Many years ago, a well-known insurance company went from being highly rated to insolvent almost in a fortnight. Most people in the industry older than 50 years old remember that time. The failure was a shock that created lasting skepticism about insurance company ratings. The industry has not had a similar event in a decade or more, which tracks with historic surplus and the historic soft market that has lasted almost a full decade (insolvencies are rarer in soft markets). To a large degree, the industry has lost institutional knowledge of what a large insolvency means, especially when everyone thought the company was solid.

When institutional knowledge is lost, people begin taking for granted the good times and they do not consider that bad things can occur. Many younger people cannot relate to advice regarding what to do if a carrier becomes unstable. A large carrier becoming unstable is a possibility they have never considered and cannot fathom.

This loss of institutional knowledge is concerning because while there is record surplus and surface stability, many red flags are flying. I am not crying wolf. I am simply attempting to create awareness of a severe event that has painful consequences, that has occurred with some regularity in the past.

Just because it has not happened in the past 10 years does not mean it will not happen again. In fact, some similarities exist now with how the economy was supposedly crash-free, just before the credit crises.

Among the warning flags are:

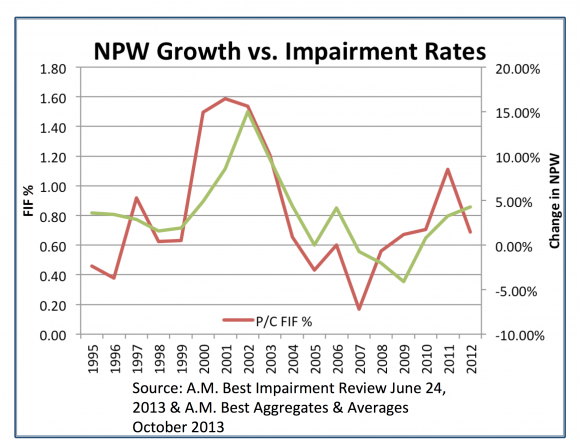

1. Rising rates.Contrary to the belief that rising rates, i.e., a hard market, floats all boats, more boats crash in hard markets.

2. The number of downgrades. Downgrades have exceeded upgrades for the third consecutive year according to A.M. Best in February 2014.

3. Reserve deficiencies exist. According to A.M. Best’s 2014 Review/Preview, the P/C industry has a $45 billion reserve deficit excluding mortgage and financial guaranty segments. Some analysts have concluded no reserve deficiency exists, but in studying reserve deficiencies for the past 15 years, A.M. Best’s estimates are usually in the middle between Pollyannas and the curmudgeons.

These deficits are not spread evenly. It is likely that specific companies have more than their disproportionate share. According to a story in Insurance Journal on Oct. 15, 2013, Tower Insurance announced a $365 million loss reserve charge after previously indicating the charge would “only be $60 million to $110 million.”

The company’s future is now being determined.

4. New types of markets.

- The industry may now have more unrated carriers doing Main Street business, often on an admitted basis.

- The industry absolutely now has more business in non-typical insurance organizations than ever. Excluding captives, a great portion of clients buying insurance from these entities do not understand the extra risk they are accepting.

- A large proportion of producers and agency owners do not understand the extra risk these entities pose to them or their insureds.

- An example of extra risk involves their capital structures, which are not normal (relative to the way most insureds think about insurance). These entities are sometimes being credited by regulators and rating companies with the ability to do capital calls/assessments. That is fine except that I’m willing to bet a material portion of these carriers’ insureds do not know they have the real potential of a capital call.

Even people who remember the highly rated carrier crashing so quickly, even those most acutely hurt that had E&O suits filed against them because that carrier failed, may not fully appreciate how industry changes could drastically impact them quite differently. The industry has changed so much since then.

Service Centers

Another change worth consideration is company service centers. What if an agency has a lot of business in a company service center and that company fails? Sure, these companies are highly rated, but so was the one that failed.

What is your contingency plan? How does the service center contract address this possibility?

I am not suggesting any company with a service center is in jeopardy. I am recommending that agencies not take their stability for granted and forge a contingency plan now. If for no other reason, we may someday again have a major carrier promote a new CEO that decides to quit the property/casualty business suddenly as one did in the early ’90s or decides to implement a new distribution model.

Similarly, what if an agency is using a non-carrier service center and that company locks its doors and pulls their computer plugs?

What happens to your agency? Your data? Your customer service? How does the contract address this possibility?

Most agencies were heavily paper-based when that large carrier failed. Downloads did not exist. Paper was likely a blessing. Consider what would happen in today’s world?

Beyond the fact the industry has lost institutional knowledge of how a large, supposedly safe carrier suddenly goes under impacts an entire industry, the industry has changed significantly in the past 10 years. I am concerned the changes combined with the loss of institutional knowledge have created significant exposures for agencies.

The exposures are severity issues, not frequency issues. Because they are severity issues, people have a more difficult time finding the urgency required to address them.

I encourage all readers to build their contingency plans. Hopefully you will never use them.

If you do, you will realize the true beauty of the quote that: “Luck is where opportunity meets preparedness.”

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI