several causative factors, including riverine (on-floodplain) flooding, water backing up in tributaries due to high flood stages in main rivers, called “backwater,” and significant local flash flooding (off-floodplain) caused by intense rainfall, flat terrain, and limited drainage capacity, which was further exacerbated by backwater effects. Many of the flooded areas were outside the FEMA 100-year flood zone and therefore not considered at high risk. For this reason, the event caught many residents and community leaders by surprise.

AIR estimates that about 30 percent and 20 percent of all losses in East Baton Rouge and Lafayette parishes, respectively, originated from off-floodplain flooding that is caused by a combination of intense precipitation, saturated soils and inadequate drainage conditions.

Areas most heavily impacted by flooding where FEMA had not indicated there was a high flood risk include neighborhoods in Monticello and northeastern Baton Rouge, both of which are south of the Comite River in East Baton Rouge Parish.

The state of Louisiana has a long history of flood events and flood mitigation efforts have been in place for many years. Many of the parishes, like East Baton Rouge, joined the National Flood Insurance Program (NFIP) in the 1970s where floodplain management and property protection measures are enforced via land use planning and zoning in flood hazard areas.

Despite these efforts, many structures in the area remain vulnerable. In Louisiana as a whole, more than 80 percent of residential construction is wood, and an estimated 5 percent have basements, which increases the risk of damage to buildings and contents. More typically, buildings are on slab foundations, which are designed to withstand flotation, collapse or lateral movement that can be inflicted by floodwaters.

More than half of the commercial buildings are steel and concrete. Unlike residential structures, commercial buildings are often engineered and built to stricter standards, and are thus less vulnerable than single-family homes. Still, mechanical, electrical and plumbing systems can experience severe damage and incur high losses.

In the U.S., residential flood insurance is typically offered to homeowners only through the NFIP, which lets residential property owners purchase flood insurance from the government. FEMA estimates that only 42 percent of homes in high-risk areas of Louisiana have flood insurance, while only about 12 percent of homes in low- and moderate-risk zones do.

Commercial business can add flood insurance as an endorsement to their property policy, although it is often subject to sublimits.

Changes in legislation and new, creative thinking are beginning to facilitate private (re)insurers’ return to the flood insurance marketplace. With the appropriate risk assessment tools, there are opportunities to develop a range of products from which customers can choose to meet their needs.

Floods are highly complex processes, and managing flood risk is a complicated task; the flood intensity and the associated losses at a given locality depends on many factors. Floods can be a consequence of a significant regional- or continental-scale precipitation system lasting for days but, at times, they can also result from highly localized, very intense and shorter meteorological events.

Floods are also highly managed, owing to flood protection systems such as dams, levees temporary barriers and mobile flood walls in some cases, and engineering operational and management flood mitigation decisions made in others.

A robust catastrophe model accounts for all the complexities of the flood peril probabilistically. Of particular importance for estimating flood losses is a model’s ability to accurately simulate individual storms — especially high intensity systems that linger over a relatively small area.

With a catastrophe flood modeling tool available now that offers a granular view of risk and allows quantification of that risk, there are long-term opportunities for private insurers, including gaps to fill in the residential flood insurance market.

Private insurers may offer superior performance in terms of building up surplus, underwriting properties, spreading risk through reinsurance and capital markets, determining actuarially sound rates, and prioritizing and implementing mitigation strategies.

On the commercial/industrial side, the insurance industry only covers a limited amount of flood risk now but opportunities are opening for considering how the market can be developed and grown.

Topics Catastrophe Flood Louisiana Talent

Was this article valuable?

Here are more articles you may enjoy.

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation

Meta Loses Insurance for Defense in Major Social Media Addiction Litigation  Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition

Zurich Insurance and Beazley Agree to $10.9B Cash Acquisition  Greek Oil Tanker Exits Hormuz Shipping Strait With Signal Off

Greek Oil Tanker Exits Hormuz Shipping Strait With Signal Off  Lloyd’s Market Engaging With US Government Over Gulf Maritime Plan, Officials Say

Lloyd’s Market Engaging With US Government Over Gulf Maritime Plan, Officials Say