One of the most successful hedge fund strategies of recent years — insurance-linked securities — is latching on to an old idea whose popularity is suddenly soaring.

Parametric insurance, where policyholders get quick payouts if weather-related metrics are met, used to be the preserve of small businesses and farmers in developing countries. Now, it’s a rapidly growing market luring large corporations across the rich world.

Sebastien Piguet, co-founder and chief insurance officer at Descartes Underwriting, says parametric models are filling a gap left by other types of insurance policies. That’s as climate change and more frequent extreme weather events challenge standard coverage models.

“It’s much more challenging to find capacity for this kind of coverage with traditional insurance,” he said.

Companies using parametrics now include French pharmaceutical firm Sanofi SA, telecommunications company Liberty Latin America, and renewable energy investor Greenbacker Capital Management. The market for such products is estimated to almost double to $34 billion in the decade through 2033.

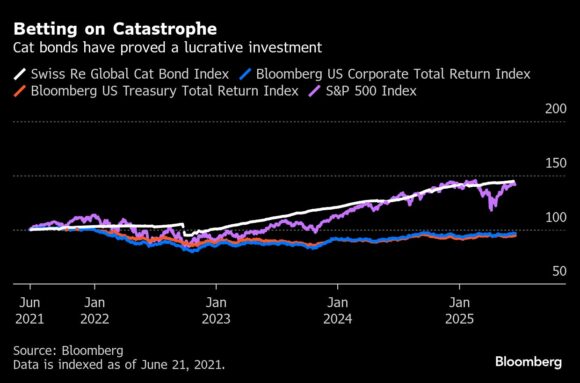

It’s a shift that’s caught the attention of ILS investment managers. Insurance-linked securities, which a Preqin ranking listed as the best-performing hedge fund strategy of 2023, have long focused on catastrophe bonds. Typically issued by insurers and reinsurers, investors in the bonds make money if predefined triggers like wind speed or insured losses aren’t met, and lose money if they are.

In recent years, that model has generated market-beating returns.

Investment funds based on parametric insurance have the potential to beat cat bond returns, according to Rhodri Morris, a portfolio manager at Twelve Securis. The Zurich-based $8.6 billion alternative investment manager, which specializes in catastrophe bonds, launched the Lumyna-Twelve Capital Parametric ILS Fund together with Lumyna Investments in February.

“We aim to return a couple of percentage points above the cat bond market,” Morris said in an interview.

The fund, which is the first of its kind, has so far attracted about €85 million ($99 million) of capital. Morris says the expectation is that it will draw as much as €200 million next year.

A key attraction for investors is they can avoid so-called trapped capital, according to Morris. Investors in cat bonds sometimes wait for months — or even years — before loss rates are assessed and payouts settled. Investors in a parametric fund will generally know within days whether an underlying insurance contract has paid out or not.

The Lumyna-Twelve parametric fund has drawn “genuine interest” from investors, Morris said. But they’ve also had questions, and there’s a number of important factors to consider, he said.

“Investors need to understand that you’re giving up liquidity in some part of the portfolio,” Morris said. “But the benefits you’re getting are higher returns and the lack of trapping.”

The fund has received seed capital from what it describes as a “top-tier European institutional investor.” Morris declined to identify the firm by name.

Luca Albertini, chief executive of Leadenhall Capital Partners, a London-based firm which oversees $4.5 billion in ILS assets including a few private parametric deals, says that while investors benefit from the transparency and quick payouts of parametric products, they need to pick investments with care.

“The attractiveness of parametric comes and goes,” and “you need to be watchful that the risk-reward remains attractive compared to alternatives in the same space,” such as cat bonds, he said.

The Lumyna-Twelve fund will be structured so that part of the capital will support deals it strikes itself. For these, it will rely on Descartes to structure the transactions, and on Assicurazioni Generali SpA — the parent of Lumyna — to provide the insurance capital to back the product.

Returns are also based on parametric deals done by Descartes and its partner Generali for their own clients. These will be bundled, with the Lumyna-Twelve fund free to invest in a chunk of the end product.

Climate-related economic losses in the US have reached $6.6 trillion over the past 12 years, so figuring out how to deal with extreme weather events is no longer just an environmental concern, but a “significant financial issue,” Bloomberg Intelligence said in a recent report.

Against that backdrop, corporate demand for parametrics keeps growing. Cyril Lelarge, global head of insurance at Sanofi, says the company has been relying increasingly on parametric coverage as it looks for ways to guard its supply chain. “It’s important for us to protect our assets for the future,” he said.

Liberty Latin America says it bought “several hundred million dollars worth” of hurricane parametric insurance in 2024. When Hurricane Beryl hit last July, Liberty says it got a quick payout of $44 million, which helped the company rebuild damaged infrastructure.

Descartes has also launched parametric cover for solar farms against tornado damage. And Aon Plc, an insurance broker, has together with Swiss Re and Floodbase rolled out a policy for hurricane-related storm surge along the US coast, while Axa SA has introduced a product that protects outdoor workers in Hong Kong from heat waves.

Parametric deals are also increasingly popular among renewables firms, with solar plants in Texas acquiring policies against hailstorms, and wind farms using them as a financial buffer when the wind fails to blow and revenue drops.

For Greenbacker Capital Management, the parametric coverage it received from Munich Re, in conjunction with a “wind proxy hedge” that it structured with kWh Analytics, helped it attract lenders, according to Dan de Boer, interim chief executive at Greenbacker.

“It allowed us to raise 20% more debt capital” for a US wind project, he said.

Photo: Members of the Mexican Army conduct sweeps after Hurricane Beryl made landfall in Tulum, Mexico, on July 5, 2024. Photo credit: Victoria Razo/Bloomberg

Topics Trends Catastrophe

Was this article valuable?

Here are more articles you may enjoy.

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan

Fla. Commissioner Offers Major Changes to Citizens’ Commercial Clearinghouse Plan  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance