Compared to others, the property/casualty insurance industry is weathering the coronavirus crisis rather well.

Property/casualty insurance is the least-impacted industry by the coronavirus pandemic, at least so far, according to an analysis from S&P Global Market Intelligence.

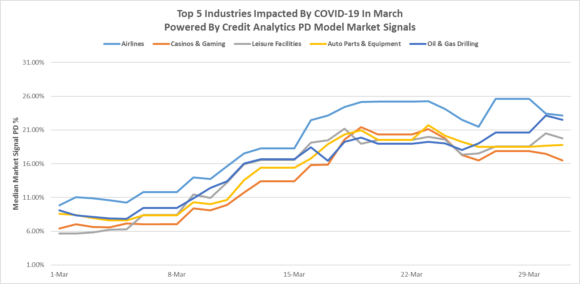

S&P compiled its analysis for March, generating industry medians from its Credit Analytics Property of Default Market Signal model (PD), which uses stock price and assets volatility as inputs to calculate a one-year probability of default.

The top five industries that have been the most impacted, based on signals, are:

- Airlines

- Casinos & Gaming

- Leisure Facilities

- Auto Parts and Equipment

- Oil & Gas Drilling

S&P points out that there are multiple reasons the airline industry is the most affected by the coronavirus: mass grounding of air traffic, border closures, and shelter-in-place policies globally. These actions, S&P said, “have caused detrimental impacts on stock performance and raise concerns about the viability of some airlines.”

The industries S&P Global Intelligence says have been the least impacted from a PD perspective include:

- Property and Casualty Insurance

- Healthcare REITs

- Multi-line Insurance

- Life & Health Insurance

- Industrial REITs

While all five sectors scored high on the “least impacted” front, they still showed some pressures, according to S&P’s PD model. “We continue to see market stresses and increasing unemployment rates, which we expect to elevate PDs in the coming months,” S&P noted.

Topics Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025 but HO Loss Persists  Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M

Westchester Close to Settling on Hurricane Sally Condo Claim That Topped $230M  Deep Freeze and Drought Fueled a Massive Florida Wildfire

Deep Freeze and Drought Fueled a Massive Florida Wildfire  Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations

Travelers Stranded by War Learn Insurance Won’t Cover Flight Cancellations